GBP/USD, EUR/GBP, GBP/AUD Price Action

British Pound Vs US Dollar, Euro, Australian Dollar – Price Setups:

- GBP/USD is holding below stiff resistance even after surprise 50-bp move by BoE last week.

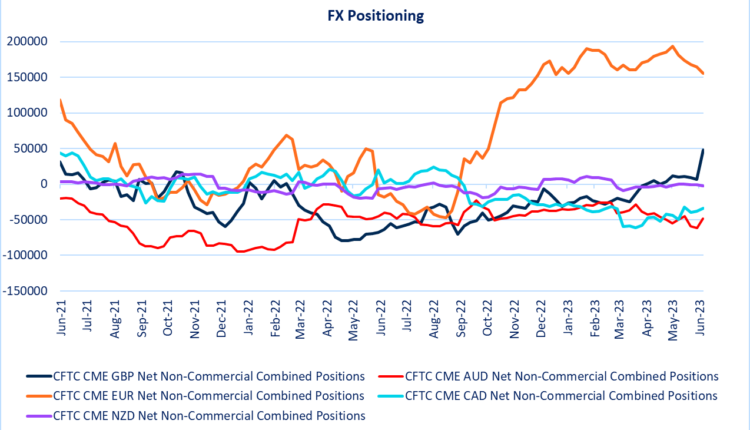

- Speculative long GBP positioning has jumped to pre-Covid levels.

- What is the outlook for GBP/USD, EUR/GBP, GBP/AUD?

Recommended by Manish Jaradi

How to Trade GBP/USD

The subdued reaction to the surprise interest rate hike by the Bank of England (BoE) last week could be a sign that the British pound’s rally could be due for a minor setback against some of its peers.

BoE surprised markets by raising its benchmark rate by 50 basis points (Vs 25 basis points expected) to 5%, the highest level since 2008, and its largest increase since February, noting second-round effects in domestic price and wage developments generated by external cost shocks are likely to take longer to unwind than they did to emerge. Data published last week showed UK headline inflation remained flat at 8.7% on-year in May, putting pressure on the central bank to act.

