How Much More Upside in GBP/USD?

GBP/USD, BRITISH POUND – Outlook:

- GBP/USD breaks above key resistance ahead of BOE rate decision.

- Medium-term GBP/USD remains constructive.

- What are the signposts to watch?

Recommended by Manish Jaradi

How to Trade GBP/USD

The British pound’s break above key resistance against the US dollar last week is another sign that GBP/USD’s medium-term fortunes could be changing.

GBP/USD rose to a one-year high ahead of the Bank of England interest rate decision on Thursday. The better-than-expected US April jobs data were overshadowed by downward revisions to the March jobs numbers, keeping intact the market pricing for 75 basis points of Fed rate cuts by the year-end.

The BOE is widely expected to raise interest rates by 25 bps to 4.5% as UK price pressures remain stubbornly high — headline inflation rose faster than expected at 10.1% on-year in March, not too far from the four-decade high of 11.1% hit in October. The market is pricing the terminal rate closer to 5% and would be looking for a confirmation of the same. A hawkish hike could drive GBP higher.

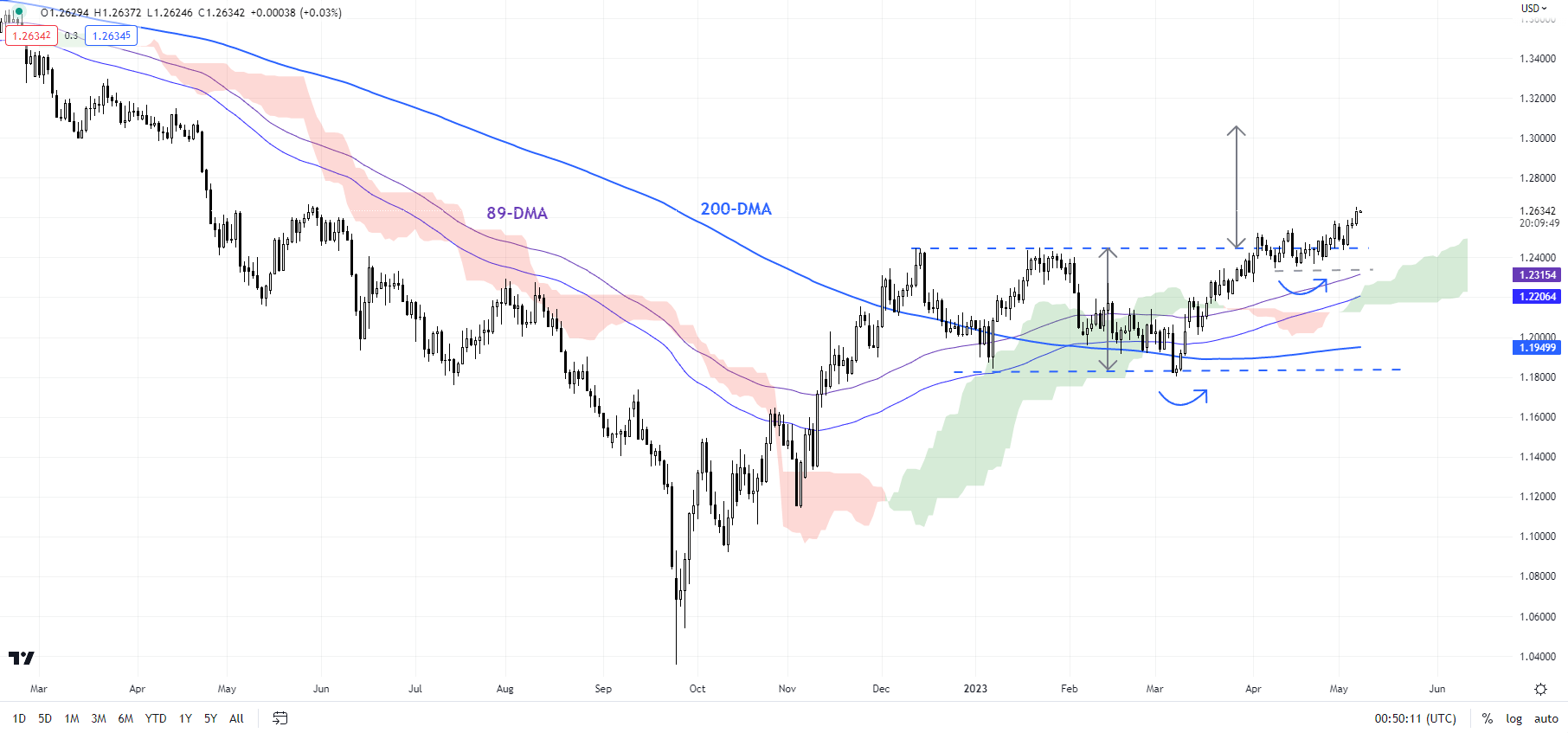

GBP/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

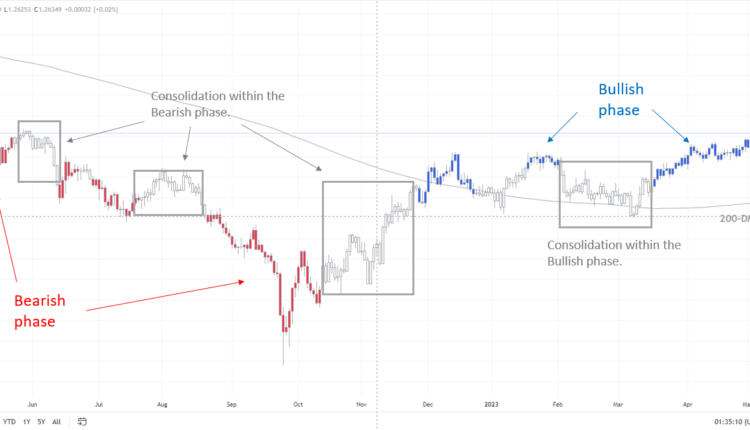

