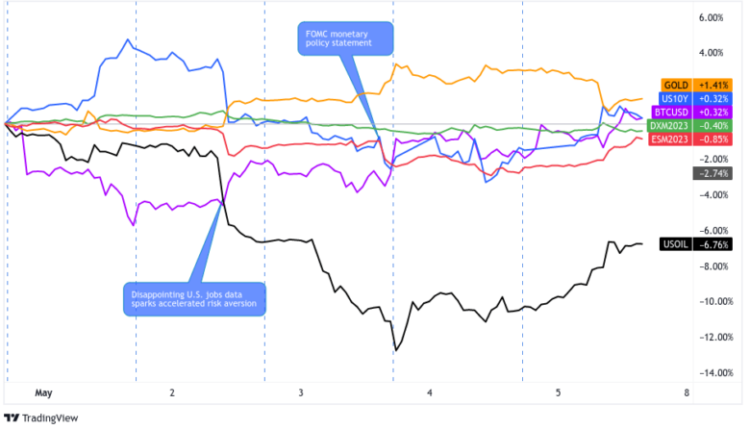

Intermarket Weekly Recap: May 1 – 5, 2023

Market players were all over the place this week as thin trading, bank jitters, and recession concerns dominated price action in the first half of the week.

Gold and JPY flexed their safe-haven muscles while “riskier” assets like equities, crude oil, and crypto took beatings.

And then the price action got hot as the RBA, Fed, and ECB published their latest monetary policy decisions.

While all three major central banks raised their interest rates, a lot of traders still considered them “dovish.” This is probably why risk assets eventually recovered some of their intraweek losses.

Notable News & Economic Updates:

🟢 Broad Market Risk-on Arguments

Japanese consumer confidence index improved from 33.9 to 35.4 in April vs. an estimated 34.7 figure, as overall livelihood, income growth, and employment ticked higher

RBNZ’s Financial Stability Report: “New Zealand’s financial system is well placed to handle the increasing interest rate environment and international financial market disruptions”

RBA surprised markets with a 25bps rate hike to 3.85%, citing “too high” inflation that will take “a couple of years” before returning to the target range. RBA noted that some further tightening “may be required” to return inflation to target “in a reasonable timeframe” -11th increase in a year, the highest rate since April 2012

U.S. Non-Farm Payrolls for April: 253K (190K forecast) vs. 165K in March; unemployment rate fell to 3.4%; Average hourly earnings came in above 0.3% forecast at 0.5%

🔴 Broad Market Risk-off Arguments

Chinese official manufacturing PMI fell from 51.9 to 49.2 vs. 51.4 estimates in April to reflect a return to industry contraction

Chinese official non-manufacturing PMI fell from 58.2 to 56.4 vs. 57.0 estimates in April to signal a sharper contraction in the sector

U.S. layoffs grew to the highest levels since 2000; the quits rate fell to 2.5% (lowest in 2 years); job openings fell to 9.59M from 10M

Germany’s retail sales were down by another -2.4% m/m in March vs. downwardly revised -0.3% in February, 0.4% expected

Shares of major U.S. regional banks fell as FRC failure shakes faith in banking sector recovery

U.S. job cuts in April 2023: 66.99K cuts vs. 24.28K in April of 2022 – Challenger, Gray & Christmas, Inc.; this is the fourth month in a row where the number of cuts was higher than the same month in the previous year

FOMC Chairman Powell mentioned that policymakers believe they are approaching the end of their tightening cycle but that cutting would not be appropriate given inflation trends

Chinese Caixin services PMI was down from 57.8 to 56.4 vs. 57.1 forecasts in April, as activity and new work reflected slower gains while input cost inflation rose to a one-year high

BOC Governor Macklem says they are not done hiking interest rates, especially if inflation climbs back above 2%

UBS considers selling Credit Suisse after acquiring the troubled bank a few weeks back, possibly keeping the investment arm while unloading the rest

Intermarket Weekly Recap

Dollar, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TV

On Monday, trading volumes were as thin as a slice of ham, likely due to the Labor Day holiday, and things weren’t looking so good for risk assets after China printed weak PMI reports.

Traders were also scratching their heads over the news of JPMorgan taking over First Republic Bank, wondering if it was the end of the banking crisis or just the beginning of a whole new disaster.

