Japanese Yen Still Battered By BOJ’s Policy Outlier Status

- Investors will hear from central banks on both sides of USD/JPY this week

- The Bank of Japan looks set to stick with its ultra-loose policy settings

- If so the Yen will continue to lose out to better yielders

Recommended by David Cottle

Learn how to prep ahead of major news like FOMC this week

The Japanese Yen rose a little against the United States Dollar on Wednesday. However the broader prognosis for USD/JPY remains unremittingly bullish in a week sure to highlight the monetary policy disparities so much in the greenback’s favor.

Both the US Federal Reserve and the Bank of Japan will give their monetary policy decisions, with the former’s coming up later Wednesday and the latter’s due on Friday. While the US central bank is expected to pause its long interest-rate hiking cycle, it has raised tightened lending conditions very considerably over the last eleven meetings in response to rising inflation.

The Bank of Japan by contrast has stuck to ultra-loose monetary policy, viewing inflation as very much an international phenomenon. The domestic Japanese demand it so desperately wants to generate remains elusive. Even an upgrade to the BoJ’s in-house inflation view is thought unlikely to trigger any automatic monetary tightening.

Governor Kazo Ueda has emphasized the need to stick with current policy settings until there’s durable growth in wages to accompany price rises. It still targets short-term interest rates at minus 0.1% and acts to cap local bond yields at zero percent. Those would be an incredibly loose set of policy aims at any time, and they’re a clear outlier among major central banks now. The BoJ has already primed market expectations, saying last week that it sees no need to change its yield policy this month.

In essence all this means that the Yen will remain the ultimate funding currency for so-called ‘carry trades,’ in which it is sold in favor of plentiful, better yielding units, and notably the US Dollar.

The BoJ has been known to act to keep this process ‘orderly’, indeed it did so last September when USD/JPY rose up to the 145 handle. As the pair approaches that level again the market may be watch for more ‘intervention’ action. The BoJ is also likely to stick with its view that the world’s third-largest national economy is set for a modest post-pandemic recovery, buffeted by headwinds from its major export partners. If so, this is unlikely to change sentiment toward the currency.

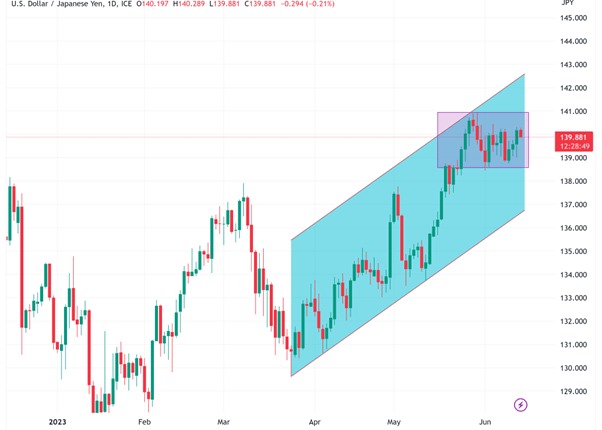

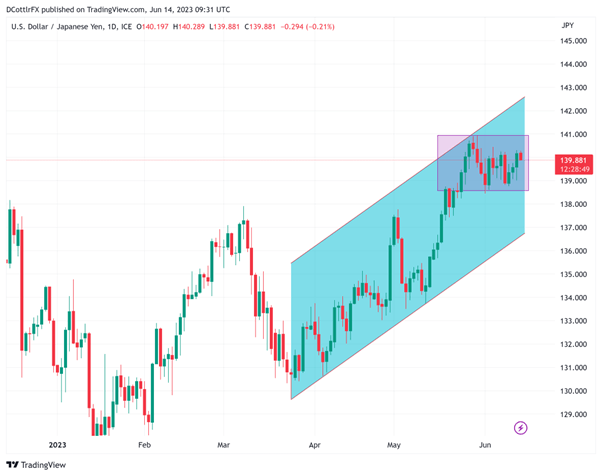

USD/JPY Technical Analysis

Chart Compiled Using TradingView

USD/JPY’s rise has been stalled a little in the last couple of weeks by the prognosis that the Fed was likely to call at least a temporary halt to its long series of interest rate hikes. This is clearly visible on the daily chart, where the peaks of May 30 at 140.9 have remained unchallenged since.

The pair has rather settled into a trading band within the broad uptrend, with support in the 138.50 region holding extremely firm when tested.

It’s also clear that the broad uptrend seen since the lows of March 27 remains very much in place and, while it does, the upside bias will remain. Indeed the lower boundary of that uptrend channel doesn’t come in until 136.73, more than three full Yen below the current market level.

Once this central bank-heavy week is out of the way, it seems highly likely that USD/JPY will once again challenge those recent highs.

IG’s own sentiment data finds a market net short of USD/JPY at this point, which may suggest that investors feel the momentum for a sustained push higher is lacking in the near-term.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

–By David Cottle for DailyFX

Comments are closed.