JPY Intervention Levels Assessed Ahead of Jackson Hole, Yen Offered

Japanese Yen (USD/JPY, EUR/JPY) Analysis

- Asian geopolitics takes center stage as FX intervention likelihood eases

- USD/JPY bullish momentum continues as 10-year treasury yield rises

- EUR/JPY trades higher off support – LT ascending channel continues

- Large speculators foresee more yen weakness

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free JPY Forecast

Asian Geopolitics Takes Center Stage as FX Intervention Likelihood Eases

US President Joe Biden welcomed Japanese and South Korean leaders to Camp David, condemning China’s recent “dangerous and aggressive behaviour”. The meeting comes at a time when China is conducting military drills around Taiwan, with Taiwan reporting 71 Chinese planes crossing the Taiwan Straight median line. The line serves as an unofficial barrier between the two sides.

In other developments, talk about Japanese intervention has calmed since Japanese Finance Minister Shunichi Suzuki announced that undesirable FX volatility matters more than the level of the currency. Such an admission appears to have set a target for USD/JPY traders around 150 to test the resolve of the finance ministry. An update from JP Morgan reveals an interest in the 150 mark as the level that may spark FX intervention.

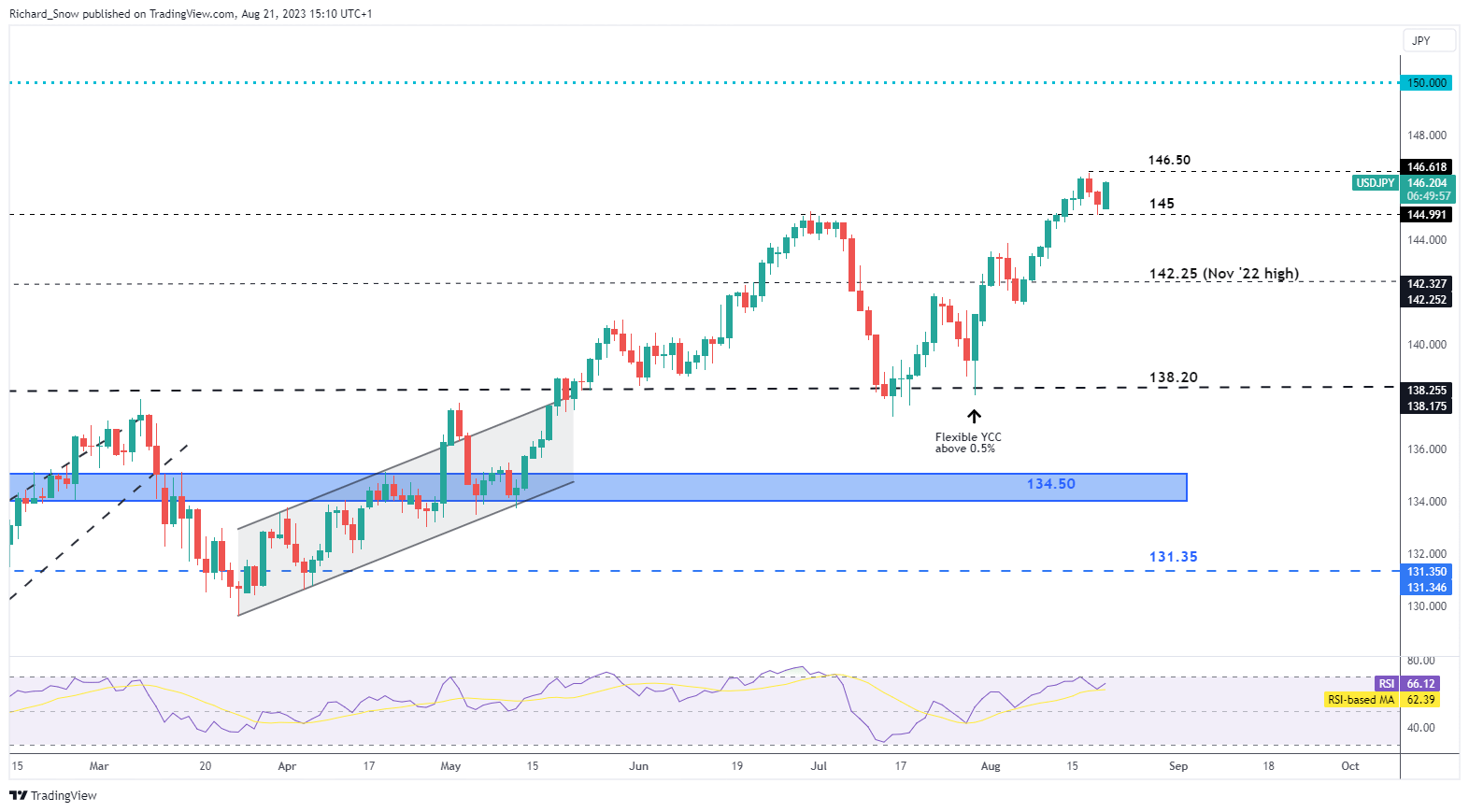

USD/JPY Bullish Momentum Continues as 10-Year Treasury Yield Rises

