ISM Services Tops Estimates, Job Openings Plunge Weighing on the US Dollar

US ISM SERVICES KEY POINTS:

Recommended by Zain Vawda

Introduction to Forex News Trading

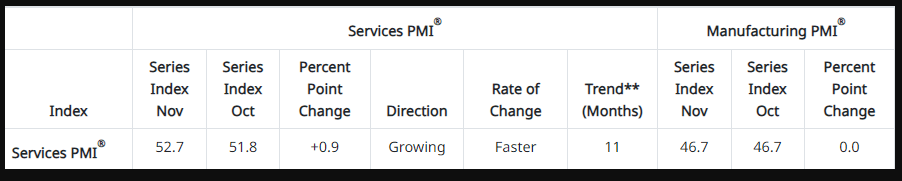

US ISM services PMI remained robust in November, topping estimates coming in at 52.7 in November 2023 from 51.8 in October. Activity in the services sector has now expanded for the 11th consecutive month following todays print. The services sector had a slight uptick in growth in November, attributed to the increase in business activity and slight employment growth.

Source: ISM

At the same time, new orders remained strong (55.5, the same as in the previous month) and inventories rebounded (55.4 vs 49.5) while price pressures slowed slightly (58.3 vs 58.6). Also, backlog of orders reversed (49.1 vs 50.9) and the Supplier Deliveries Index increased (49.6 vs 47.5), indicating that supplier delivery performance was faster.

Respondents’ comments vary by both company and industry. There is continuing concern about inflation, interest rates and geopolitical events. Rising labor costs and labor constraints remain employment-related challenges.

Customize and filter live economic data via our DailyFX economic calendar

JOLTs JOB OPENINGS PLUNGES TO 30-MONTH LOWS

The number of job openings decreased to 8.7 million on the last business day of October, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations changed little at 5.9 million and 5.6 million, respectively.

On the last business day of October, the number of job openings decreased to 8.7 million (-617,000). The job openings rate, at 5.3 percent, decreased by 0.3 percentage point over the month and 1.1 points over the year. During the month, job openings decreased in health care and social assistance (-236,000), finance and insurance (-168,000), and real estate and rental and leasing with the only increase coming from the information sector.

Recommended by Zain Vawda

Trading Forex News: The Strategy

THE US ECONOMY AND DOLLAR OUTLOOK

Another batch of key data out of the way ahead of the FOMC Meeting with the NFP report still due on Friday. The Dollar for its part has continued its upward trajectory in light of renewed safe haven demand and tapering of rate cut bets. The continuous repricing of the Fed rate cut expectations for 2024 continues to rumble on with a slight tapering this week not being inspired by any particular data releases.

This may be in line with the mixed comments and messages we continue to get from Fed policymakers many of whom are happy with the progress but believe market participants are getting ahead of themselves on the rate cut front. The ISM Services is not ideal for the Fed as it has been cited as one of the sticky areas in relation to inflation. However, another drop-off in the Jols job openings number may overshadow the ISM data as we do have the NFP on Friday. This week's jobs data could see more of the same with wild swings in expectations until Fed Chair Powell takes the podium at the FOMC meeting.

MARKET REACTION

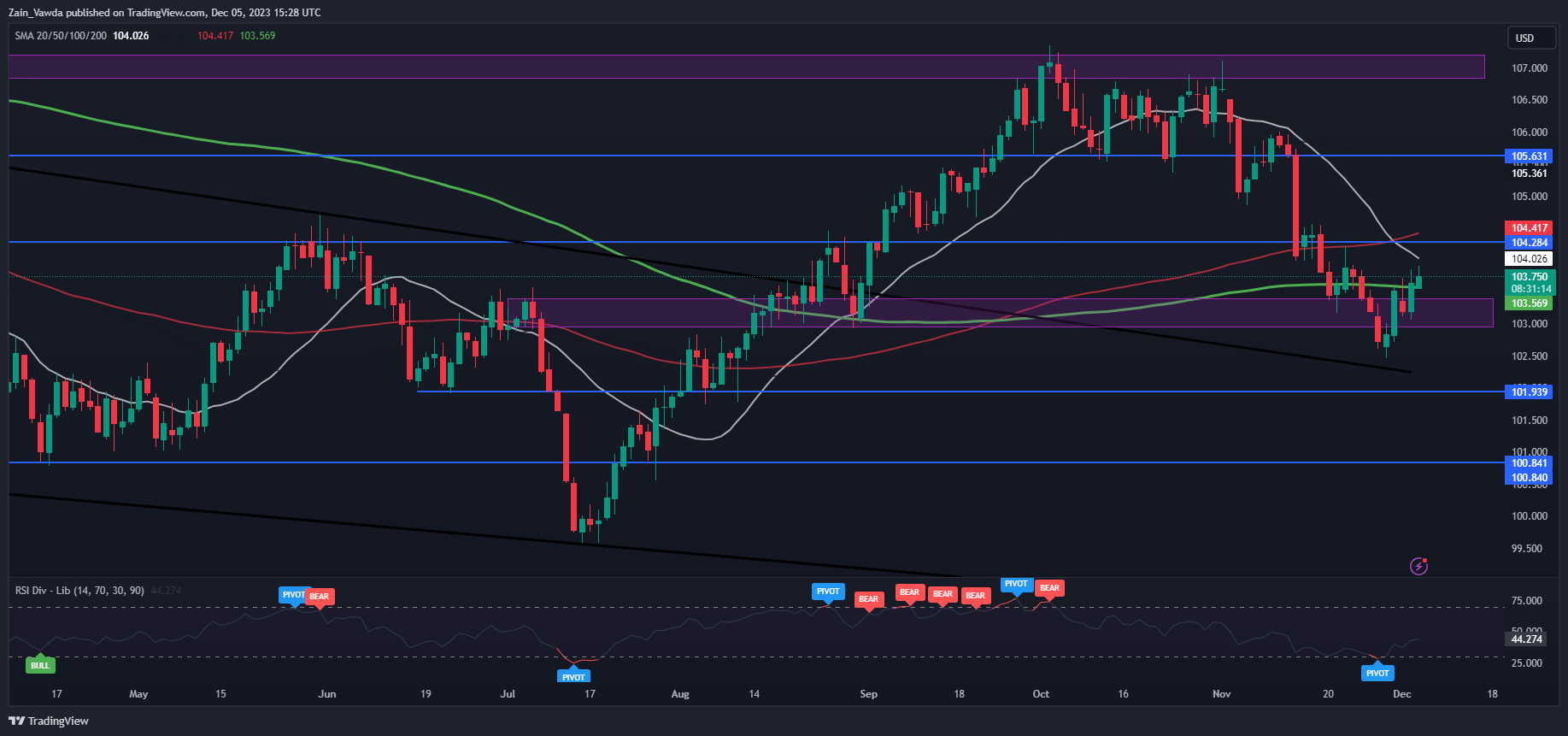

Dollar Index (DXY) Daily Chart

Source: TradingView, prepared by Zain Vawda

The Initial reaction to the data saw a sharp selloff in the DXY but since then we have seen abit of a recovery. The DXY retested the 200-day MA before bouncing and may have a challenge piercing through the MA and support resting just below at the 103.50 mark.

I expect DXY downside to remain limited ahead of the NFP report on Friday, however we could be in for a slight pullback ahead of the report as traders may eye some profit taking following the early week USD gains.

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.