Global Market Weekly Recap: May 22 – 26, 2023

It was a relatively low volatility week across the major asset classes as traders likely held off on taking action as they awaited developments on the U.S. debt ceiling issue.

Normally volatile catalysts like global flash PMIs and inflation updates took a back seat to the U.S. debt story, which ultimately ended up being positive for risk traders on Friday after a roller coaster ride of updates throughout the week.

Notable News & Economic Updates:

🟢 Broad Market Risk-on Arguments

Over the weekend, White House official said that debt ceiling negotiations will resume early this week, although House Speaker McCarthy lamented talks have “moved backwards” in Biden’s absence

Crude oil prices got a boost from lower inventory levels, as the heatwave in Asia lifted demand for fuel oil to run air conditioning facilities

HCOB Flash Eurozone Services PMI at 55.9 vs. 56.2

Flash U.S. Services Business Activity Index: 55.1 vs. 53.6 previous

U.S. Preliminary GDP read for Q1 2023: 1.3% q/q; price index came in at 4.2% q/q (4.0% q/q forecast) vs. 3.9% q/q previous

On Friday, there were reports that Biden and McCarthy are “edging close” to a U.S. debt ceiling deal

🔴 Broad Market Risk-off Arguments

Credit rating Fitch put U.S. on “negative watch” on account of debt ceiling impasse

HCOB Flash Eurozone PMI for May: 44.6 vs. 45.8

Germany’s Q1 2023 GDP was revised from 0.0% to -0.3%, following Q4’s 0.5% decline, indices of business and consumer confidence suggested weakening economic conditions

Flash US Manufacturing PMI in May: 48.5 vs. 50.2 previous

FOMC meeting minutes showed that members are “uncertain” about how much tightening may be needed

Stronger than expected U.K. CPI figures raised the possibility of a wage-price spiral, with BOE Governor Bailey expressing concerns about stick inflation

Chinese CB leading index chalked up 0.6% month-over-month decline in April, following earlier upgraded 0.3% figure

RBNZ hiked OCR by 0.25% as expected, but highlighted concerns about global growth, subdued inflation, and weaker business demand conditions, suggesting that rates may have peaked

Global Market Weekly Recap

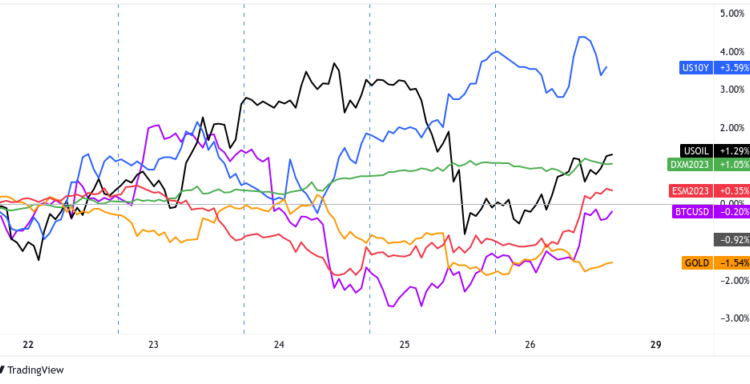

Dollar, Gold, S&P 500, Bitcoin, Oil, U.S. 10-yr Yield Overlay Chart by TV

After last Friday’s positive vibes, investors settled back in a somber mood at the start of this week, following the breakdown of U.S. debt ceiling negotiations over the weekend.

Neither the White House nor House Republicans seemed willing to budge on their demands, with Speaker McCarthy mentioning that both sides were “nowhere close” to reaching a deal.

Adding to the pressure was U.S. Treasury Secretary Yellen reminding that the government could wind up defaulting on its debts by June 1, causing market sentiment to turn sour again midweek.

Risk-off flows weighed mostly on commodity currencies, particularly the Kiwi which was reeling over the cautious shift and likely rate pause signal from the RBNZ earlier in the session. Concerns about China’s feeble economic rebound also weighed on metals like copper and iron ore.

Over in Europe, data from Germany reflected weakening business and consumer sentiment while stronger-than-expected U.K. CPI read also raised concerns of a wage-price spiral.

It didn’t help higher-yielding assets that the FOMC minutes released during Wednesday’s U.S. session kept the door open for another hike in June, as policymakers noted that wage growth was running well-above the 2% inflation goal.

The main beneficiary of these moves was the U.S. dollar, which was able to chalk up consecutive winning days while traders pared Fed rate cut bets.

Surprisingly, U.S. equities also managed to score a late rally on Thursday’s market hours as the tech sector got a boost from optimistic AI-related forecasts, particularly for Nvidia.

However, overall risk sentiment remained wobbly going into Friday’s trading sessions after credit rating agency Fitch put the U.S. on “negative watch.” Also, a Moody’s Investors Service spokesman said that making the June 15 coupon payment for Treasuries will be critical to avoiding a credit rating downgrade.

But by the Friday U.S. session, traders leaned heavily into risk-on mode after news hit the wires that White House and Republican negotiators had tentatively resolved most of the major issues of the deal. Risk sentiment may have also likely been influenced by optimistic rhetoric from officials that a deal is slowly coming together.

This prompted a rally in all major assets, especially risk-on assets like equities and crypto; gold was the exception as it drifted lower through the U.S. session, likely on lowering odds of a financial system catastrophe event.

During this time, we also got another hot inflation update from the highly anticipated U.S. Core PCE event release. Normally, this scenario tends to push risk assets lower on rising odds of central bank tightening/higher-for-longer rates, but equities and crypto held their ground, and oil prices even ticked higher into the weekend close.

Comments are closed.