History of the Maserati EA – Trading Ideas – 31 January 2023

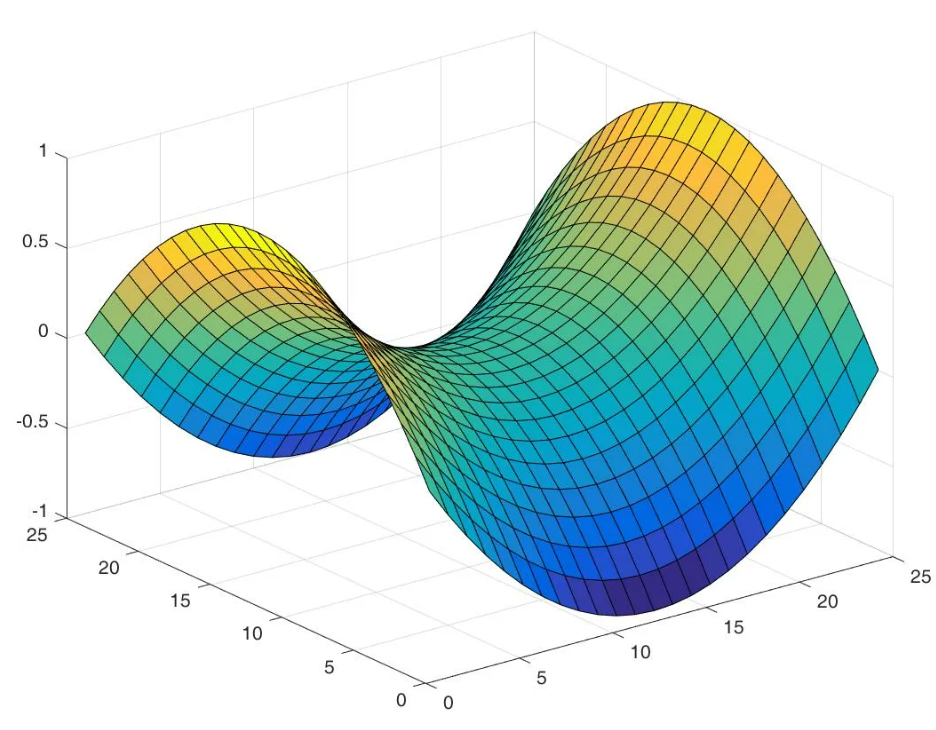

I've always found the world of trading and finance to be fascinating. I had aspirations of coming up with a successful trading method that would make me stand out from other traders. But I was aware that a strong background in mathematics was necessary for me to succeed in my objectives. In order to model the changes in currency prices, I began to study Calculus diligently. After that I studied linear algebra, which I used to examine and work with currency data matrices. I was able to estimate probabilities and make predictions based on historical data with the aid of statistics. The best portfolio allocation and risk minimization were then achieved using optimization. In order to examine currency trends and patterns, I also used time series analysis.

I looked into machine learning because I was dissatisfied with just using historical data. This helped me create trading algorithms and predictive models. I used Monte Carlo Simulation to further assess potential outcomes and risk in my trading strategies. I used Fractal Geometry in addition to all of these methods to examine market patterns and predict future trends. I researched stochastic processes to simulate erratic behavior in the financial markets and used number theory to encrypt financial transactions and defend against online threats. With the help of all these mathematical calculations, I was able to develop a successful trading strategy. I incorporated all of my knowledge and used it in a sophisticated, all-encompassing way, which gives me a big edge over other traders. My plan was a huge success, and I gained a reputation as a financial genius.

A brief overview of gathering information for my advisor.