A strong start to the week for US 10-year yields has strengthened the US dollar and sees USD/JPY start the week on a positive note. Last week, worsening Chinese data meant the dollar was primed for further upside, particularly as yields rose on positive US economic data. Markets anticipate the Fed will have to keep rates ‘higher for longer’ in response to strong US data.

This week, the economic calendar is very light. Apart from August flash PMI data, markets will be looking ahead to Thursday and Friday as the Fed ‘s annual Jackson Hole Economic Symposium is upon us. It remains to be seen whether any major bombshells will be leaked at the event but the likelihood appears slim. With major central banks nearing – or potentially at – peak interest rates, central bankers will be hesitant to chart a path forward given how uncertain the inflationary environment has been this year. Therefore, it may turn out to be a rather straight forward conference where central bank heads read from the same hymn sheet.

USD/JPY trades higher in the moments after the US session began, eying a return to Thursday’s swing high at 146.50. The dollar bull trend remains constructive, therefore, the dotted blue line of 150 becomes a massive target. A rejection of 146.50 brings the 145 level back into play, on the downside. If the yen starts to see a return to favour – perhaps on renewed geopolitical tensions in the region – 142.25 may become relevant. However, the slow week suggests traders may be tempted to take money off the table ahead of Jackson Hole which could see slow and steady price discovery into Jackson Hole.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade USD/JPY