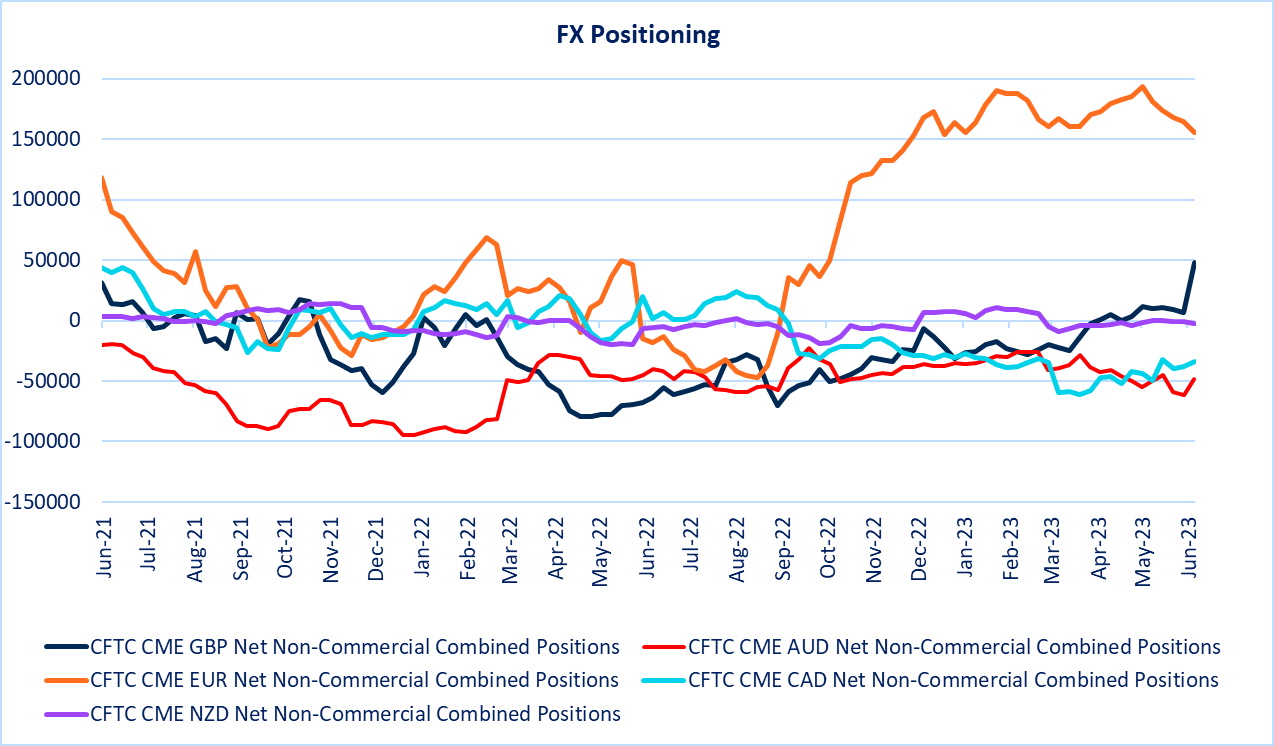

Speculative Long GBP Positioning

Source data: Bloomberg; chart prepared in Microsoft Excel

Before last week’s hike, BoE had hiked its benchmark rate by 25 basis points in May after pausing in April. Markets are now pricing in a 50% chance the benchmark rate would peak at 6.25% by the end of the year. A solid run of UK data since mid-February, as reflected in the Economic Surprise Index, has prompted upgrades to economic growth forecasts for the current year. However, aggressive tightening could dent prospects for next year, raising the risk of a recession, and undermining the overbought GBP.

GBP/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView; Notes at the bottom of the page

