Japanese Yen is on the Slide as the Fed and Bank of Japan Return to their Corners

Japanese Yen, USD/JPY, US Dollar, Fed, BoJ, China PMI, Crude Oil, Gold – Talking Points

- The Japanese Yen remains under pressure after the US Dollar resumed strengthening

- The Fed reminded markets of their intention and yields responded, backed by the data

- If Treasury yields continue North, will it push USD/JPY higher and prompt the BoJ into action?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The Japanese Yen slid to its weakest level since November last year in the aftermath of the leaders from the Fed and Bank of Japan reiterating their monetary policy disparity earlier in the week.

Fed Chair Jerome Powell has been consistently crossing the wires in the last few days putting his hawkish wares on show. Conversely, Bank of Japan Governor Kazuo Ueda has made it clear that his bank will maintain its ultra-loose settings for the foreseeable future.

The jawboning from Japanese authorities has stepped up a notch going into the end of the week. Today it was Finance Minister Shunichi Suzuki’s turn to warn that the government will respond to excessive moves in currency markets. USD/JPY retreated back below 145 on the comments.

Elsewhere, Treasury yields have held onto the massive gains seen in the US session following solid jobs data. The policy-sensitive 2-year note nudged 4.89% and is almost back to levels seen before the collapse of SVB, as is the back end of the curve.

Global government bonds in developed markets followed the lead to various degrees.

APAC equity markets have been relatively subdued although China’s CSI 300 saw some gains after the NBS PMI data hit forecasts of 49.

The People’s Bank of China (PBOC) set the Yuan stronger than anticipated as it appears that Beijing may look more closely at the exchange rate.

Crude oil is steady going into Friday’s session with the WTI futures contract approaching US$ 70 bbl while the Brent contract is oscillating around US$ 74.50 bbl.

After touching US$1,900 overnight, gold has recovered to be trading near US$ 1,915 at the time of going to print.

Looking ahead, after UK GDP and European CPI data, Canada will also see GDP figures. In the US, the PCE inflation gauges will the focus as the calendar rolls into a new month, quarter and half year.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade USD/JPY

USD/JPY TECHNICAL ANALYSIS

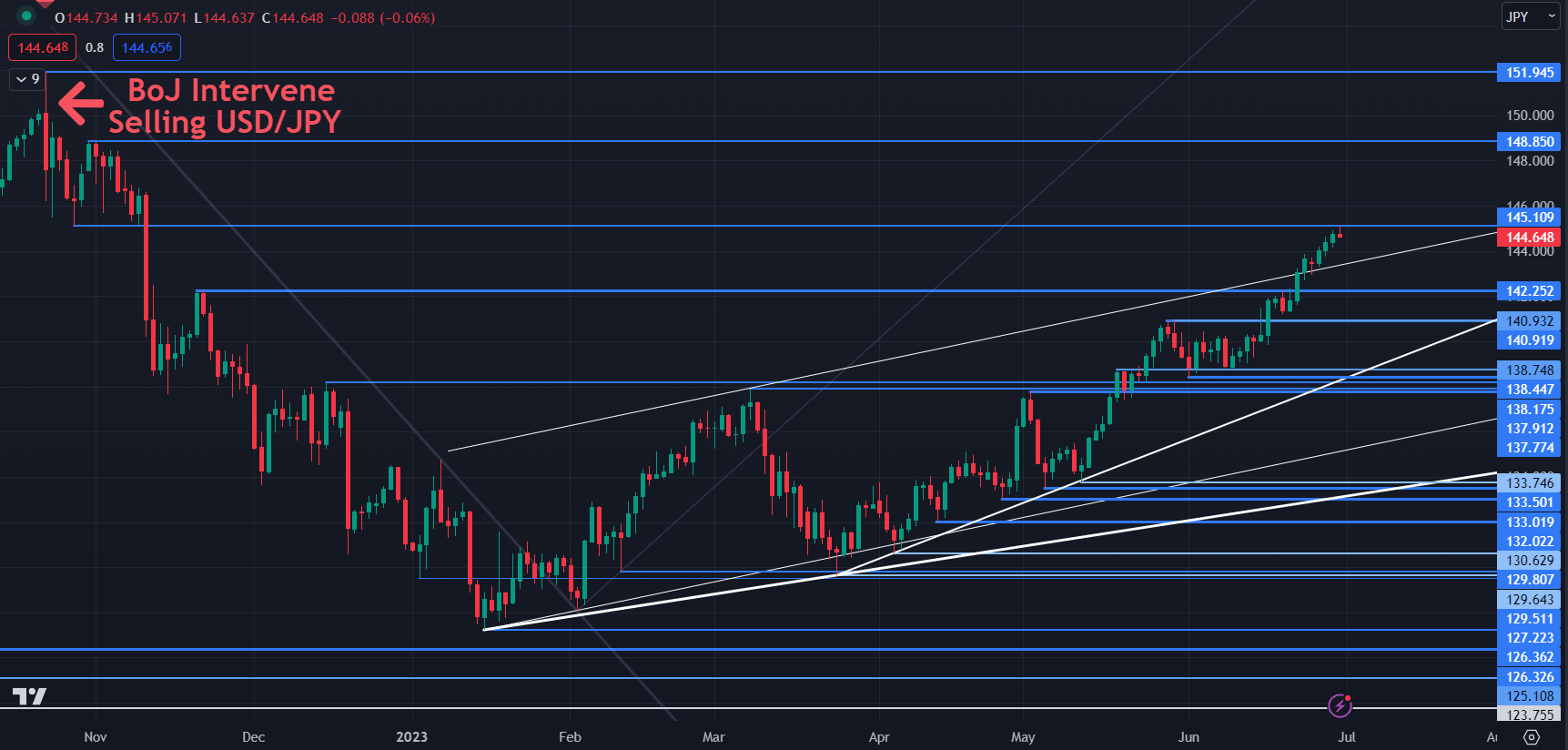

USD/JPY topped out just below a breakpoint at 145.10 today and that level might continue to offer resistance. Further up, the prior peaks at 148.85 and 151.95 may also offer resistance.

On the downside, support could be at the breakpoints of 142.25 and 140.90. Further down, there is a cluster of breakpoints and previous lows in the 137.75 – 138.85 area and this might be a support zone.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

Comments are closed.