IMF Warns of Global Economic Slowdown, Core Inflation to Decline Slowly

IMF World Economic Outlook Latest Analysis

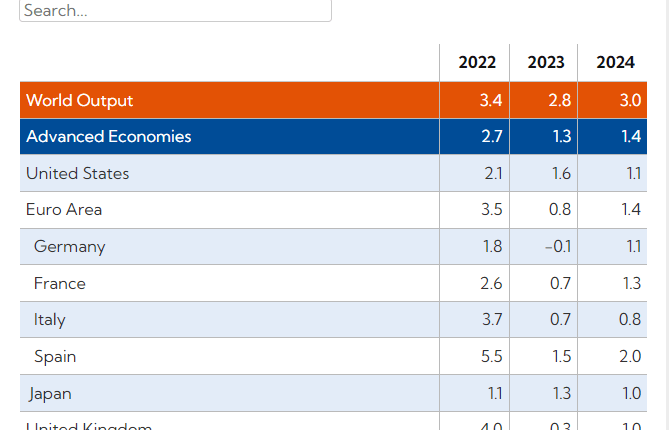

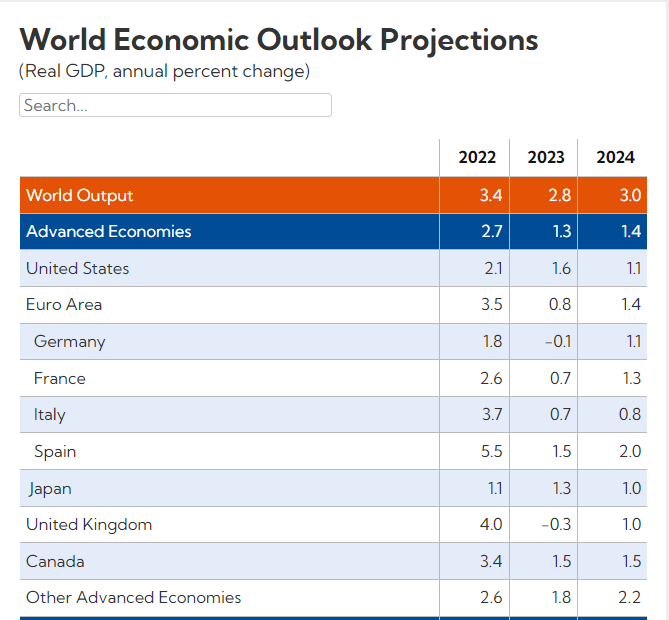

- World output is seen falling to 2.8% this year from 3.4% in 2022.

- Advanced economies' output slashed to 1.3% in 2023 from 2.7% last year.

Recommended by Nick Cawley

Trading Forex News: The Strategy

The latest IMF World Economic Outlook warns that global growth will turn lower in 2023 with advanced economies' output less than half the rate seen last year. The US economy is seen growing by 1.6% this year, and by 1.1% in 2024, while the German and UK economies are set to contract this year by 0.1% and 0.3% respectively.

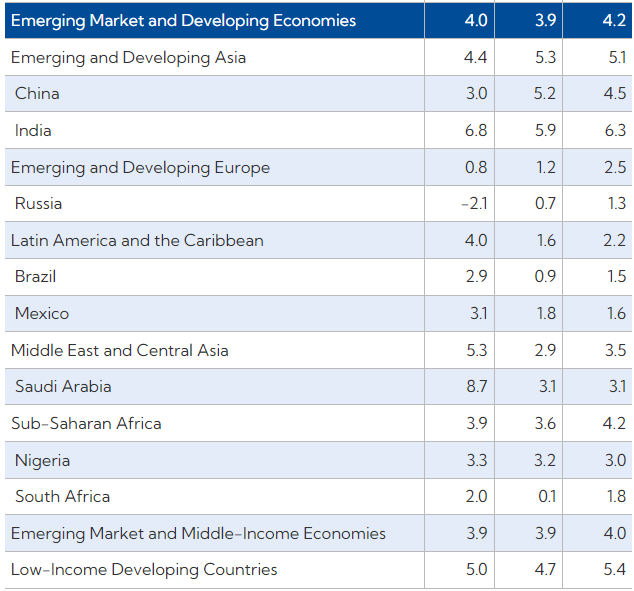

The picture for Emerging Market and Developing Economies is slightly brighter with a small downturn in 2023 before stronger growth in 2024. China is seen expanding by 5.2% this, compared to 3% last year, while the Indian economy is seen growing by 5.9% this year, compared to 6.8% in 2022, and 6.3% in 2024.

The IMF report – A Rocky Recovery – released today, also notes that core inflation may be slower to fall than previously thought.

‘First, inflation is much stickier than anticipated, even a few months ago. While global inflation has declined, that reflects mostly the sharp reversal in energy and food prices. But core inflation, which excludes energy and food, has not yet peaked in many countries. We expect year-end to year-end core inflation will slow to 5.1 percent this year, a sizeable upward revision of 0.6 percentage points from our January update, and well above target.’

The IMF analysis also suggests that ‘once the current inflationary episode has passed, interest rates are likely to revert toward pre-pandemic levels in advanced economies.’ The level to which rates fall will depend on ‘ whether alternative scenarios involving persistently higher government debt and deficit or financial fragmentation materialize.’

For all market-moving data releases and economic events see the real-time DailyFX Calendar.

What is your view on Global Growth and Inflation – positive or negative?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.