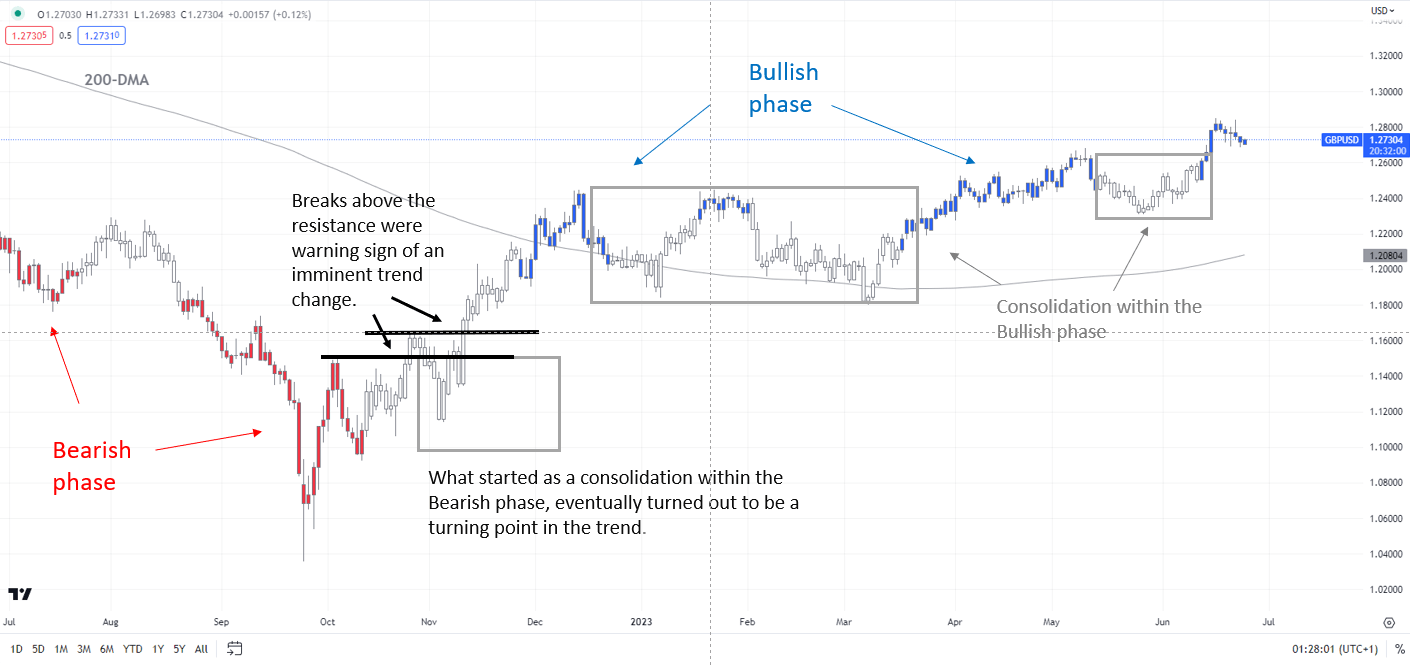

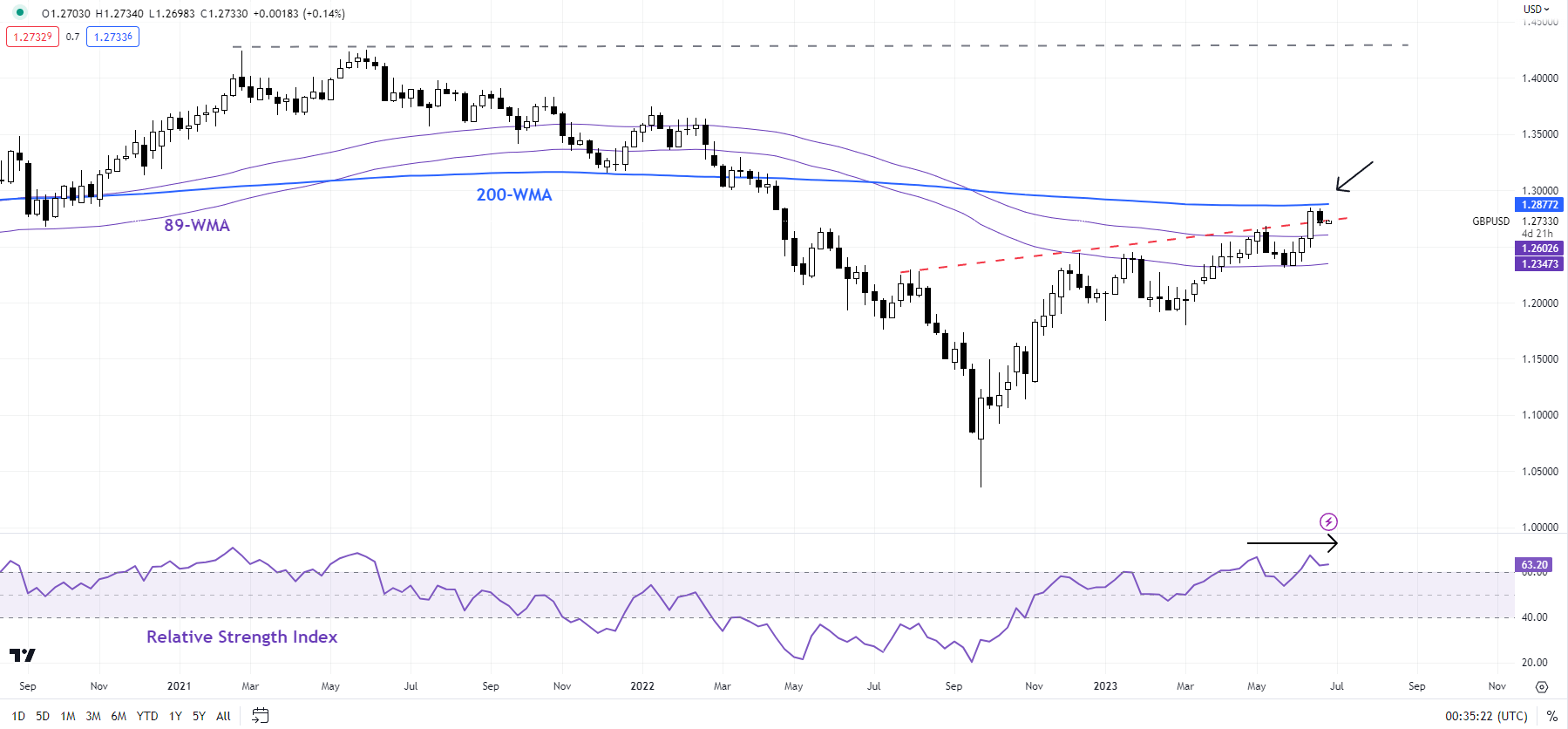

GBP/USD: Likely soft bias

Negative divergence (rising price associated with stalling in momentum) on the weekly charts as strong resistance indicates that GBP/USD’s rally is losing steam for now. Speculative long GBP positioning is back to pre-Covid levels just as the pair tests the 200-week moving average (now at about 1.2900), roughly coinciding with an uptrend from mid-2022.

