GBP/USD May Fall as USD/CAD Rises Amid Changes in Retail Exposure

US Dollar, GBP/USD, USD/CAD, Technical Analysis, Retail Trader Positioning – IGCS Update

- US Dollar has been stabilizing in recent days after a string of losses

- Retail traders became more bullish GBP/USD, bearish USD/CAD

- Is this a sign that the US Dollar may strengthen in the coming days?

Recommended by Daniel Dubrovsky

Get Your Free USD Forecast

The US Dollar has been stabilizing in recent days after a string of losses earlier this month. In response, IG Client Sentiment (IGCS) has been showing that retail traders have been increasing upside exposure in GBP/USD while boosting downside bets in USD/CAD. IGCS tends to function as a contrarian indicator. With that in mind, is this a sign that the US Dollar might climb ahead?

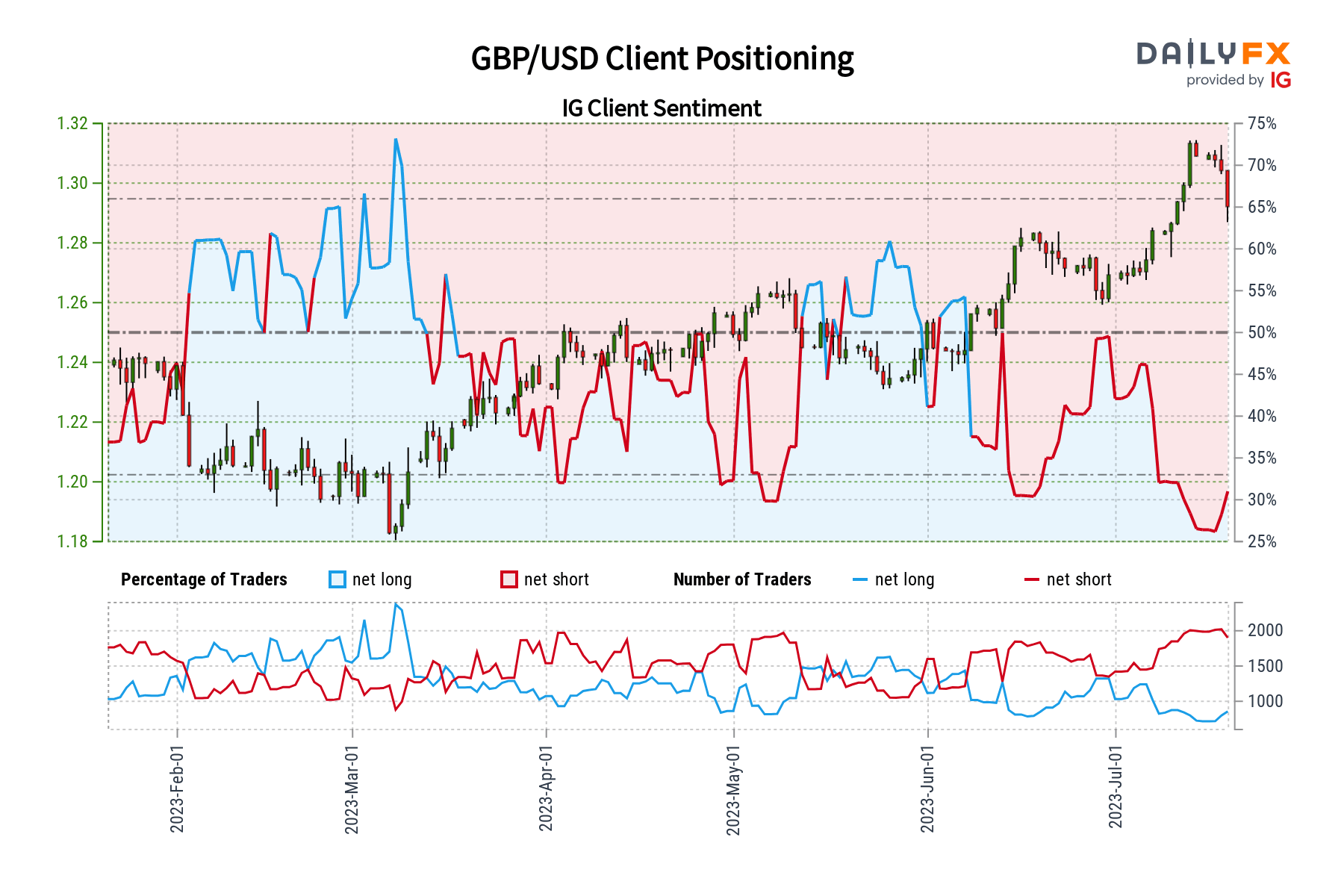

