Intermarket Weekly Recap: Apr. 24.-28, 2023

Traders were in a fickle mood throughout the week, as sentiment was influenced by earnings data, debt ceiling concerns, banking sector jitters, and Fed tightening expectations.

Equity indices and commodities managed to pull up around the middle of the week thanks mostly to a positive earnings turnout from tech companies, as well as legislation that would allow Congress to raise the debt ceiling.

Notable News & Economic Updates:

🟢 Broad Market Risk-on Arguments

Chinese President Xi reportedly talked to Ukraine’s Zelenskiy in a “long and meaningful” phone call discussing importance for parties to seek peace

Alphabet Q1 results surpassed both revenue and operating income estimates, as Google’s advertising revenue came in stronger than expected

House of Representatives narrowly passed a bill that would raise the debt ceiling and slash federal spending

Amazon reported a 9% year-over-year growth in revenues in Q1 to $127.36 billion, more than 2% above consensus estimates

EIA reported that or the week ending April 21, 2023, commercial crude oil inventories (ex SPR) fell by 5.1M bbl to 460.9M bbl

The Bank of Japan held off on any changes to its monetary policy (interest rate stays at -0.10%; yield curve control range on 10-yr bonds stays at 0.50% on either side of 0.0% target) on Friday; removed forward guidance and announced its intentions to review monetary policy

🔴 Broad Market Risk-off Arguments

Banking sector jitters returned on Wednesday as First Republic bank considers sale of $100 billion in assets amid deposit run of $72 billion in Q1

Sweden’s Central Bank hiked interest rates by 50 bps to 3.5% on Wednesday; signaled at least one more hike in June or September

US consumer confidence hit its lowest levels since July (104.0 to 101.3) on pessimism on the expectations side, even as the present situation component of the survey held up

Q1 US advanced GDP missed expectations of 2.0% growth, as the actual figure came in at 1.1%, also lower than the earlier 2.6% expansion in Q4

Quarterly Core PCE for Q1 2023 came in above consensus at 4.9% q/q from 4.4% q/q previously, upping Fed interest rate hike expectations; the monthly U.S. Core PCE Price Index read came inline with expectations / previous read at +0.3% m/m

Intermarket Weekly Recap

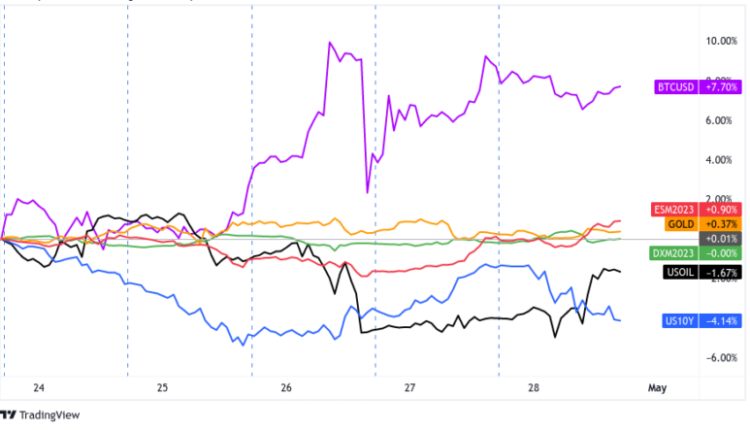

Dollar, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay 1-Hour by TradingView

Higher-yielding assets like equities and commodities started the week on the back foot, as market players braced for a potentially lackluster earnings week.

The U.S. debt ceiling also came into focus thanks to lower-than-expected incoming tax revenues, and the political pushback from House Republicans kept investors wary of a potential government default.

Risk appetite soured further when First Republic bank reported a massive deposit flight, as well as plans to downsize operations, reviving banking sector contagion fears and triggering another wave lower for U.S. equities on Tuesday, and possibly the rally in bitcoin that saw the crypto asset retest the $30K handle on Wednesday.

Interestingly enough, the U.S. dollar failed to bank on its safe-haven appeal this time, allowing commodities like crude oil and gold to pull up from their earlier declines. In addition, oil was able to momentarily benefit from supply concerns stemming from Iraq and Sudan.

Treasury yields were also broadly lower then, as traders likely trimmed Fed rate hike bets on account of fiscal sector concerns. It didn’t help that the U.S. printed another weak regional manufacturing survey (Dallas Fed index) that had traders buzzing about the R-word again.

Wednesday marked another day in the red for U.S. equities and bond yields when the CB consumer confidence turned out weaker than expected, although stocks bucked the trend and pulled up slightly higher after hours when Alphabet and Microsoft printed upbeat earnings data.

This stock market rebound carried on the next day when European banking shares (Deutsche Bank and Barclays) and U.S. tech companies like Meta and Amazon printed strong Q1 figures. The S&P 500 Index rose 2% on Thursday, the most in a single day since January, while the NASDAQ 100 Index advanced 2.8%.

U.S. Treasury yields also enjoyed quite the recovery, despite the downbeat advanced GDP reading for Q1. As it turns out, the 3.7% annualized increase in consumption and 4.9% year-over-year gain in core PCE likely had traders trimming Fed rate cut bets.

Crude oil also managed to hold its ground after filling the gap from three weeks back after the OPEC announced a surprise output cut. Gold, on the other hand, suffered another wave lower but managed to keep its head above the $1,980 key support level.

Friday’s calendar was extremely busy as traders had to manage the BOJ’s latest monetary policy statement, GDP readings from Europe and Canada, and more U.S. inflation signals; most notably the monthly U.S. Core PCE Price Index and Employment Cost Index.

U.S. data was probably the most watched, most of which came relatively inline with expectations, but hinted that the inflation fight is not done yet for the Fed. Overall, they weren’t the market movers many traders hoped they would be.

And with the global GDP updates being lagging indicators, and thus having very little influence, there wasn’t anything to derail the risk-on momentum brought on by positive U.S. earnings reports, and likely why we saw one last push higher before the Friday close.

Comments are closed.