German Ifo Highlights Ongoing German Economic Weakness, ECB Rate Pushback

EUR/USD Forecast – Prices, Charts, and Analysis

- German manufacturing sentiment fell further in November.

- ECB’s Vasle pushes back on rate cut bets

Learn How to Trade EUR/USD with our Complimentary Guide

Recommended by Nick Cawley

How to Trade EUR/USD

Most Read: Market Week Ahead: Gold Regains $2k, GBP/USD, EUR/USD Rally as USD Slides

Sentiment in German business has ‘clouded over’ according to the latest Ifo report with companies ‘less satisfied with their current business’, and ‘more skeptical about the first half of 2024.’

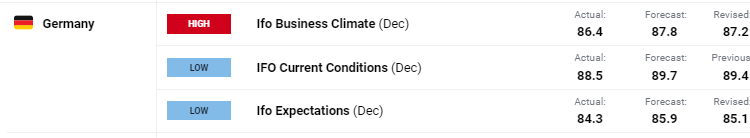

Results for the Ifo December Business Survey show:

In manufacturing, the Business Climate Index fell noticeably. Companies assessed their current business situation as significantly worse. Their expectations also grew more pessimistic. Energy-intensive industries are having a particularly tough time. Order books continue to shrink overall.

In the service sector, the business climate improved slightly. Service providers were more satisfied with their current business. They also reported less skepticism in their outlook for the coming six months. In restaurants and catering, the business situation improved but expectations took a nosedive.

In trade, the business climate suffered a setback. Companies assessed their current situation as markedly worse. Their expectations also darkened. For retailers, holiday trade is disappointing this year.

In construction, the Business Climate Index fell to its lowest level since September 2005. Companies assessed their current situation as worse. Moreover, roughly one in two companies are expecting business to deteriorate further in the months ahead.

ECB policymaker Bostjan Vasle today continued the central bank’s pushback against current interest rate expectations, saying that market expectations for rate cuts are premature and ‘inconsistent with the stance appropriate to return inflation to target.’ Current market pricing shows the first 25bp rate cut fully priced in at the April meeting with a total of 150 basis points of cuts seen through 2024.

EUR/USD is trading in a tight 40 pip range so far today in quiet market conditions. On Tuesday we have the final Euro Area inflation reading – forecast at 3.6% vs 4.2% prior -while on Friday we have the Fed’s preferred inflation report, core PCE, released at 13:30 UK. Both releases have the ability to move EUR/USD in either direction. Initial support for the pair starts with the 23.6% Fibonacci retracement at 1.08645 followed by a prior level of horizontal support at 1.0787. Resistance at last Wednesday’s 1.1017 high followed by 1.1076.

EUR/USD Daily Chart

Chart Using TradingView

IG retail trader data shows 47.56% of traders are net-long with the ratio of traders short to long at 1.10 to 1.The number of traders net-long is 7.28% higher than yesterday and 23.84% lower than last week, while the number of traders net-short is 8.03% higher than yesterday and 12.92% higher than last week.

To See What This Means for EUR/USD, Download the Full Report Below

| Change in | Longs | Shorts | OI |

| Daily | 8% | 13% | 11% |

| Weekly | -21% | 18% | -4% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.