GBP/USD Sentiment Outlook – Bearish

The IGCS gauge shows that about 41% of retail traders are net-long GBP/USD. Since most traders are still biased to the downside, this hints prices may continue to rise down the road. That said, upside exposure has increased by 27.5% and 30.82% compared to yesterday and last week, respectively. With that in mind, recent changes in exposure hint that the price trend may reverse lower.

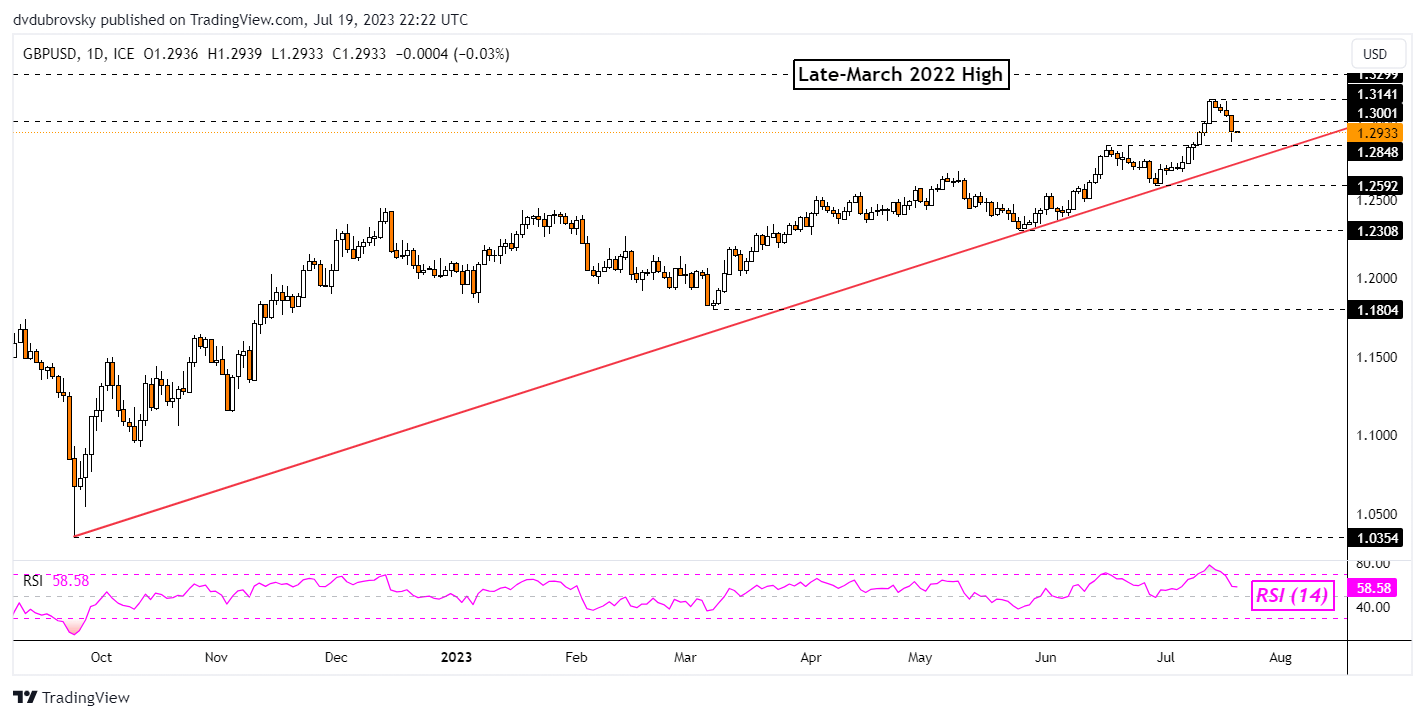

Daily Chart

On the daily chart, GBP/USD can be seen aiming lower in recent days after finding new resistance at 1.3141. Recent losses have brought Sterling closer towards the long-term rising trendline from the beginning of September. In the near-term, this could reinstate the broader upside focus. Otherwise, breaking lower would open the door to reversing the dominant uptrend.

