Is Euro’s Downtrend Over? EUR/USD, EUR/AUD, EUR/NZD Price Setups

Euro Vs US Dollar, Australian Dollar, New Zealand Dollar – Outlook:

- EUR/USD has rebounded from quite strong support.

- Downside in EUR/AUD could be limited; EUR/NZD’s slide is losing steam.

- What is the outlook and the key levels to watch in key Euro crosses?

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the fourth quarter!

Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

The euro appears to have garnered some cushion for now, thanks to the apparent shift in Fed rhetoric. The question then comes up is this a game changer for EUR/USD?

From a monetary policy perspective, the divergence in policy outlook appears to be reducing. The minutes of the FOMC meeting stressed the need for proceeding carefully in determining the extent of additional policy tightening. In recent days, the key Fed officials have indicated the sharp rise in yields / financial conditions has reduced the need for further interest rate hikes. Similarly, two ECB officials on Wednesday saw a reduced likelihood of additional tightening as the disinflation process is underway.

However, the economic growth divergence in favor of the US could limit the rebound in EUR/USD. The US economy appears to be on a solid footing, whereas the Euro area economy’s underperformance could drag – the rise in German real estate insolvencies could be another headwind.

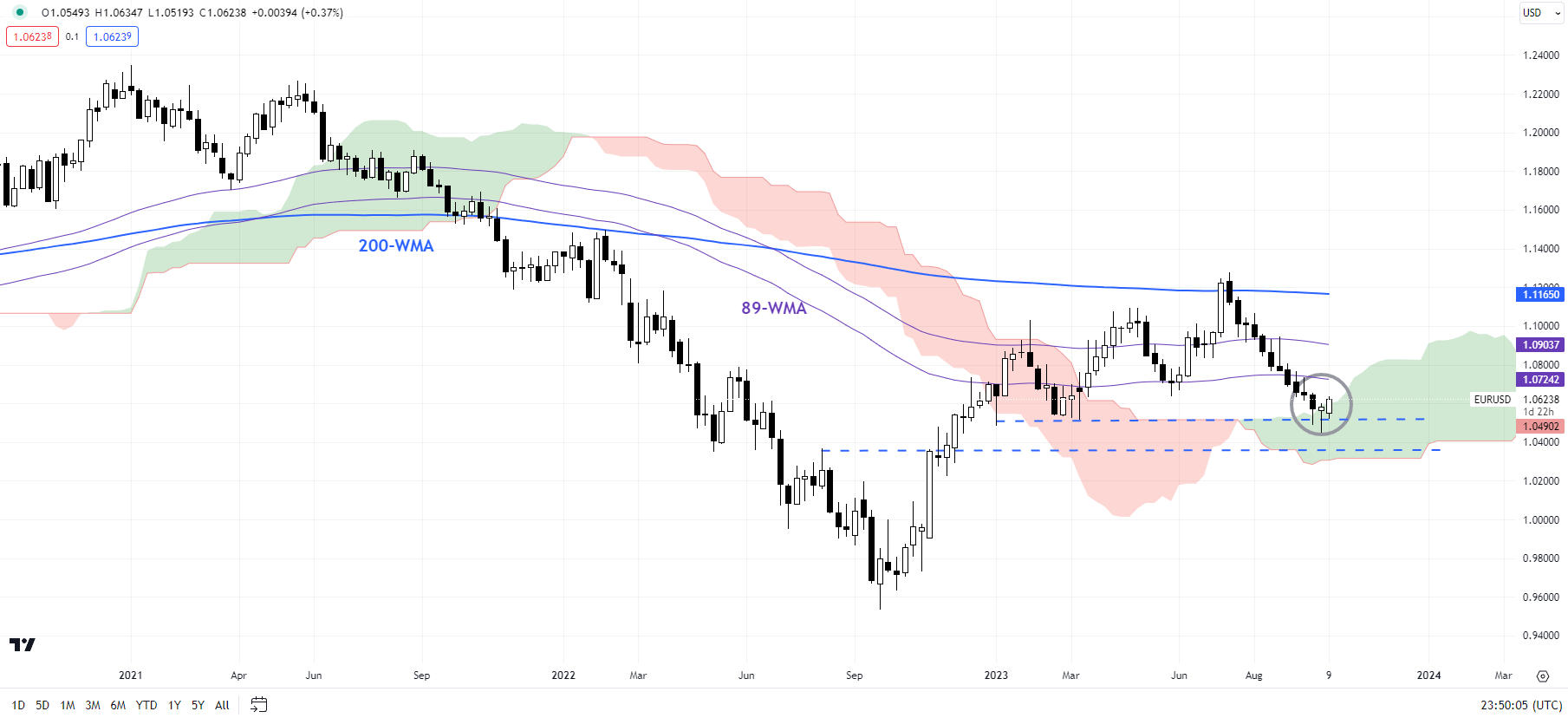

EUR/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

EUR/USD: Major support holds

On technical charts, EUR/USD is attempting to rebound from crucial support zones, including the March low of 1.0500 and the lower edge of the Ichimoku cloud on the weekly charts. The rebound comes three weeks after the prospect of it was first highlighted in “Euro Could Be Due for a Minor Bounce: EUR/USD, EUR/JPY, EUR/GBP, Price Setups,” published September 19.

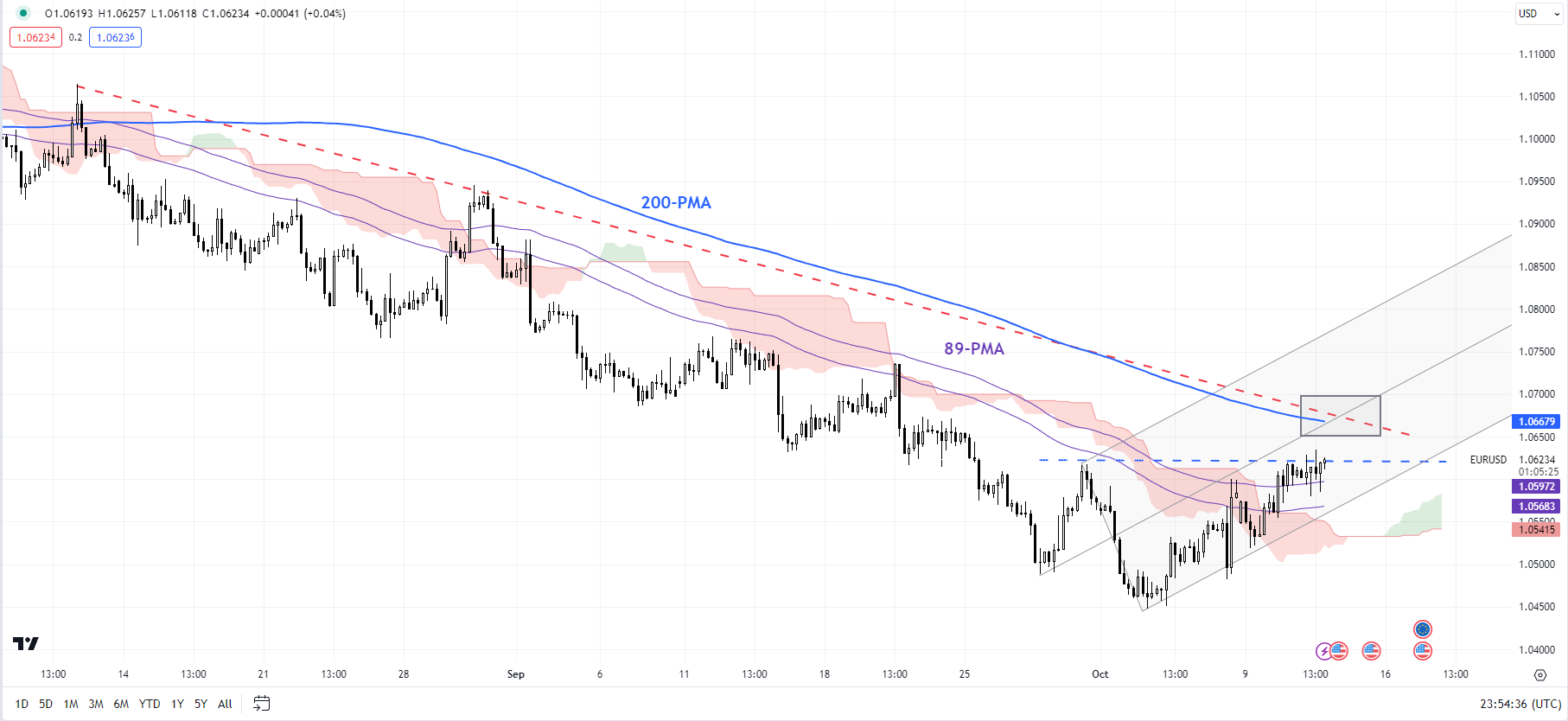

EUR/USD 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

Supercharge your trading prowess with an in-depth analysis of gold‘s outlook, offering insights from both fundamental and technical viewpoints. Claim your free Q4 trading guide now!