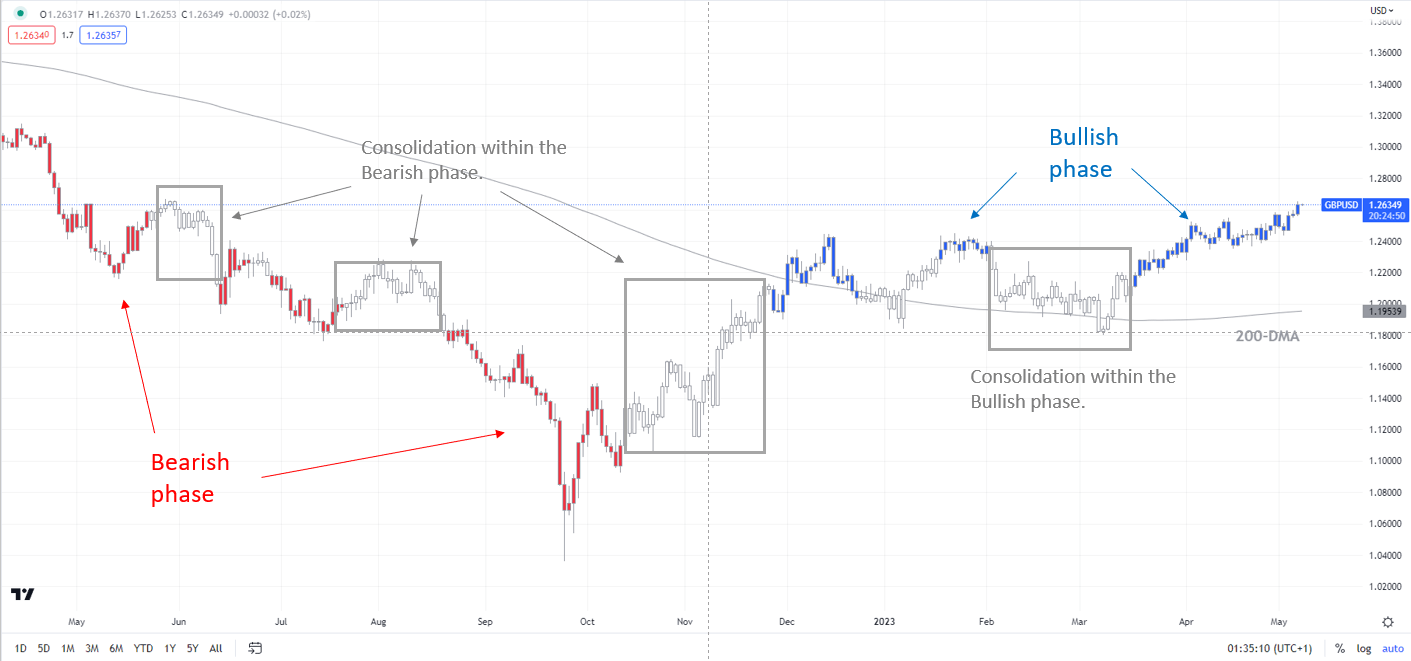

Note: In the above colour-coded chart, Blue candles represent a Bullish phase. Red candles represent a Bearish phase. Grey candles serve as Consolidation phases (within a Bullish or a Bearish phase), but sometimes they tend to form at the end of a trend. Note: Candle colors are not predictive – they merely state what the current trend is. Indeed, the candle color can change in the next bar. False patterns can occur around the 200-period moving average, around a support/resistance, and/or in a sideways/choppy market. The author does not guarantee the accuracy of the information. Past performance is not indicative of future performance. Users of the information do so at their own risk.

Moreover, UK macro data have exceeded expectations in recent weeks – the UK Economic Surprise Index is around a 2-year high, compared with its US counterpart, which has been declining since the end of March. In this regard, US CPI data due Wednesday (core CPI expected to soften to 5.5% on-year in April from 5.6% in March) will be crucial after the US Federal Reserve hiked interest rates last week and indicated it may pause there.With no BOE rate cuts expected this year by markets, the relative monetary policy outlook is GBP supportive for now.