Recommended by Daniel Dubrovsky

How to Trade GBP/USD

Chart Created in Trading View

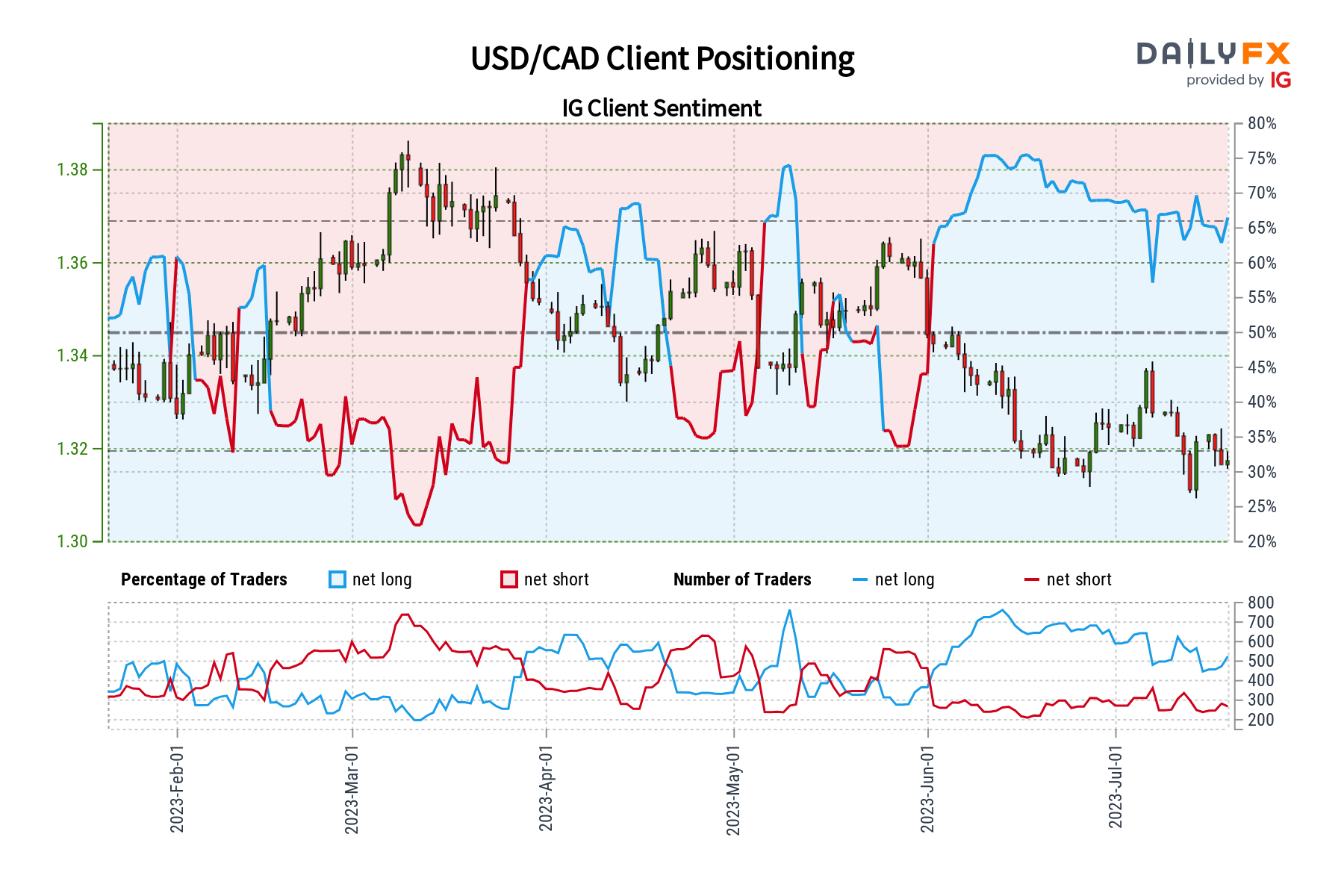

USD/CAD Sentiment Outlook – Bullish

The IGCS gauge reveals that about 65% of retail traders are net-long USD/CAD. Since most of them are still biased towards the upside, this hints that prices may continue to fall. However, downside exposure increased by 18.07% and 4.26% compared to yesterday and last week, respectively. With that in mind, recent changes in positioning hint that prices may soon reverse higher.

