Is the Panic Over? Sentiment Reversal Lifts the Euro

EUR/USD News and Analysis

- EU bank stocks post sizeable recovery as market jitters fade on reassuring news on banking stability

- Markets fully price in another 25-basis point hike from the ECB as banking fears ease

- EUR/USD

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

How to Trade EUR/USD

EU Bank Stocks Post Sizeable Rebounds on Culmination of Reassuring News Flow

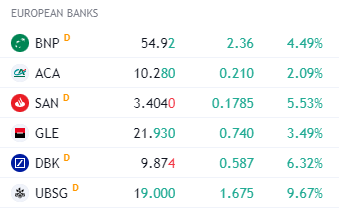

EU banking stocks have been the subject of much scrutiny since the UBS forced acquisition of beleaguered Credit Suisse. Today thus far, there has been an overall improvement in stock prices of a number of large European banks as can be seen in the snapshot below:

EU banks rise across the board (daily percentage change on the far-right column)

Source: TradingView, prepared by Richard Snow

It would appear that recent market fears have calmed. Whether it’s the realization of the different treatment of AT1 bonds outside of Switzerland, or reassurances from the European Central Bank (ECB) and now the S&P ratings agency that echo the sentiment that European banks are able to weather turmoil, EU assets have responded positively.

Furthermore, according to the European Banking Authority’s Chairman Jose Manuel Campa, European banks are also said to not only meet the minimum liquidity requirements but actually hold amounts well in excess of this. He went on further to warn that despite this there is no room for complacency. Major EU banks regained some recent losses.