GBP/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

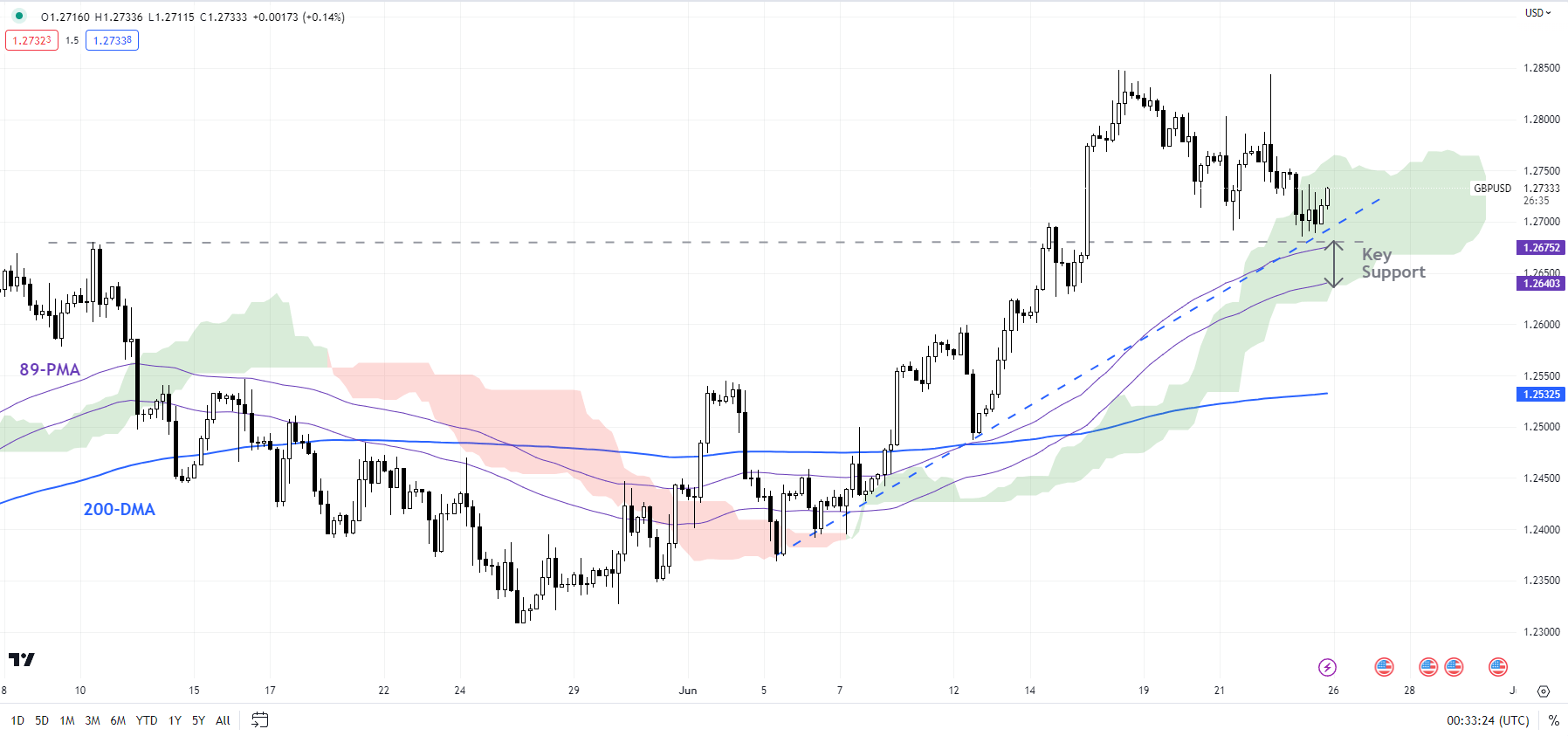

GBP/USD could maintain a soft bias in the near term, with any pullback being restricted around a converged cushion at about 1.2625-1.2675, including a minor uptrend line from early June, coinciding with the 89-period moving average and the lower edge of an Ichimoku cloud on the 240-minute charts. Only a break below the cushion would raise the risk of a deeper setback toward 1.2500.

GBP/USD 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

From a trend perspective, GBP/USD’s broader trend remains up, as the colour-coded daily candlestick charts show. Beyond the daily timeframe, from a medium-term perspective, the rise this month to a one-year high in May confirmed the higher-tops-higher-bottom sequence since late 2022, leaving open the door for some medium-term gains. (see “British Pound Buoyant Ahead of BOE: How Much More Upside?”, published May 8).