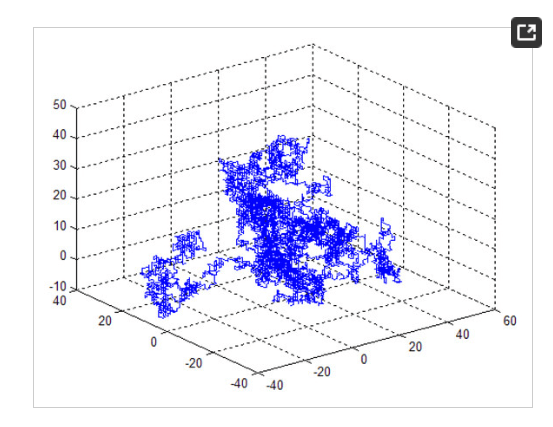

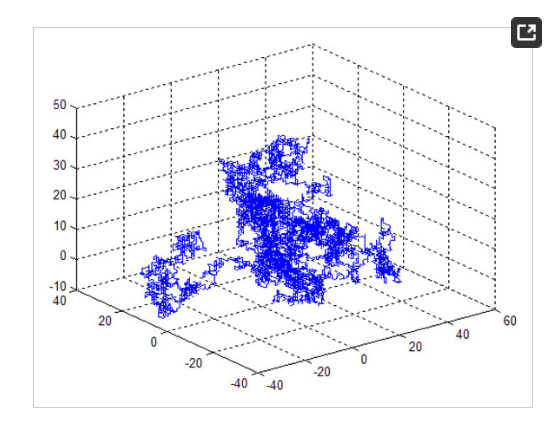

Multifractal analysis has been applied to the study of various stylized financial market facts, including market efficiency, financial crisis, risk assessment and collapse prediction. This concept can be called the random walk hypothesis (RWH). An example of a three-dimensional random walk is shown in Figure 1. Models of this type are used in many applications where they help to explain the observed characteristics of fields, which are known to be the result of random processes, i.e., where the spatial and temporal characteristics of the physical system are non-dec.

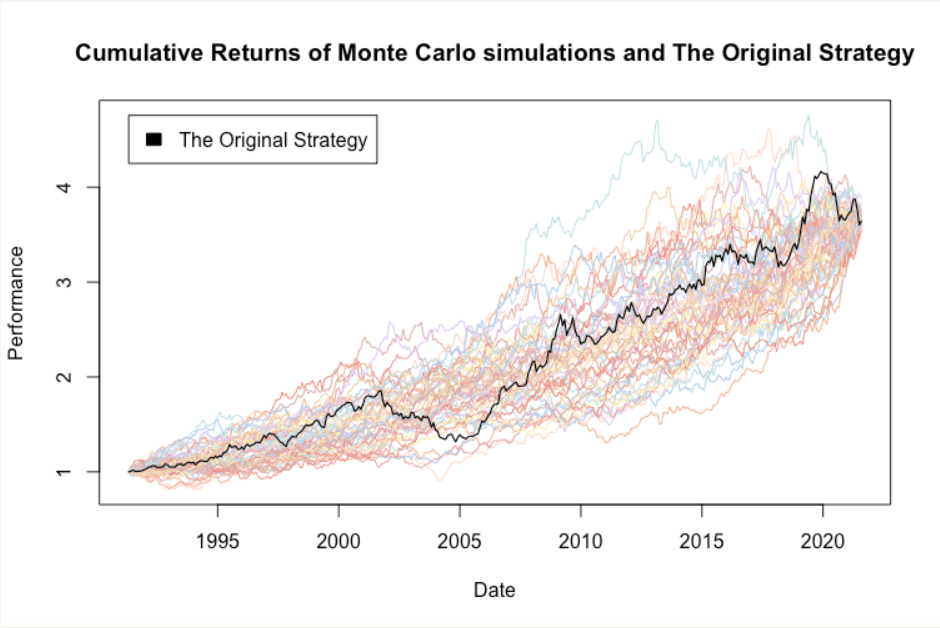

Monte Carlo simulation is used to predict the probability of various outcomes when other approaches, such as optimization, would be difficult to use. The main goal is to create alternative scenarios that take into account possible risk and help in decision making.