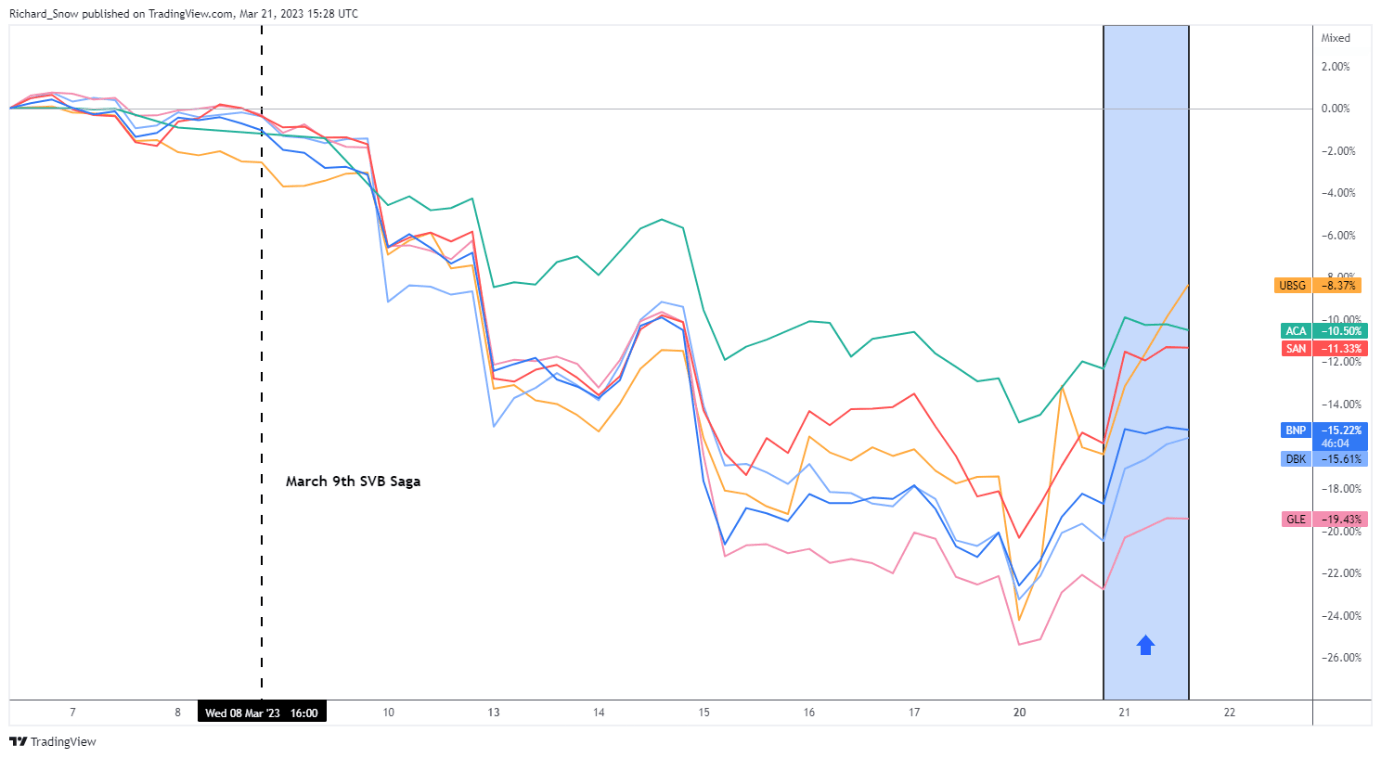

Decline and Partial Recovery of EU Banking Stocks with Today’s Broad Rise

Source: TradingView, prepared by Richard Snow

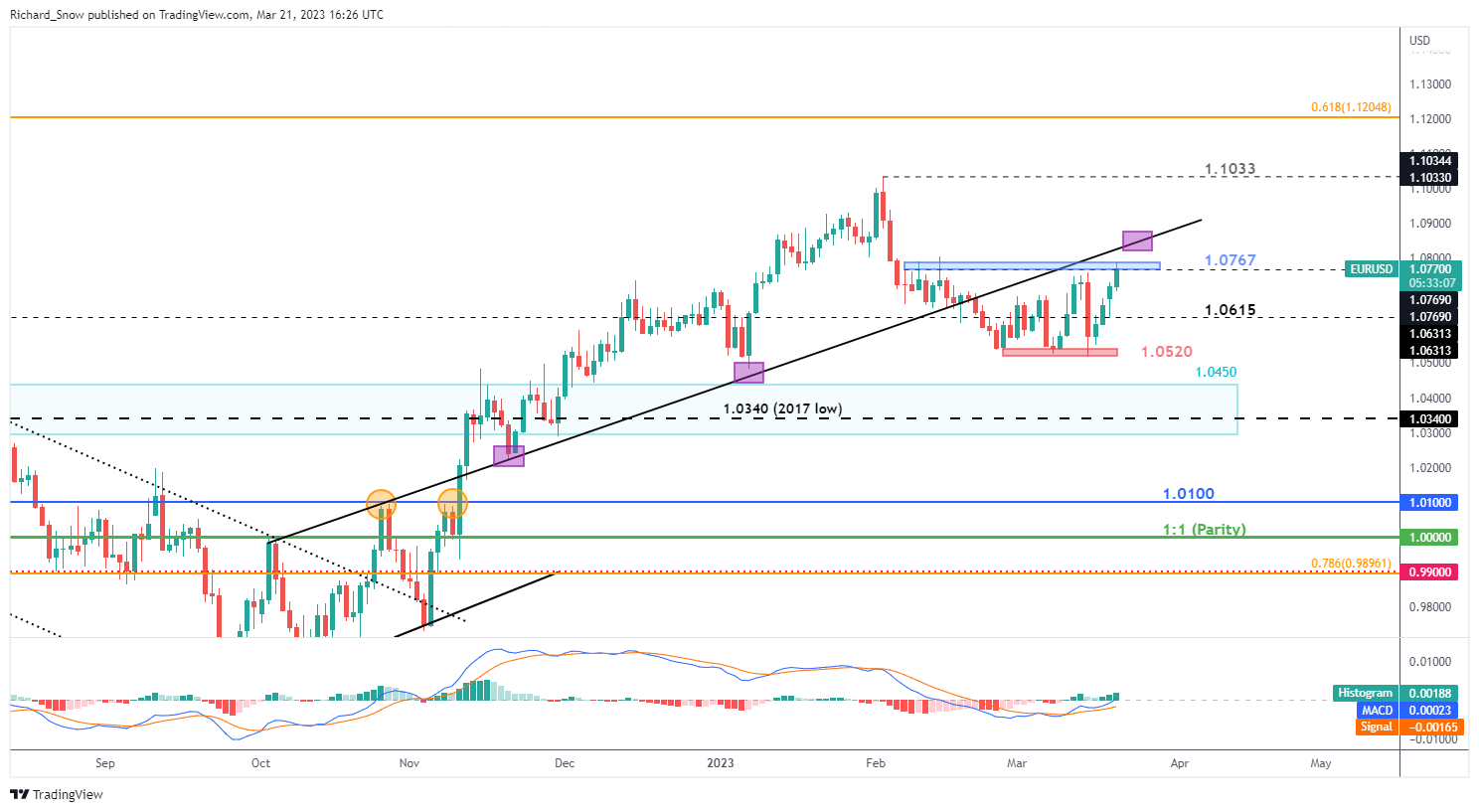

EUR/USD Technical Developments and Levels to Consider

Looking at the EUR/USD daily chart below, the pair continues to trade higher, helped by a dollar sell-off as treasury yields plummeted and what appears to be improved sentiment around the European banking sector with the ECB standing ready with liquidity tools should they be required. However, in financial markets things can change very quickly.