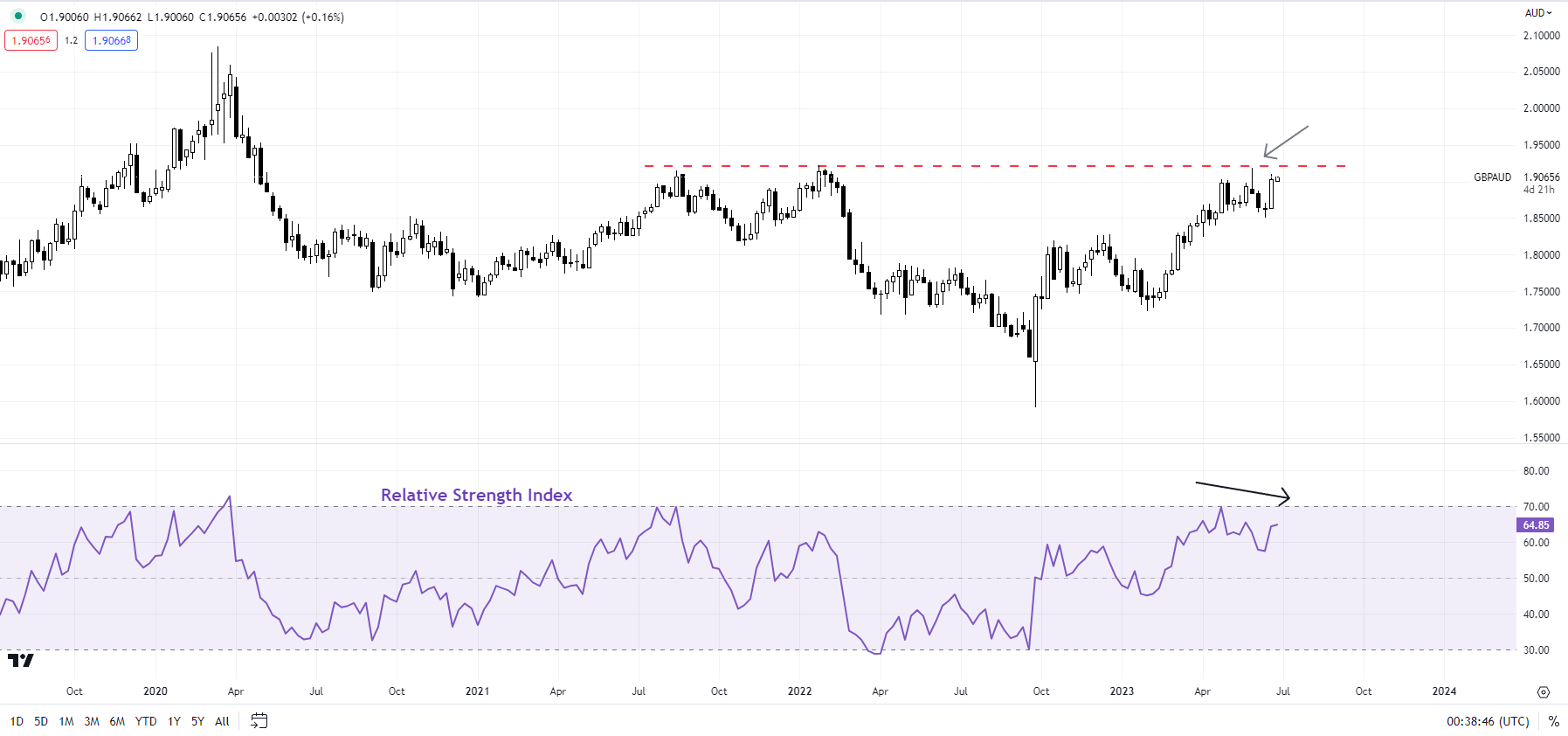

GBP/AUD Weekly Chart

Chart Created Using TradingView

GBP/AUD: Upside capped

GBP/AUD’s rebound since mid-June lacks steam, suggesting that it may not be the start of a new leg higher, especially given the stiff horizontal trendline resistance at about 1.9200. Still, unless the immediate floor at 1.8450 gives way, the path of least resistance for the cross remains sideways to up. Any break below could open the door toward the early-April low of 1.8250.