To make matters worse, U.S. officials were getting all hot and bothered over the U.S. debt ceiling, with Treasury Secretary Yellen warning that the U.S. could default as soon as June 1st if the ceiling isn’t raised.

Meanwhile, Biden invited top congressional players to the White House for a chat over the debt issue, to hopefully avoid a full-blown global financial crisis if the U.S. decided to default. Who knew Treasury bond news could be so dramatic?

So, risk assets were lower to start the week, most notably led by bitcoin, which took a dive down to the $27,700 level after getting rejected at $30,000 over the weekend.

Crude oil benchmarks also slid lower than a penguin on an ice slide on recession concerns, with WTI crude oil price bottoming out around the $67.00 handle.

The Reserve Bank of Australia (RBA) was under the spotlight on Tuesday as it surprised markets with a 25bps rate hike when everybody and their momma priced in a pause. Turned out, RBA members weren’t too happy at the rate consumer prices are decelerating.

Not surprisingly, AUD shot up across the board at the news. NZD also found some support on speculations that RBNZ will soon say “TWINSIES!” and scrap a pause in favor of another rate hike.

It was the other way around for EUR, which slipped against safe havens like USD and JPY after Euro Area inflation numbers came in weaker-than-expected and supported the idea of the ECB pausing in the foreseeable future.

U.S. session trading saw full-blown risk aversion when stocks of regional banks crashed. Some even plummeted by 16% to 20% on bank contagion concerns!

Aside from U.S. equities (S&P 500 dropped below 4,100), crude oil and Treasury yields also took hits. Safe haven gold breached the psychological $2,000 mark before pulling back while BTC/USD traded from $28,300 to $29,300 within a few hours.

It was the U.S. dollar’s turn to experience pain on Wednesday after the FOMC shared its May monetary policy decision. As expected, the Fed hiked its rates by 25 bps to the 5.00% – 5.25% range, which is the “terminal rate” FOMC members marked on their March dot plot projections!

In his presser, Fed Chairman Powell shared that:

- There was strong support among FOMC members for a hike

- The Fed will be data-dependent going forward

- They may be approaching the end of the tightening cycle

- A rate hike pause was not discussed

- They felt a rate cut was “not appropriate” given the inflation trends

- Credit tightening is a focus

Traders took that as a “dovish hike” and dropped the dollar like a hot potato. Other assets also took hits, with S&P 500 making new weekly lows below 4,070 and crude oil sliding even lower. Safe havens benefited with gold firmly trading above $2,000 and JPY raking in all the risk aversion gainz.

Markets generally took a chill pill on Thursday while the ECB stole the spotlight leading into the U.S. trading session. The central bank raised its rates by 25 bps (not 50bps as some traders had expected) and promised to cut off its Asset Purchase Programme (APP) reinvestment in July.

Despite declaring an end to APP reinvestment, sharing that some members voted for a 50bps hike, and the ECB President saying that “we are not pausing, that’s very clear”, the euro fell on the event, likely due to a mix of several ideas.

This may include disappointment of only a 25 bps hike, a slowing rate of inflation, and recent lending survey data pointing to slowing credit conditions, suggesting that the run-up in interest rates is starting to put pressure on the Euro area economy.

On Friday, risk sentiment improved further, possibly due to all of the central bank hikes being out of the way (and the rhetoric leaning dovish), but volatility was muted ahead of the Friday NFP report.

Volatility picked up quickly on the release of hotter-than-expected employment numbers from the U.S., which prompted further risk-taking.

This reaction contradicts the recent theme of “pricing in higher odds of Fed tightening on good economic news,” suggesting that maybe traders are starting to pretty good that the economy is holding strong and inflation seems to be stabilizing, while a peak in the rate hike cycle may be near.

We also saw a strong bounce in equities on the session, potentially lifting risk-on vibes, as regional bank stock rocketed higher (possibly profit-taking from the severe sell-off this week in depressed names like Western Alliance, PacWest, and Zions Bancorp).

Unfortunately for risk-on traders, it wasn’t enough to get risk assets equities or oil back into the green, but there was an outlier in bitcoin which benefited from the resurgence of banking crisis fears this week.

Comments are closed.