Grinds Higher but Acceptance Above 1.2100 Remains Elusive

GBP/USD PRICE, CHARTS and ANALYSIS:

- UK Mortgage Approvals Decline for a Fifth Consecutive Month.

- EU-UK Deal Optimism May be Misplaced as Benefits for the Broader UK Economy are Expected to be Minimal.

- Technicals Providing a Host of Conflicting Signals at the Moment as the 1.2100 Level Holds Firm.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Recommended by Zain Vawda

Get Your Free GBP Forecast

Most Read: Pound Sterling Reacts Favorably to NI Protocol – GBP/USD, GBP/JPY Rise

GBP/USD FUNDAMENTAL BACKDROP

GBPUSD enjoyed an 80-pip rally from its Asian session lows before finding some resistance following the European open. The move could be down to improved risk appetite as Chinese manufacturing data beat estimates overnight providing markets with a degree of optimism and seeing the dollar index lose a bit of shine. Whether this will last though will be interesting during the course of the day.

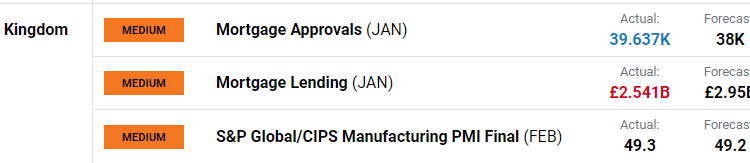

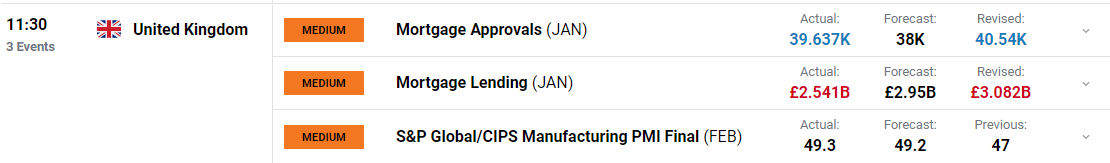

UK mortgage approvals meanwhile continued their decline in January coming in at 39.6k compared to 40.5k in December, making that a 5th monthly decline in a row. Excluding the Covid pandemic period this was the lowest print since January 2009. The net mortgage lending to individuals decreased as well from GBP3.1 billion to GBP2.5 billion in January as rising rates and tighter lending practices continue to bite consumers. We also heard some comments from Bank of England (BoE) Governor Andrew Bailey which struck a somewhat cautionary tone. Governor Bailey stated “I would caution against implying that we are finished raising interest rates or that we will inevitably need to do more” remaining somewhat non-committal. The Governor stressed the need to evaluate how rate hikes already implemented may be affecting the economy.

For all market-moving economic releases and events, see the DailyFX Calendar

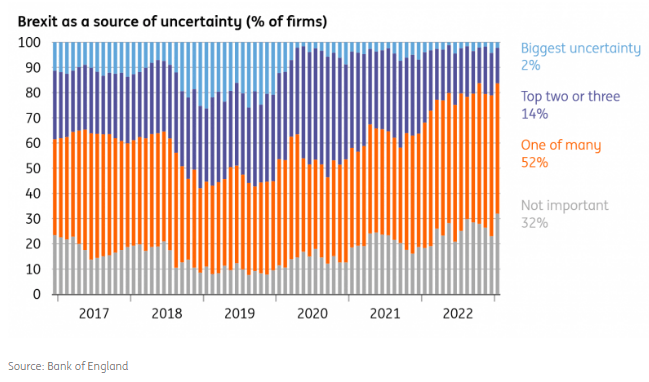

The recent deal between the UK and EU or “Windsor Framework” has given the pound some momentum, yet it has struggled to hold on to said gains. The reasons for this might in part be down to the fact that the economic impact of the deal is not likely to be significant for the UK economy as it does not improve trade terms between the rest of the UK and the EU. A recent survey by the Bank of England has revealed that Brexit is no longer a key uncertainty for UK businesses with 52% citing it as just “one of many” challenges moving forward.