GBP/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

On technical charts, GBP/USD’s decisive break above a horizontal trendline from the end of 2022 at about 1.2450 has triggered a breakout from the sideway channel (the lower edge of the channel is a horizontal trendline around 1.1840), implying a potential rise toward 1.3000-1.3100 based on the width of the pattern.

Last week’s rise confirms the higher-tops-higher-bottom sequence since late 2022. For more discussion, see “British Pound Price Setup: GBP/USD, EUR/GBP, GBP/JPY”,published March 29. Importantly it could be unfolding into something more than just a corrective rebound, that is, it opens the door for a reversal of GBP/USD’s medium-term downtrend (first highlighted in October – see “GBP/USD Technical Outlook: Forming an Interim Base?” published October 3.

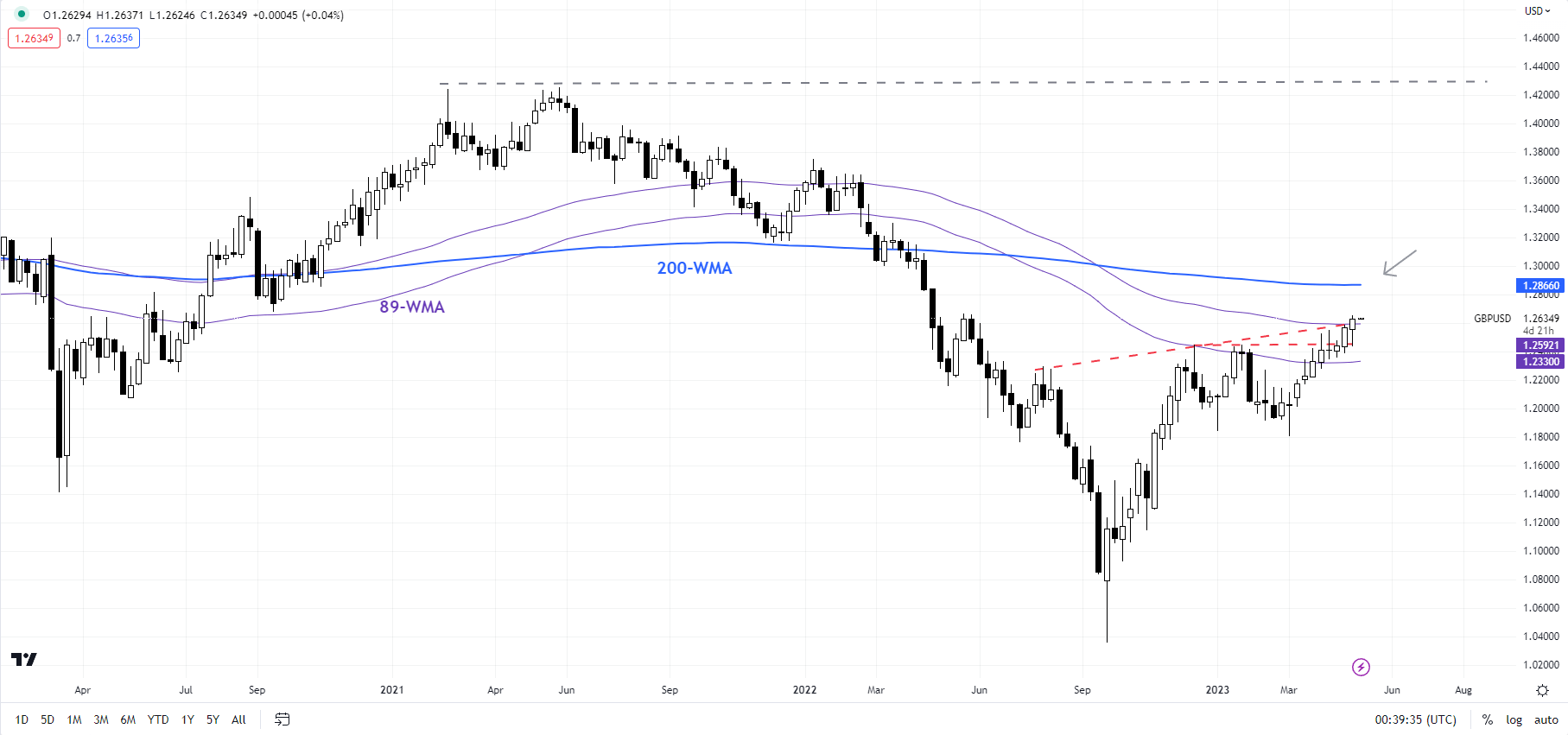

GBP/USD Weekly Chart

Chart Created Using TradingView

GBP/USD’s trend has been bullish in recent months, as the colour-coded candlestick charts based on trend/momentum indicators show. This is further reinforced by the rise above the upper edge of the Ichimoku channel on the weekly charts. GBP/USD is now testing a stiff barrier on the 89-week moving average – the last time it was decisively above the average was in 2021. Subsequent resistance is on the 200-week moving average (now at about 1.2870).

On the downside, the mid-April low of 1.2350 could offer quite a strong cushion in the event of a pullback. A break below 1.2350 would be needed for the upward pressure to fade in the short term.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

Comments are closed.