Recommended by Manish Jaradi

Get Your Free Gold Forecast

EUR/USD is now approaching a tough converged hurdle, including the 200-period moving average on the 240-minute charts, a downtrend line from August, slightly above the end-September high of 1.0620. A crack above this resistance area is needed for the immediate downside risks to fade. Zooming out, a hold above 1.0300-1.0500 is crucial to keep the broader recovery pattern intact from the broader recovery that started last year.

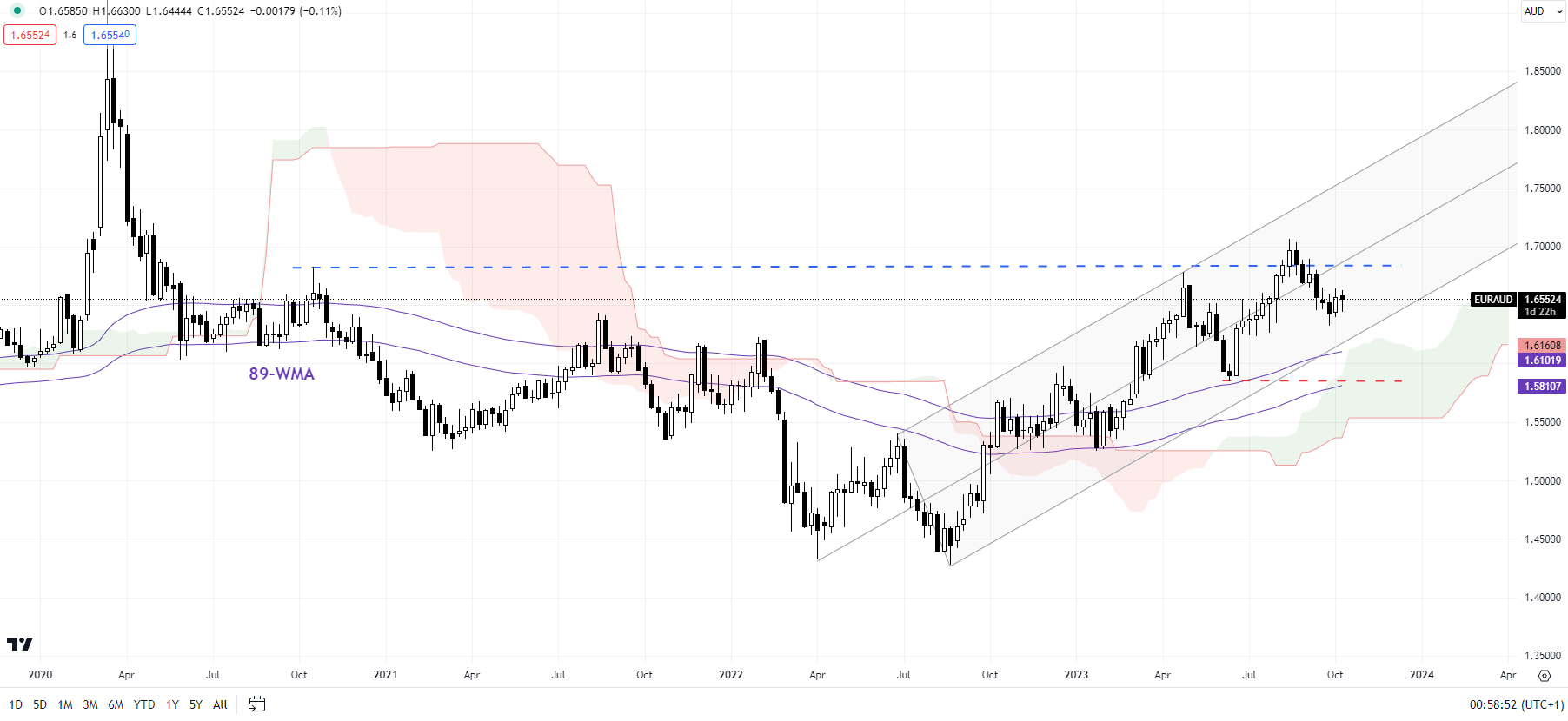

EUR/AUD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

EUR/AUD: Uptrend hasn’t been derailed

Despite the recent retreat, the broader uptrend in EUR/AUD remains intact, as reflected in the higher-highs-higher-lows sequence since 2022. The cross appears to be nicely guided by a rising pitchfork channel since last year. Unless the cross falls below the June low of 1.5850, the path of least resistance remains sideways to up in the interim. While 1.5850 is in place, the probability of an eventual rise above resistance at the August peak of 1.7050 is high.