Later in the day we have ISM Manufacturing PMI data out of the US which could see the dollar index gain a bit of strength should the print exceed forecasts of 48. However, I do not expect a significant impact with the ISM services data on Friday likely to provide more volatility.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL OUTLOOK

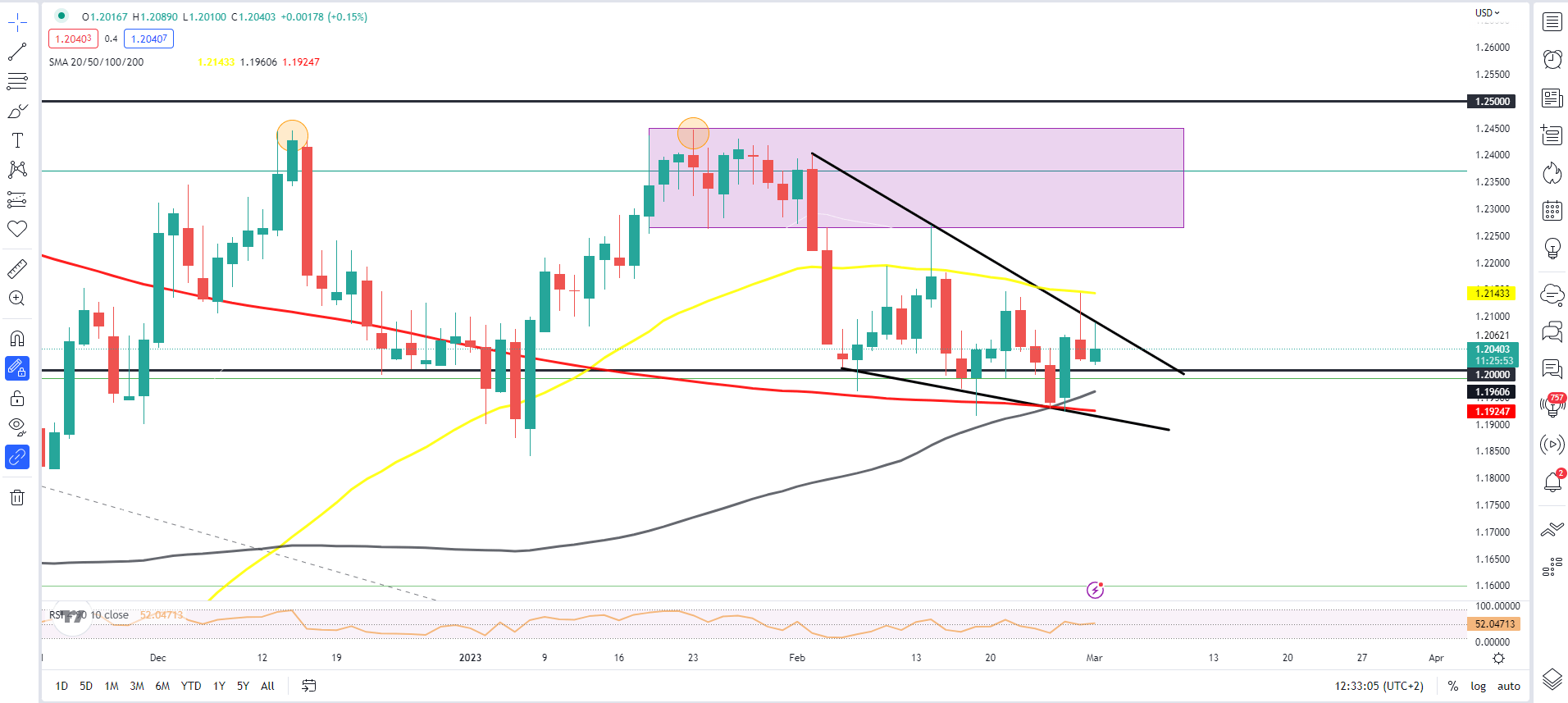

On the daily timeframe remain caught between the moving averages with the 50-day MA providing resistance to the upside and the 100 and 200-day MA having formed a golden cross providing support. Yesterday saw an attempt to break higher before rejecting of the 50-day MA and printing a shooting star daily candle close with no downside follow through as of yet. GBPUSD is currently probing the top of a descending wedge pattern which is in play as well.

Given the current nature of markets and risk appetite there is every chance that we remain rangebound in the short-term with a catalyst likely needed to inspire a breakout. A daily candle close above the 1.2100 level might give potential bulls more conviction of an extended upside rally.

Alternatively, a daily candle close below the wedge pattern or the 100 and 200-day MA may bring more bearish pressure to the table.

GBP/USD Daily Chart – March 1, 2023

Source: TradingView

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.