Intervention Concerns Provide Optimism for Yen Bulls

JAPANESE YEN PRICE, CHARTS AND ANALYSIS:

- Japanese Officials Keep Yen Bulls Optimistic with Intervention Talk.

- USD/JPY Approaching Key 145.00 Level Which Served as a Significant Resistance Area in 2022 with a Month Needed for a Break Higher. History to Repeat Itself?

- Range Breakouts on USDJPY and EURJPY Could Provide Some Short-term Opportunities.

Recommended by Zain Vawda

Download the Updated Q3 Forecast for the Japanese Yen

Read More: USD/JPY, EUR/JPY Head Higher as Yen Intervention Talk Fails to Arrest Slide

JAPANESE YEN BACKDROP

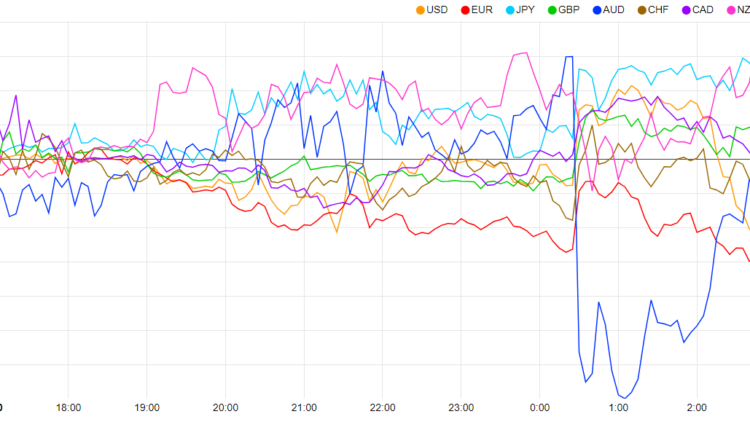

The Japanese Yen has held its ground over the past few days as intervention talk continues. Yen pairs have seen a slight lull of late with USDJPY in particular feeling the effects of a potential intervention while trading at a key area of resistance. The Yen has started the day with a wee bit of strength as indicated by the currency strength chart below and with the US Independence Day holiday could be in or some short-term gains against the greenback in particular.

Currency Strength Chart Strongest: NZD Weakest: EUR, USD

Source: FinancialJuice

Japan Finance Minister Suzuki confirmed earlier today that he is in contact with US counterparts when it comes to the FX markets. The Japanese Finance Minister and the Bank of Japan Governor Kazuo Ueda have been quick to stress that they are not monitoring FX levels but rather will act if moves become excessive and volatile. Market participants have grown weary as USDJPY made its way toward the 150.00 level which was the level at which intervention occurred last year. However, given the comments and the levels of GBPJPY and EURJPY I think it will be more important to pay close attention to the rate at which the Yen depreciates against its counterparts, with a quick depreciation likely to trigger intervention from Japanese officials.

The Japanese economy did receive a bout of good news to kickstart the week as business sentiment in the second quarter improved, according to data from the BoJ’s Tankan Survey. The improvement comes as raw material costs are seen to have peaked with factory output and consumption rising as well. Annualized GDP growth in Q1 came in at 2.7% with analysts believing the Japanese economy is on course for a steady recovery. Exports remain low in what seems to be a trend globally at the minute, but this has been offset by increased spending and consumption on the domestic front.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Q3 is no doubt going to be an intriguing one where the Yen is concerned with my belief that we will see signs or a potential tweak to the Yield Curve Control (YCC) Policy at some point. This is without a doubt one of the key reasons for Governor Ueda’s appointment as he is seen as the man who could put Japanese monetary policy back on a more traditional path.

Looking ahead to the rest of the day and it could prove to a quiet one with the US Independence Day Holiday. US data in particular picks up from Wednesday and could stoke some volatility ahead of the US NFP report due on Friday. There isn’t much in terms of risk events for the Yen this week with comments from officials likely to be the key source of any Yen volatility.

For all market-moving economic releases and events, see the DailyFX Calendar

PRICE ACTION AND POTENTIAL SETUPS

EURJPY

Analysis of EURJPY at present is tricky as we trade at levels last seen in 2008. Given the failure of the Yen to sustain any sort of strength, going against the overall bullish trend does not seem like a smart play especially over a medium or long-term horizon. EURJPY is currently approaching a previous gap in price around the 159.00 level which could serve as a form of resistance with the psychological 160.00 handle slightly higher. From an intraday perspective we have been consolidating in a tight range over the last 5 days or so with a breakout in either direction likely to provide some short-term opportunities.

Looking at the IG Client Sentiment data for cues and we can see that retail traders are currently net SHORT on EURJPY with 80% of traders holding short positions (as of this writing). Not surprising at all given that EURJPY has been hovering in overbought territory since June 15 (14-day RSI). At DailyFX we typically take a contrarian view to crowd sentiment meaning we could see EURJPY prices continue to rise with the price gap around the 159.00 handle looking ever more likely to be met.

EUR/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

Key Levels to Keep an Eye On:

Support levels:

- 156.75

- 155.00 (psychological level)

- 154.00

Resistance levels:

USDJPY

USD/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

From a technical perspective, USD/JPY has been on a tear since consolidating below the 141.00 handle for the first half of June. We have since rallied over 300 pips toward the psychological 145.00 handle

The 145.00 handle held firm last year for about a full month (highlighted by pink box on the chart) between September 7 and October 6, 2022, before breaking higher toward the 150.00 handle. It was at this level which the Bank of Japan stepped in, is history set to repeat itself? As mentioned earlier the comments from Japanese officials of late suggest that excessive moves in Yen may be the catalyst for intervention and something that is definitely worthwhile monitoring.

USDJPY is currently confined to a tight range just below the 145.00 handle with a range breakout to the downside likely leading to a third touch of the ascending trendline. Similar to EURJPY the 14-day RSI has been in overbought territory since June 21 which further supports a downside narrative.

However, bear in mind that the fundamental picture has been the main driver of Yen pairs for the majority of the year and could continue to scupper any potential technical setups.

Key Levels to Keep an Eye On:

Support levels:

- 143.80

- 142.40

- 140.00 (psychological level)

Resistance levels:

Introduction to Technical Analysis

Relative Strength Index (RSI)

Recommended by Zain Vawda

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.