Japanese Yen Watchful After Ueda Address, US CPI to Come

USD/JPY ANALYSIS & TALKING POINTS

- BOJ Governor Ueda’s comments did not aid the faltering JPY.

- US CPI highly anticipated after last week’s stellar NFP.

- Ascending triangle remains in play.

Recommended by Warren Venketas

Get Your Free JPY Forecast

JAPANESE YEN FUNDAMENTAL BACKDROP

The Japanese Yen is steadily weakening against the USD and looking for it’s 4th consecutive positive close. Now hovering above the 135.00 psychological handle, recent comments from the Bank of Japan (BOJ) Governor Kazuo Ueda dampened any near-term pivot hopes from their longstanding ultra-loose monetary policy. Although there was mention of exiting the current policy, stabilization around inflation consistently meeting their 2% target rate will be critical. In summary, it is likely to take some time before the BOJ looks to alter their policies leaving the yen vulnerable. That being said, uncertainty around the ongoing US debt ceiling increase may play into the safe haven allure of the yen.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

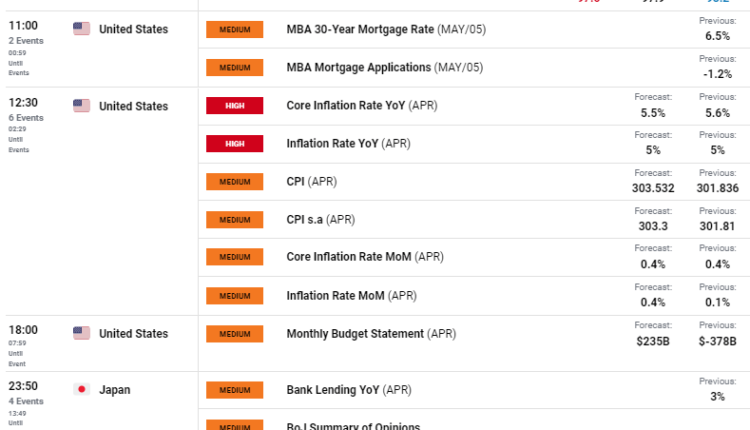

The economic calendar (see below) for the pair is relatively busy today with the Japanese coincident and leading economic index reports showing the local economy could be contracting via a miss on the latter.

US CPI will dominate headlines today, and while inflationary pressures have been fading, the rate of decline is not as initially anticipated. Anything marginally higher on both core and headline figures could substantiate last week Non-Farm Payroll (NFP) data; possibly repricing the Fed’s interest rate probabilities to the upside (more hawkish).

ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

USD/JPY DAILY CHART

Chart prepared by Warren Venketas, IG

JPY continues to be the worst performing G10 currency against the greenback this year (roughly 3% down). The daily USD/JPY chart shows price action confined within a ascending triangle pattern (black) with prices recently pushing off trendline support. Traditionally, a bullish continuation pattern, the preceding trend in this case has been downward; however, a break above triangle support coinciding with the 200-day moving average (blue) could expose the 140.00 resistance handle once more. From a bearish perspective, a triangle support break/50-day moving average (yellow) could invalidate the pattern and bring into consideration subsequent support zones.

Key resistance levels:

- 137.91/Triangle resistance

- 200-day MA (blue)

Key support levels:

- 135.00

- Triangle support/133.63/50-day MA (yellow)

- 131.58

IG CLIENT SENTIMENT: MIXED

IGCS shows retail traders are currently net SHORT on USD/JPY, with 53% of traders currently holding short positions (as of this writing). At DailyFX we take a contrarian view on sentiment; however, due to recent changes in long and short positioning, we arrive at a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.