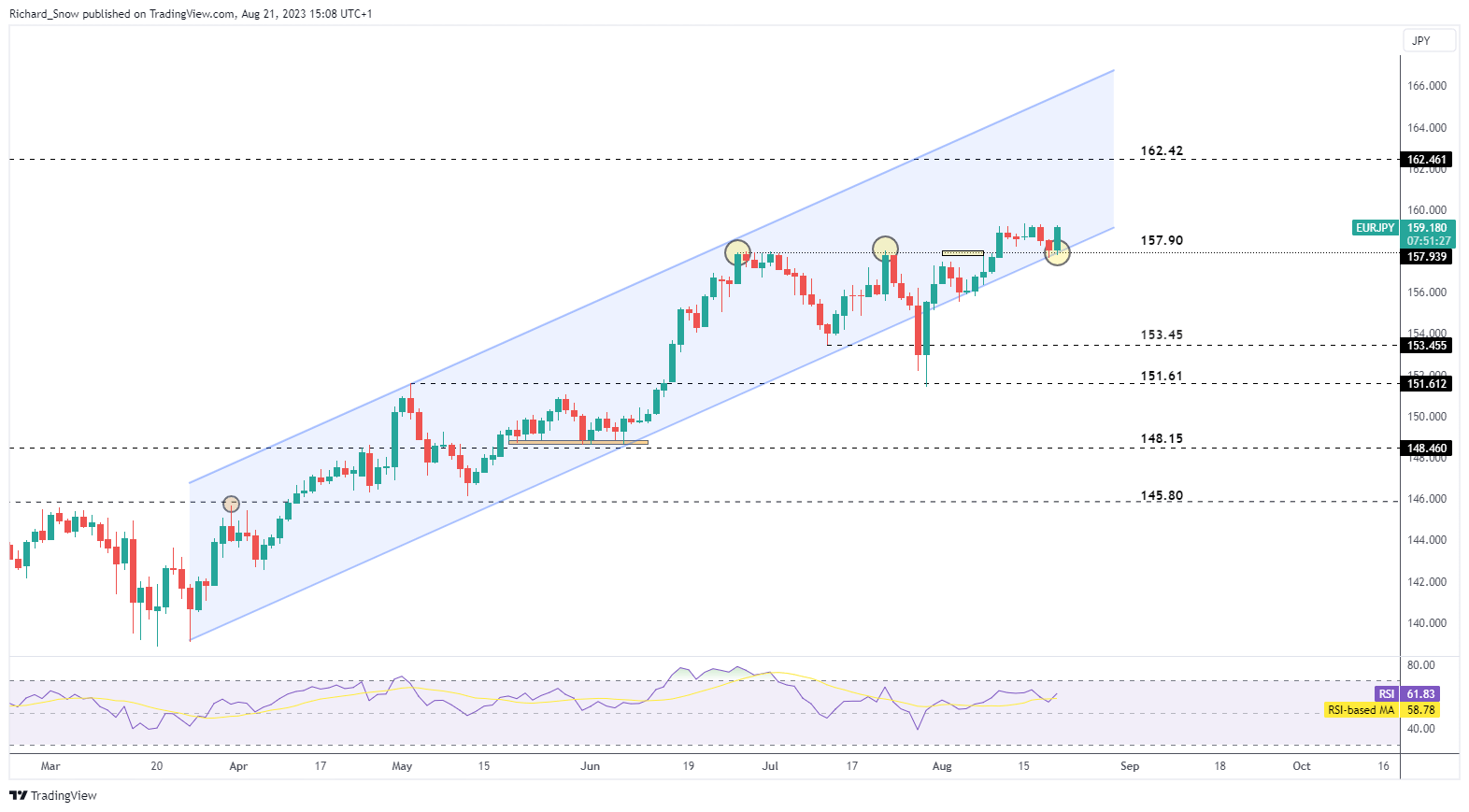

EUR/JPY Trades Higher off Support – LT Ascending Channel Continues

EUR/JPY appears to have found support at the confluence area comprising of the 157.90 level and channel support. The 157.90 level has proven a level of interest, previously denying bullish momentum. With the pair heading higher, 162.42 is the next level of resistance which is a fair distance away. Support is back at 157.90, followed by 156.00 and 153.45.

With the EU and German PMI out later this week, the euro may struggle to influence bullish momentum, meaning further upside may have to be led by yen weakness.

EUR/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

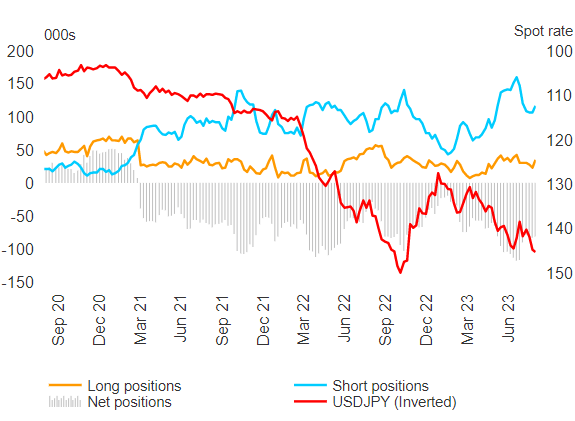

Large Speculators See More Yen Weakness

The latest data from the CFTC’s commitment of traders report shows an uplift in JPY shorts with longs moderating around similar levels. Overall, these speculators maintain a net-short positioning, reflecting a bearish view of the yen.

Commitment of Traders Report

Source: CFTC, CoT, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.