GBPUSD Slips Again As UK Rate Outlook Hangs Heavy On Sterling

BRITISH POUND TALKING POINTS AND ANALYSIS

• GBPUSD Inches Down in Europe

• Last week’s surprise Bank of England decision to hold rates still weighs

• US Durable Goods data will be the near-term focus

Recommended by David Cottle

Get Your Free GBP Forecast

The British Pound slipped just a little against the United States Dollar in Wednesday’s European trading session, but more broadly Sterling looks set for its worst month since August last year.

Naturally interest rate differentials are doing the damage. The Bank of England kept its key lending rate on hold at 5.25% last week, surprising markets which had looked for yet another increase. A Reuters poll of economists now finds a base case that rates will stay put, at least until July of 2024, although there was reportedly a significant minority still expecting them to rise.

It’s easy enough to see why there’s no unanimity. Consumer price inflation in the United Kingdom may have decelerated in the past three months, but, at 6.7% it’s still clearly far above the BoE’s 2% target. For sure recent economic data have been soft, from last month’s retail sales figures through to more current Purchasing Managers Index figures, and it’s likely that prices will reflect that over time. But it certainly hasn’t happened yet. Indeed, the Bank of England’s own rate setters were evenly split this month between holding rates and raising them. It took the Governor’s casting vote to see the ‘hold’ camp win.

Still, an uncertain monetary policy backdrop and a weakening economy don’t exactly scream ‘buy sterling’ especially against the US Dollar. The world’s largest economy is clearly doing far better than the UK’s, even if there are question marks over how long that can last.

US Rate Path Looks Easier To Define

The interest-rate picture in the US seems a lot clearer cut. A raft of Federal Reserve Speakers including Minneapolis Fed Governor Neel Kashkari and Fed Governor Michelle Bowman have voiced expectations that rates will need to rise this year. The Fed’s own Summary of Economic Projections suggests a quarter-basis point increase this year, with rates held above the 5% level for all of 2024.

There’s not a huge amount of UK economic data on tap this week to sustain traders’ interest in the ‘GBP’ side of GBP/USD. The big events are all out of the US, including Wednesday’s durable goods order figures. The market will get a look at final British Gross Domestic Product numbers for the second quarter. They’re expected to rise a little, but an anemic 0.4% annualized gain is expected and, even if seen, is likely to prove to historic to have a lasting impact on battered sterling.

The Pound has lost almost 4% against the Dollar in the past month, even though the US economic numbers have been by no means uniformly strong, with weakening consumer confidence numbers coming through just this week.

However unless and until the numbers are thought likely to change that interest rate outlook, the Dollar is going to dominate trade.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

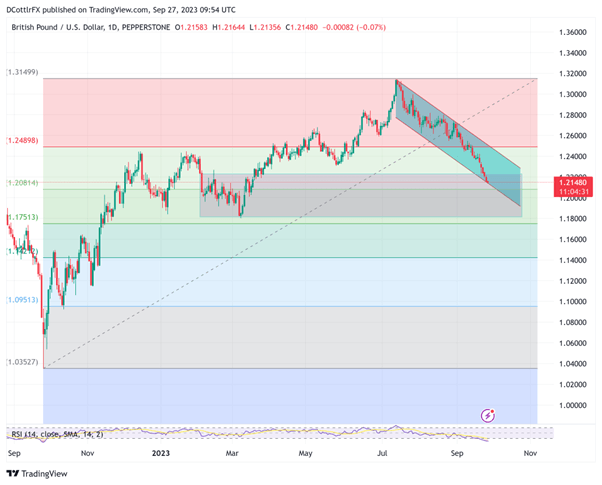

GBP/USD Technical Analysis

Chart Compiled Using TradingView

GBP’s retreat has been remarkably consistent since the pair topped out on July 13. The daily chart now shows a clear ‘head and shoulders’ pattern capping the market, the pound struggling to show more than a handful of daily gains in the past two weeks.

GBP/USD fell below the first Fibonacci retracement of the rise from last September’s lows to the peaks of July when it finally abandoned 1.24898 on September 14. Falls since have taken the pair into a trading band last dominant between February 3 and March 16. It offers support at 1.18079 and, perhaps more significantly, above that at 1.201814, the second retracement level.

Near-term downward channel support comes in at 1.21026, very close to current market levels. Bulls will need to punch all the way up to 1.24538 to break that downtrend, and there’s little sign so far that they can do so.

Sentiment towards the pair looks quite bullish at current levels, according to IG’s own client sentiment tracker, but that in itself can be a strong contrarian indicator.

–By David Cottle for DailyFX

Comments are closed.