GBP/USD bears are taking a breather above important supports

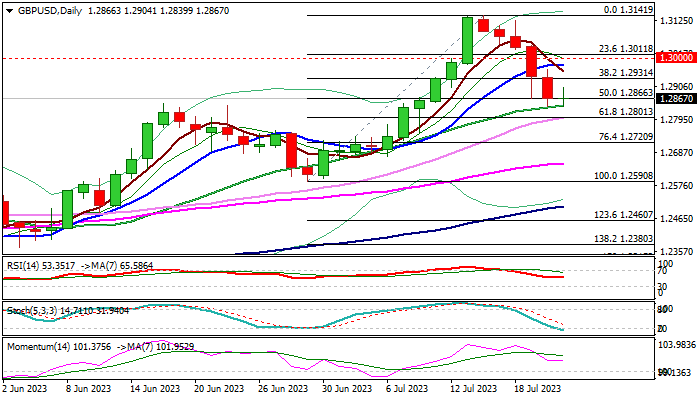

GBP/USD Forecast: Pound Sterling needs to stabilize above 1.2870 to rebound

GBP/USD stays relatively calm on Friday and trades near 1.2870, a key pivot point in the short term. The pair closed in negative territory for a fifth consecutive day on Thursday, dropping below 1.2850 for the first time in 10 days.

After the US Department of Labor reported on Thursday that the weekly Initial Jobless Claims declined to 228,000 in the week ending July 15, the lowest reading since the second week of May, the US Dollar (USD) gathered strength, weighing on GBP/USD. Read more…

GBP/USD outlook: Bears are taking a breather above important supports

Pullback from new 2023 peak extends into sixth straight day, although bears face headwinds at important support zone at 1.2866/43 (50% retracement of 1.2590/1.3141 upleg / 20DMA) and consolidating above these levels in European session on Friday.

Oversold stochastic contributes to scenario, however, consolidation is likely to be narrow and short, as dollar continues to strengthen and weighs on sterling. Firm break of 1.2866/43 pivots is needed to generate fresh bearish signal for test of immediate support at 1.2801 (Fibo 61.8% / 30DMA) and possible stronger acceleration. Read more…

Pound Sterling sets for breakdown as resilient consumer spending inspired strength fades

The Pound Sterling (GBP) dropped sharply despite the United Kingdom Retail Sales data turning out more resilient than expected. The GBP/USD pair rebounds swiftly as consumer spending growth expanded strongly in June. Monthly Retail Sales in June expanded by 0.7% vs. expectations of 0.2%. Annual consumer spending data contracted by 1.0% against the consensus of -1.5%.

The United Kingdom’s consumer spending remained resilient in June despite the burden of higher inflation and interest rates by the Bank of England (BoE). Upbeat retail demand has offset the optimism inspired by soft inflation data for June as higher consumer spending could allow firms to raise the prices of goods and services at factory gates again. Also, consumer spending resilience might elevate hopes of a consecutive 50-basis-point (bp) interest rate hike by the UK central bank. Read more…

Comments are closed.