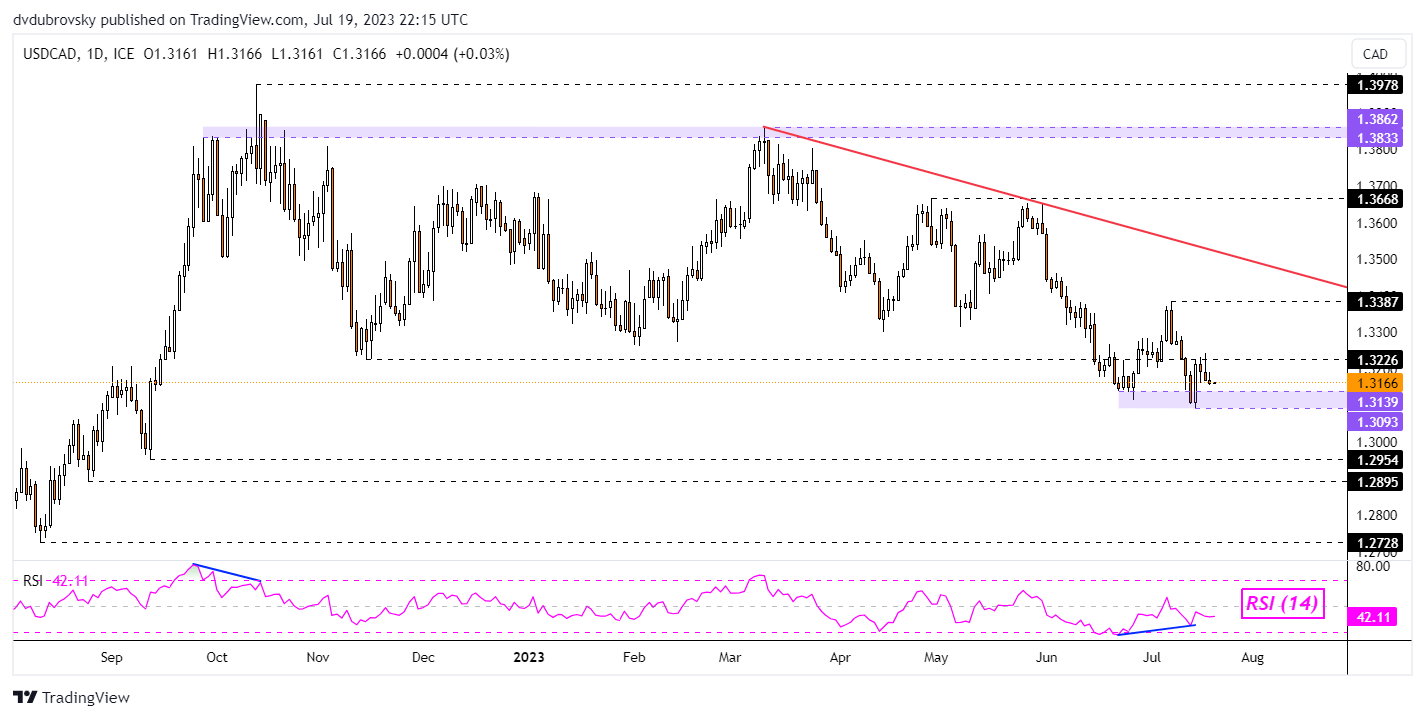

Daily Chart

On the daily chart, USD/CAD recently reinforced a support zone between 1.3093 and 1.3139. Prices are in a downtrend since March, guided by the falling trendline from that month (red line on the chart below). A turn higher places the focus on the July 7th high of 1.3387. Beyond that sits the falling trendline. Falling through support exposes the September low of 1.2954.

Chart Created in Trading View

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

Discover what kind of forex trader you are

Comments are closed.