GBP/USD Retreats as the Fed and BoE Hog the Limelight

GBP/USD Price, Charts and Analysis:

Recommended by Zain Vawda

Get Your Free GBP Forecast

Most Read: US Dollar Price Action Setups: EUR/USD, GBP/USD, AUD/USD, USD/JPY

GBP/USD FUNDAMENTAL BACKDROP

Cable continued its decline in the early hours of the Asian session to drop below the 1.2350 level. GBP/USD had a modest bounce to trade just above the 1.2350 level heading into the European open which saw dollar bulls return pushing GBPUSD toward the 1.23000 handle.

The upside rally on GBPUSD appears to have run out of steam, however with key risk events ahead the move could be due to repositioning by market participants ahead of the storm. As focus turns to the central banks there remains a real possibility of policy divergence between the FED and BoE which should result in some gains for cable. The Fed are expected to raise rates by 25bps while the BoE is expected to raise by 50bps as it battles stubborn inflation. The key guide, however, will be the comments by Fed Chair Powell and BoE Governor Bailey regarding the path for rate hikes moving forward. Market participants appear to be looking for some sort of dovish rhetoric from Fed Chair Powell given the resilience of US Data and the decline in US inflation. A dovish Powell and Bullish Bailey could form a perfect cocktail which could see GBPUSD finally test the psychological 1.2500 level and beyond.

Recommended by Zain Vawda

How to Trade GBP/USD

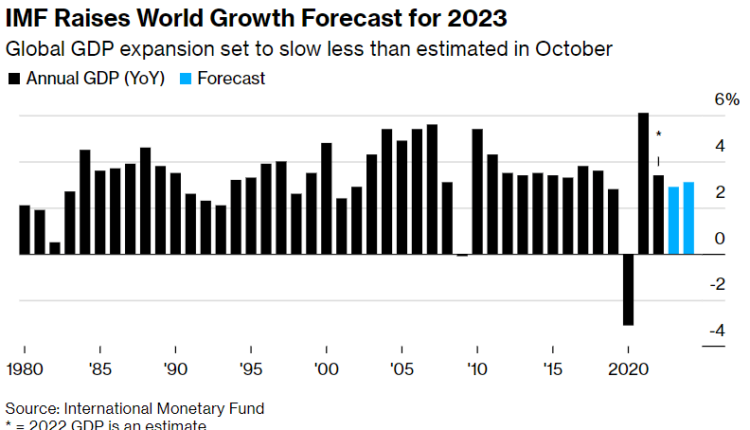

Overnight brought news from the IMF as it raised its growth forecast for 2023 which comes following the World Banks’ dour outlook earlier in January. The IMF did warn that the fight against inflation may not be over with Russia and China potentially posing further risks to recovery. The reading for the UK however will not inspire confidence with the economy expected to contract by 0.6%, in stark contrast to its peers from the developed world.

Adding further complications for the UK economy at present is Chancellor Jeremy Hunts indecision over tax cuts and the economic complications of the worker’s strike. Chancellor Hunt also issued a warning to PM Sunak regarding inflation stating that bringing inflation below the 5% mark in 2023 will be tough.

On the calendar for the day, we do have UK mortgage approvals and lending data and CB consumer confidence from the UK.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK

Looking ahead to the rest of the day, we could be in for similar price action to Monday if the DXY continues to trickle higher. GBPUSD has printed a double-top pattern on the daily which does hint at further downside. As you can see on the chart, we do remain rangebound and could see a test of the lower end of the range before the FOMC meeting tomorrow.

GBP/USD Daily Chart – January 31, 2023

Source: TradingView

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently SHORT on GBP/USD, with 55% of traders currently holding short positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are short suggests that GBP/USD may continue to rise.

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.