Have Precious Metals Turned Bearish?

Gold, XAU/USD, Silver, XAG/USD – Technical Outlook:

- Gold’s recent retreat appears to be consolidation within the broader uptrend.

- Silver is approaching fairly strong technical support ahead of US CPI data.

- What are the key levels to watch?

Recommended by Manish Jaradi

How to Trade Gold

GOLD TECHNICAL OUTLOOK – BULLISH

Precious metals may have retreated most recently, but technical charts suggest it may be too soon to conclude that the three-month-long uptrend is over.

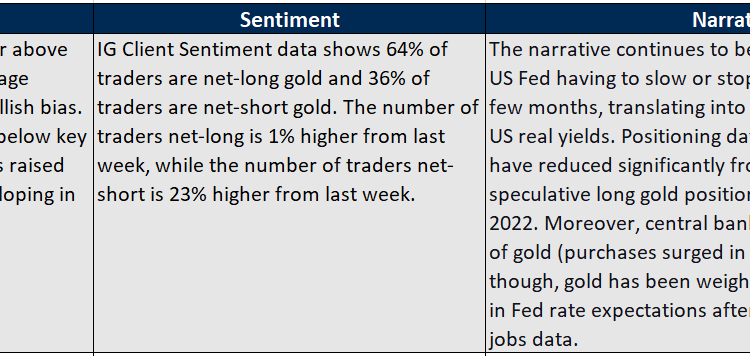

The upward pressure in gold and silver has faded over the past couple of weeks after surprisingly strong US jobs data, triggering a repricing higher in US Fed rate expectations. US rate futures are pricing the Fed’s target rate to peak over 5% in July Vs below 5% at the end of last month.

In this regard, Philadelphia Federal Reserve President Patrick Harker’s remarks on Friday were comforting – he flagged the prospect of rate cuts in 2024 should inflation continue to ease and did not alter his view that moving to smaller interest rate rises would be a good strategy. Harker echoed Fed Chair Powell’s disinflation tone last week.

A key focus is now on US inflation data due Tuesday. US monthly consumer prices and core CPI likely rose 0.4% on-month in January. Core CPI likely rose 5.5% on-year and the headline inflation rose 6.2% on-year last month. A softer-than-expected data could reaffirm the view that US inflation is peaking and soothe investors’ nerves.

XAU/USD Daily Chart

Chart Created Using TradingView

On technical charts, while XAU/USD’s fall below 1895-1900 confirms the upward pressure has faded a bit in the short term, it may not be sufficient to conclude that the uptrend is over. Gold continues to hold above the strong support area of 1775-1810, coinciding with the 200-day moving average and the lower edge of the Ichimoku cloud.

Moreover, the retreat so far is less than 38.2% of the rise from November – retracements of 38.2%-50% are considered to be reasonable, and not necessarily the end of the prevailing trend. However, gold would need to break above the support-turned-resistance at 1895-1900 for the immediate downward risks to ease. In sum, the broader bullish view for gold remains intact,unchanged from the previous updateeven though the short-term outlook is Neutral.

XAG/USD Daily Chart

Chart Created Using TradingView

SILVER TECHNICAL OUTLOOK – NEUTRAL

Silver is approaching a vital cushion area, including the 200-day moving average and the lower edge of a rising channel from mid-2022 (around 21.00-22.00). This follows a break below a horizontal trendline from early January at about 23.10, opening the way toward the mid-December low of 22.50, roughly the price objective of a sideways topping pattern.For the imminent downside risks to fade, XAG/USD would need to break above 23.00-23.10.

— Written by Manish Jaradi, Strategist for DailyFX.com

Comments are closed.