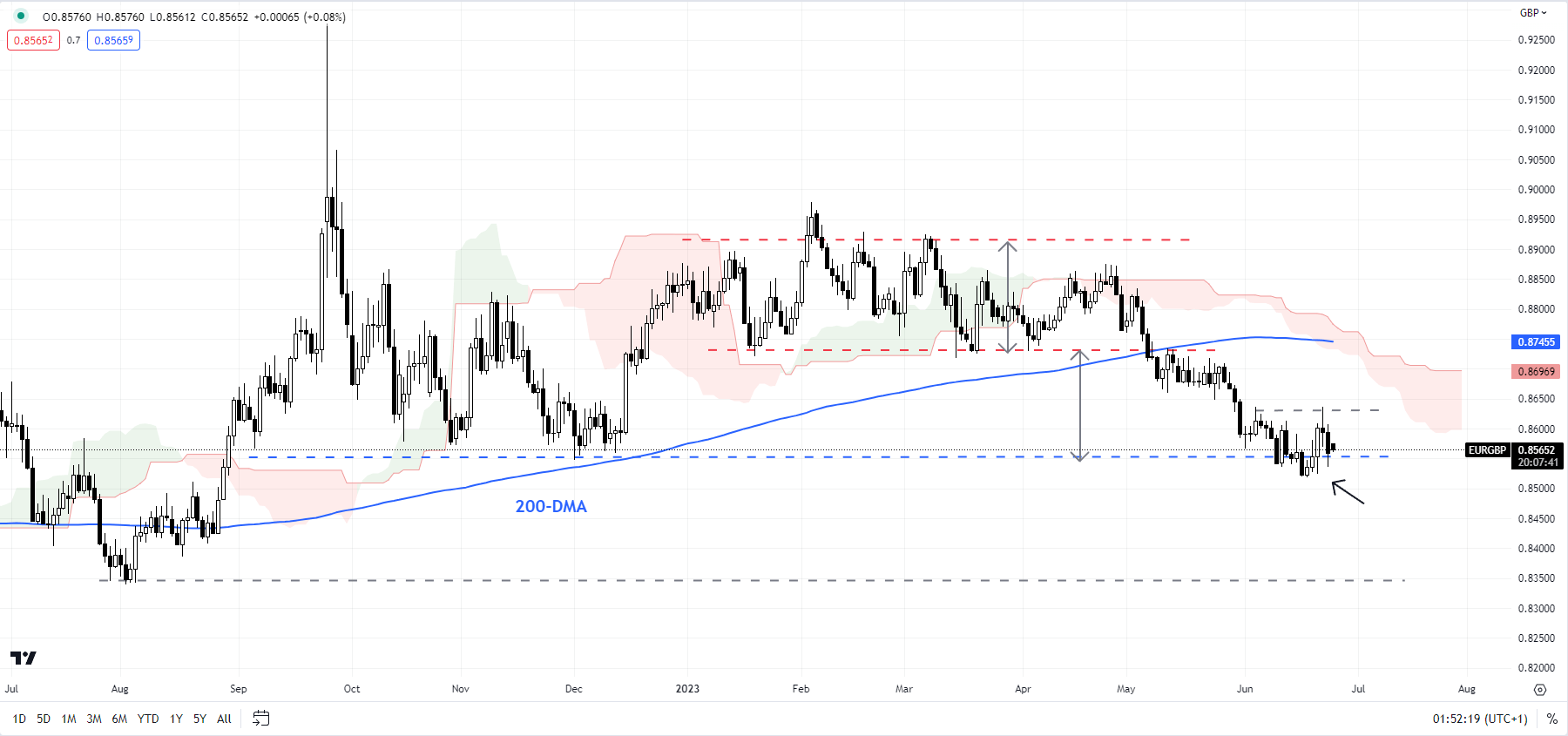

EUR/GBP Daily Chart

Chart Created Using TradingView

EUR/GBP: Holding above key support

Downward momentum appears to be easing as EUR/GBP tests a key floor at the December low of 0.8545 – a possibility highlighted in “Euro After ECB Rate Hike: EUR/USD, EUR/AUD, EUR/GBP Price Setups”, published June 19. There is a potential for some consolidation/minor rebound in the near term. Immediate resistance is at last week’s high of 0.8635. Any break above would confirm that the immediate downward pressure had eased.

Note: The above colour-coded chart(s) is(are) based on trending/momentum indicators to minimize subjective biases in trend identification. It is an attempt to segregate bullish Vs bearish phases, and consolidation within a trend Vs reversal of a trend. Blue candles represent a Bullish phase. Red candles represent a Bearish phase. Grey candles serve as Consolidation phases (within a Bullish or a Bearish phase), but sometimes they tend to form at the end of a trend. Candle colors are not predictive – they merely state what the current trend is. Indeed, the candle color can change in the next bar. False patterns can occur around the 200-period moving average, or around a support/resistance and/or in sideways/choppy market. The author does not guarantee the accuracy of the information. Past performance is not indicative of future performance. Users of the information do so at their own risk.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

Comments are closed.