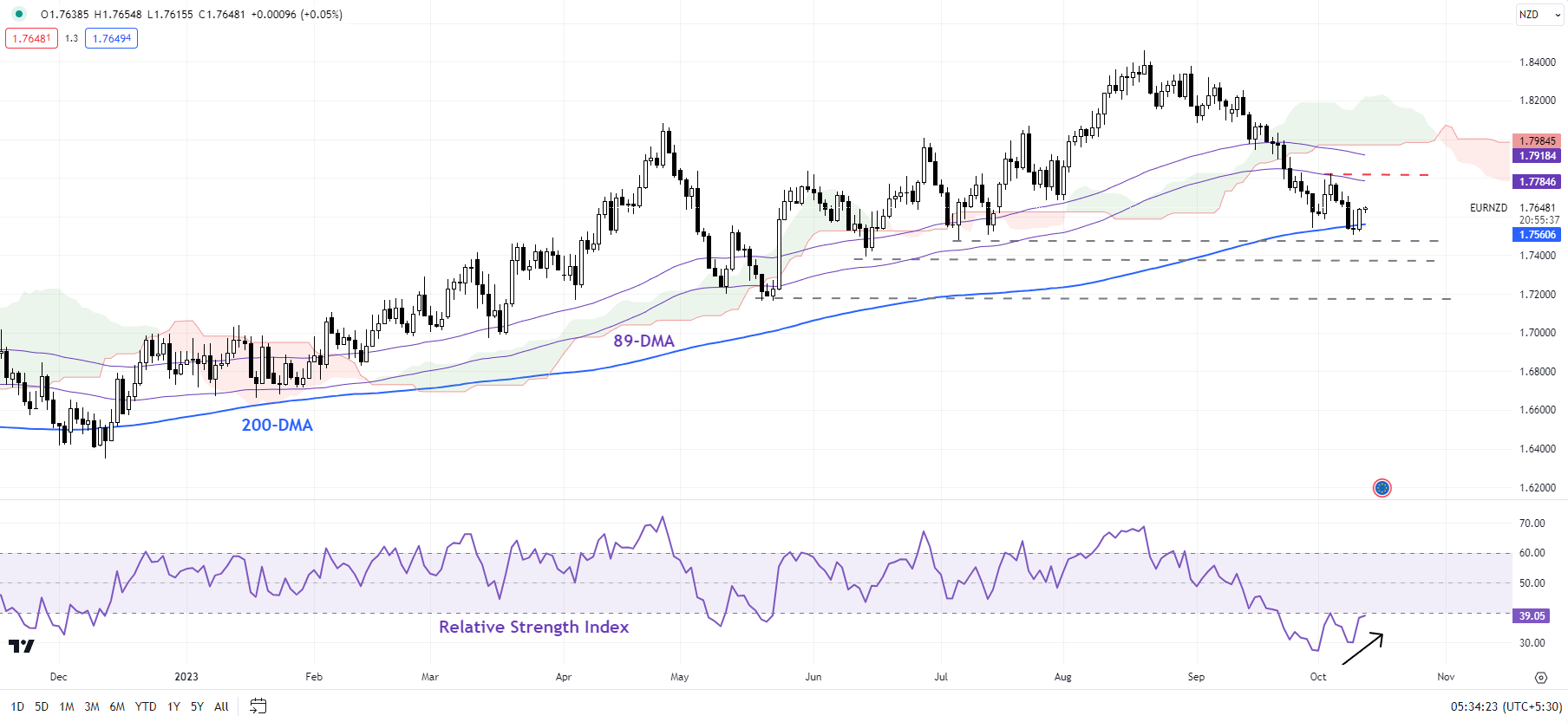

EUR/NZD Daily Chart

Chart Created by Manish Jaradi Using TradingView

EUR/NZD: Slide is losing steam

A positive divergence (ascending 14-day Relative Strength Index associated with declining price) on the daily charts suggests that EUR/NZD’s slide appears to losing steam. The cross is testing fairly strong support on the 200-day moving average, not too far from the June and July lows, with stronger support at the May low of 1.7165. However, EUR/NZD would need to crack above the early-October high of 1.7825 for the immediate downside risks to dissipate.

Discover the power of crowd mentality. Download our free sentiment guide to decipher how shifts in EUR/USD's positioning can act as key indicators for upcoming price movements.

Recommended by Manish Jaradi

Improve your trading with IG Client Sentiment Data

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

Comments are closed.