EUR/USD now tests the zone of resistance around 1.0767, where a close above this level seen as the first step to an approach of the yearly high at 1.1033. Before that, the diagonal trendline resistance provides another challenge for EUR/USD bulls as the trendline has proven to act as a pivot point for past price action whether as support or as resistance.

On the short side of EUR/USD, support comes in at 1.0615, followed by the zone of support at 1.0520.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Momentary Banking Calm Redirects Attention to Rate Hikes Again

Now that markets have had tome to assess the rout in the banking sector and whether the EU is more or less vulnerable to a systemic crisis than the rest of the developed world, it appears that the early signs of a return to stability may be in the works.

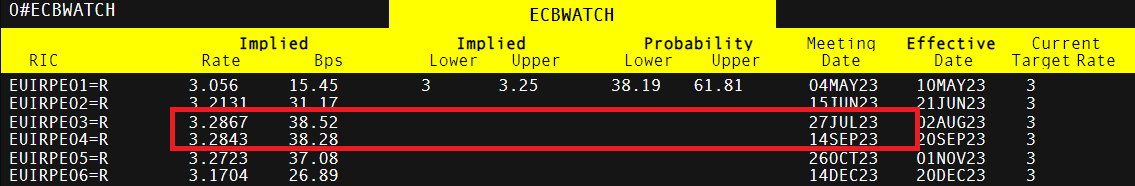

With markets appearing convinced that the ECB has a handle on things, implied rate probabilities now fully price in a 25-basis point hike anywhere from now until September. According to recent ECB commentary, markets underappreciate the path of future rate hikes, meaning if stability within the banking sector is confirmed, the governing council could still send interest rates even higher (potentially supporting euro valuations) to get inflation under control.

Implied ECB Rate Probabilities

Source: TradingView, prepared by Richard Snow

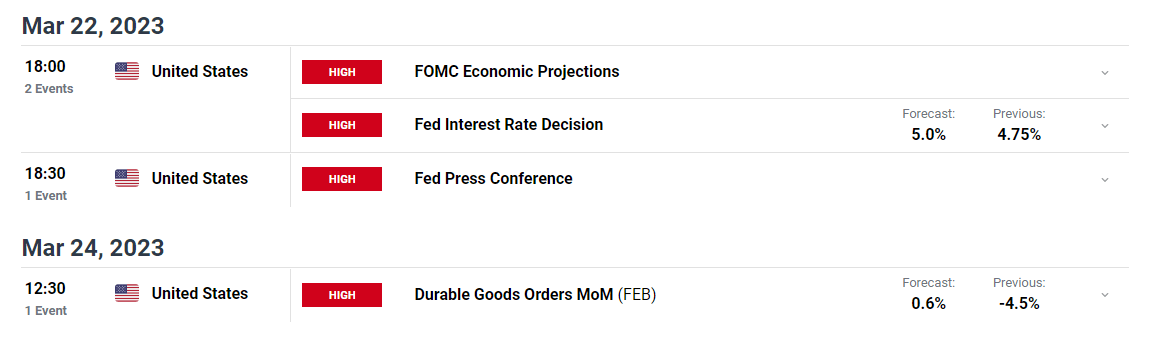

Major Risk Events Ahead

The more cautionary ZEW sentiment figures earlier today (EU and Germany) had little influence on EU assets today and the remainder of the week is filled with US high importance data. The FOMC is due to announce whether we see a 25 bps hike or no hike but other, less likely outcomes cannot be ruled out. The summary of economic projections is also due to be released but the relevance of the data will need to be assessed in light of the extreme volatility we have witnessed around fears of a systemic banking crisis. If the numbers were confirmed before March 9th they may not reflect the current landscape.

Customize and filter live economic data via our DailyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.