Hawkish BoE Leaves Rates Unchanged – GBP/USD Breaks Above 1.2700

GBP/USD Analysis and Chart

- BoE monetary policy left unchanged, 3 members vote for a 25bp hike.

- Fed’s dovish pivot sends global bond yields slumping to multi-month lows.

For all market-moving economic data and events, see the DailyFX Calendar

Most Read: US Dollar Sinks on Fed Dovish Pivot

Learn How to Trade Economic Releases with our Complimentary Guide

Recommended by Nick Cawley

Trading Forex News: The Strategy

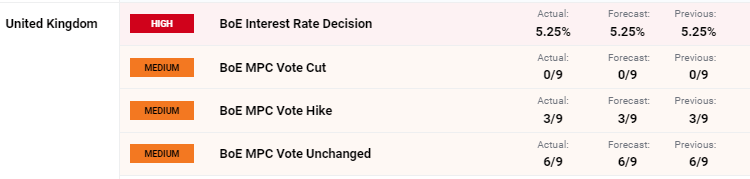

The Bank of England left all monetary policy settings unchanged today, as expected, for the third meeting in a row, while three MPC members continue to push for another 25 basis point rate hike.

BoE Governor Bailey continued to press forward the central bank’s case that UK inflation was still too high and that rates would be hiked if needed, and that the current restrictive policy would likely be needed for an extended period of time.

Governor Bailey’s hawkish stance is in stark contrast to last night’s FOMC outcome where Fed Chair Powell left the market in no doubt that the US central bank will cut rates in 2024. The Fed’s prediction of three 25 basis points cuts next year however is in sharp contrast to current market pricing that sees a total of 150 basis points of rate cuts in 2024 with the first quarter-point cut seen at the March FOMC meeting.

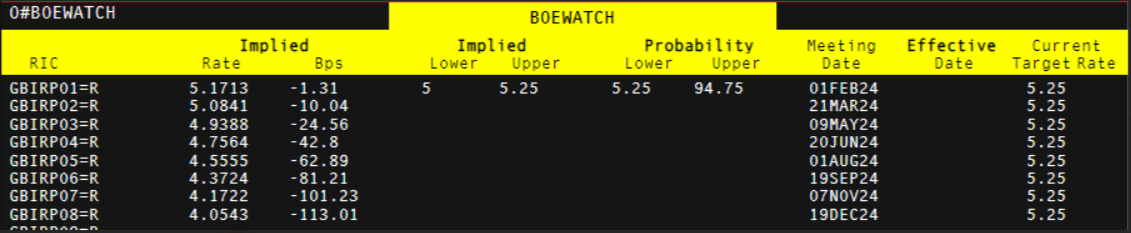

Current UK rate forecasts differ from the Bank of England’s hawkish view with the first 25bp rate cut set to be announced at the March BoE meeting with a total of 113bps of cuts seen in 2024.

BoE Rate Expectations

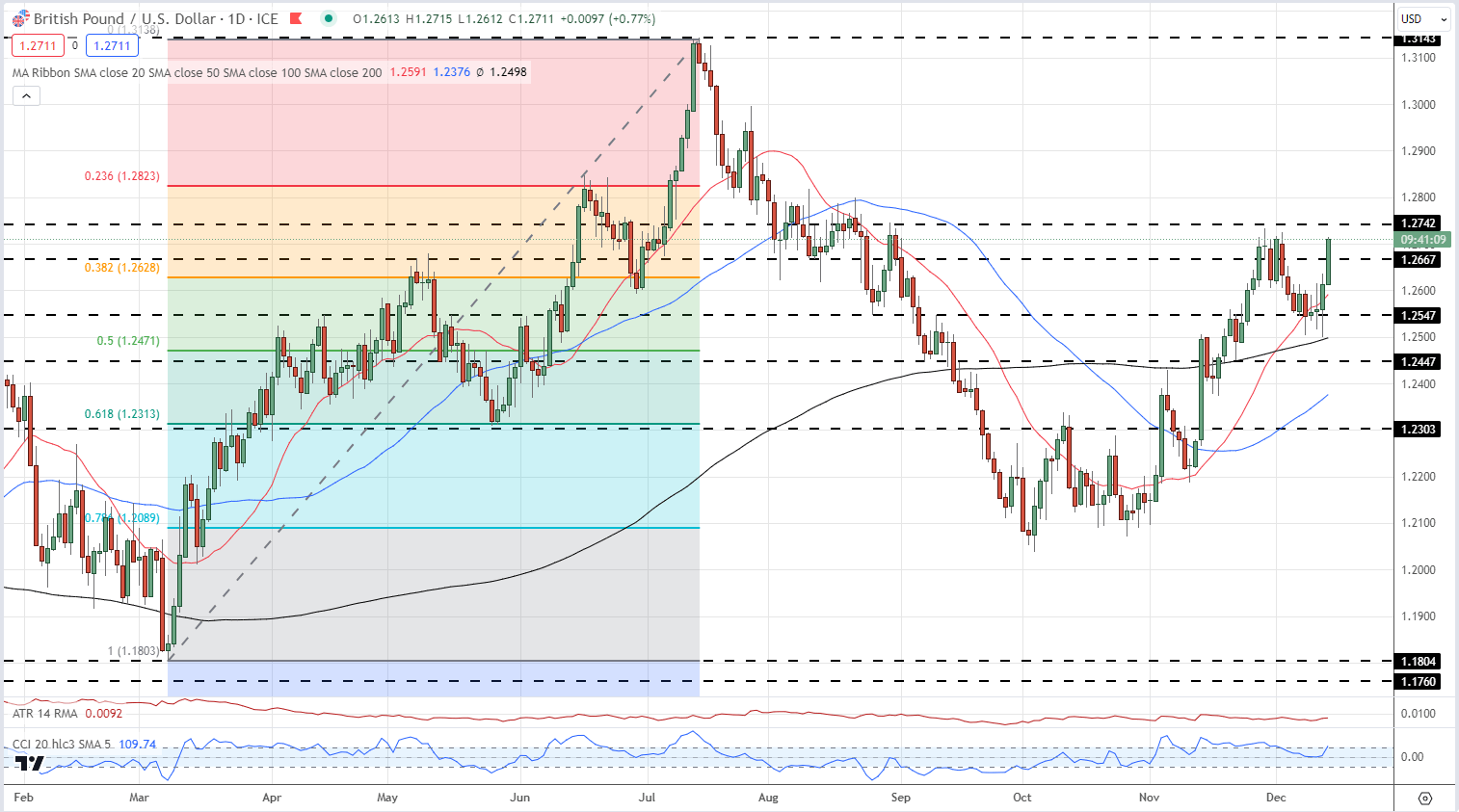

Cable picked up further after today’s announcement and tested 1.2700 against the US dollar. The US dollar is weak today after last night’s FOMC meeting and cable may well test the November 29 high at 1.2733 in the near term. A break above here would see the pair back at levels last traded at the end of August.

Recommended by Nick Cawley

How to Trade GBP/USD

GBP/USD Daily Price Chart

Chart using TradingView

GBP/USD retail trade data shows 49.23% of traders are net-long with the ratio of traders short to long at 1.03 to 1.The number of traders net-long is 8.40% lower than yesterday and 11.30% lower than last week, while the number of traders net-short is 0.09% higher than yesterday and 5.46% lower than last week.

What Does Changing Retail Sentiment Mean for GBP/USD Price Action?

| Change in | Longs | Shorts | OI |

| Daily | 10% | -8% | 0% |

| Weekly | -8% | 7% | 0% |

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.