GBP/USD forecast – 1.2580 aligns as next bullish target

GBP/USD outlook: Cable at two-week high above 1.25 ahead of US labor report

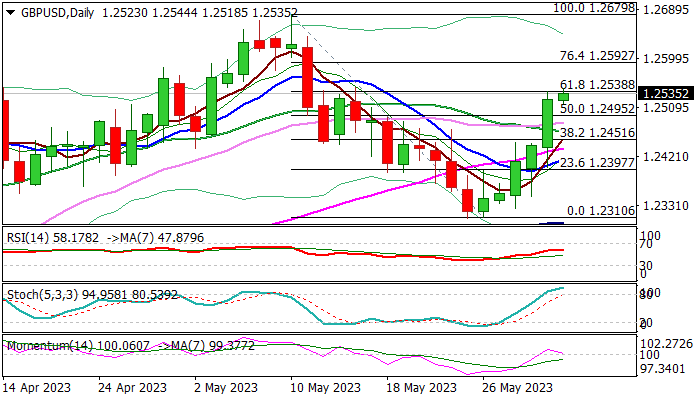

Cable is establishing above 1.2500 mark, in extension of six-day rally from 1.2310 higher base, boosted by hawkish BoE outlook, with the latest acceleration sparked by fresh weakness of the US dollar, as tensions about debt ceiling eased.

Bulls cracked pivotal Fibo barrier at 1.2538 (61.8% of 1.2679/1.2310 pullback) with break here to add to positive signals and unmask key barrier at 1.2679 (2023 high of May 10), although strongly overbought stochastic and fading bullish momentum warn that bulls may take a breather. Read more …

GBP/USD Forecast: 1.2580 aligns as next bullish target

GBP/USD has been moving sideways in a narrow channel above 1.2500 on Friday, with market participants refraining from making large bets ahead of the all-important May jobs report from the US.

The persistent selling pressure surrounding the US Dollar (USD) fuelled GBP/USD's rally on Thursday and the pair reached its highest level in three weeks near 1.2550. The significant downward revision to the first-quarter Unit Labor Costs data, from 6.3% to 4.2%, triggered a fresh leg of USD sell-off in the American session by feeding into dovish Federal Reserve (Fed) expectations. Read more …

GBP/USD consolidates its recent gains to nearly three-week peak, US NFP report awaited

The GBP/USD pair enters a bullish consolidation phase near a two-and-half-week high touched on Friday and oscillates in a narrow band, around the 1.2530-1.2535 region through the first half of the European session.

The US Dollar (USD) extends the overnight sharp retracement slide from the vicinity of its highest level since mid-March set on Wednesday and remains depressed for the second successive day, which, in turn, acts as a tailwind for the GBP/USD pair. A slew of influential Federal Reserve (Fed) officials this week backed the case for skipping an interest rate hike and forced investors to scale back their expectations for another 25 bps lift-off in June. This, along with a positive risk tone, weighs on the safe-haven buck. Read more …

Comments are closed.