Types of Monte Carlo Strategy Simulations

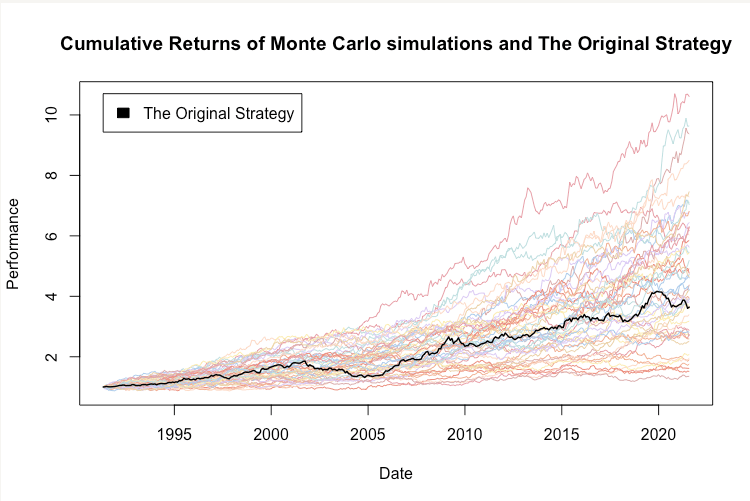

There are several types of Monte Carlo applications in quantitative trading strategies. I have focused on different ways to randomize strategy returns.

- Monte Carlo sampling without replacement

- Monte Carlo sampling with replacement

- Monte Carlo returns with replacement.

- Comparison with random strategies

Monte Carlo sampling without replacement:

This Monte Carlo method only changes the order of the returns, i.e., its “shuffles” the returns. The basic assumption underlying this method is that the returns will remain the same (or similar), but the order in which they appear may change.

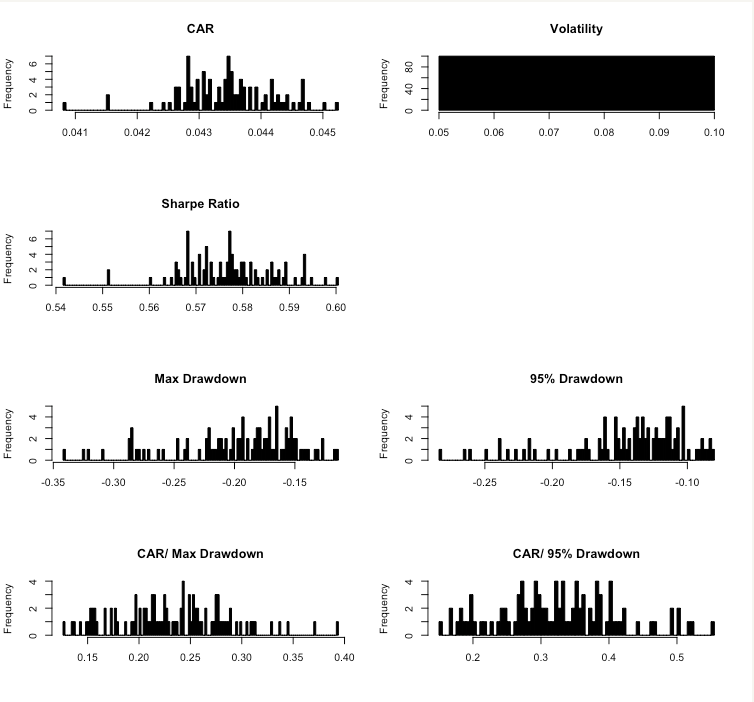

In addition, the following figure shows a set of histograms showing the frequency of individual risk and return characteristics in 100 simulations. There is only one value for volatility, because I applied random sampling without replacement.

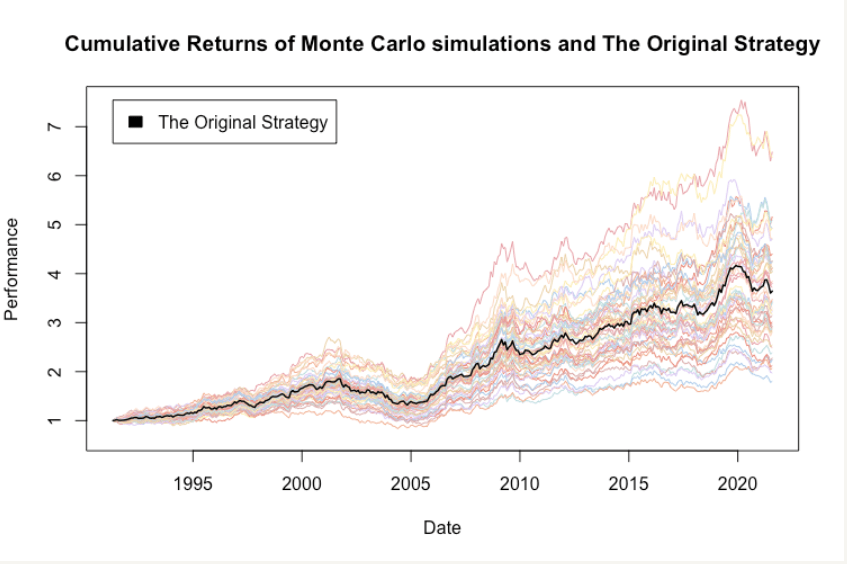

Monte Carlo sampling with substitution:

This Monte Carlo method not only changes order of the returns, it also randomly skips or repeats returns of the original strategy. The main assumption behind this method is, that a return distribution will stay the same (or similar), but returns may change more significantly. Monte Carlo sampling with replacement creates much more variety in simulated strategy returns.

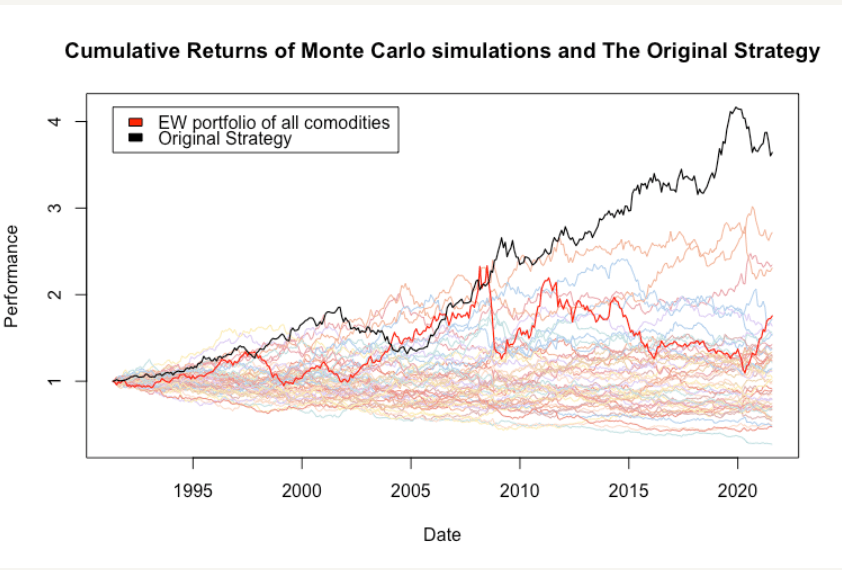

Monte Carlo return alterations:

This Monte Carlo method changes randomly picked returns in random direction by a pre-specified amount. The main assumption behind this method is, that returns may simply become smaller or larger in the future. It’s useful to observe strategy’s sensitivity to such a scenario.

Comparison against Random Strategies:

This Monte Carlo method is used to create a set of random strategies to compare to the original strategy. It is based on the assumption that our initial strategy should outperform most random strategies.

Random trades, by definition, fluctuate around zero most of the time. This should be one of the easiest hurdles to overcome in our strategy. This set of Monte Carlo tests serves as an independent (from our strategy) benchmark to be surpassed.

The secret of Maserati Advisor's amazing results lies in the combination of the cycle matrix and advanced machine learning algorithms. This unique combination of mathematical methods gives traders unprecedented insight and predictive ability. The cycle matrix I developed based on my extensive knowledge of linear algebra is a powerful tool that analyzes market patterns and identifies recurring cycles in currency prices. Combining this with the latest advances in machine learning, Maserati EA is able to make predictions with remarkable accuracy and navigate even the most unpredictable market conditions. The cycle matrix combined with machine learning forms the core of Maserati EA and provides traders with a powerful and sophisticated financial trading solution. Maserati's exceptional results and reliable performance are testament to the effectiveness of this innovative approach.

It is important to understand that buying Expert Advisors without live signals and historical data is not a wise investment. Live signals and historical data provide important information that is used to evaluate the performance and accuracy of an EA. Without this information, it is impossible to determine if an EA is a viable option for your trading strategy. Investing in a trading advisor without live signals and historical data is like buying a car without a test drive or studying its past performance. You simply can't make an informed decision without evaluating the live performance of the advisor and its past track record.

Buy Reliable Advisor is like a Maserati car.

Maserati EA MT5

Telegram channel

The real result

Comments are closed.