GBP/USD and EUR/GBP After BoE Hike

GBP/USD and EUR/GBP Analysis and Charts

- GBP/USD is down one cent over the week in thin trade.

- EUR/GBP remains rangebound.

Recommended by Nick Cawley

How to Trade GBP/USD

UK Breaking News: BoE Hikes by 25bps to 15-Year High

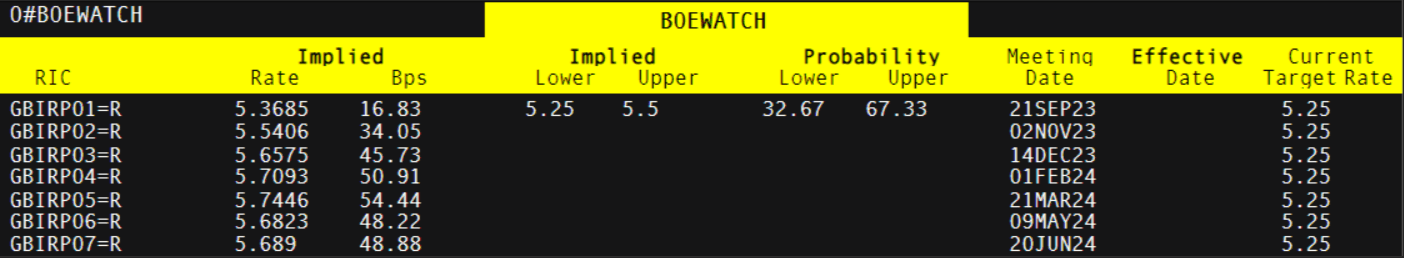

The Bank of England raised interest rates by 25 basis points on Thursday, in line with market forecasts, and left the door open for a further hike at September’s meeting. The UK central bank has now raised interest rates, by varying degrees, for 14 months in a row as it tries to control stubbornly high inflation. The latest market pricing shows a 67% probability of a 25bp hike on September 21 with a terminal rate of a fraction under 5.75% in March next year. The BoE, as always, says that future rate decisions will be data-dependent.

The BoE also said on Thursday that it would look at the future rate of UK bond sales, QT, at the September meeting. A faster pace of UK bond sales may help to tighten monetary conditions at the margin and give the Bank of England a small amount of wiggle room if needed.

For all market-moving events and data releases see the real-time DailyFX Calendar

Cable is picking up a small bid ahead of the weekend after the latest US Jobs Report showed a slight slowdown in job creation in July. The June headline figure was also revised lower to 185k from 207k.

July Jobs Report: Payrolls Rise by 187k, Driving Action in Gold and the US Dollar

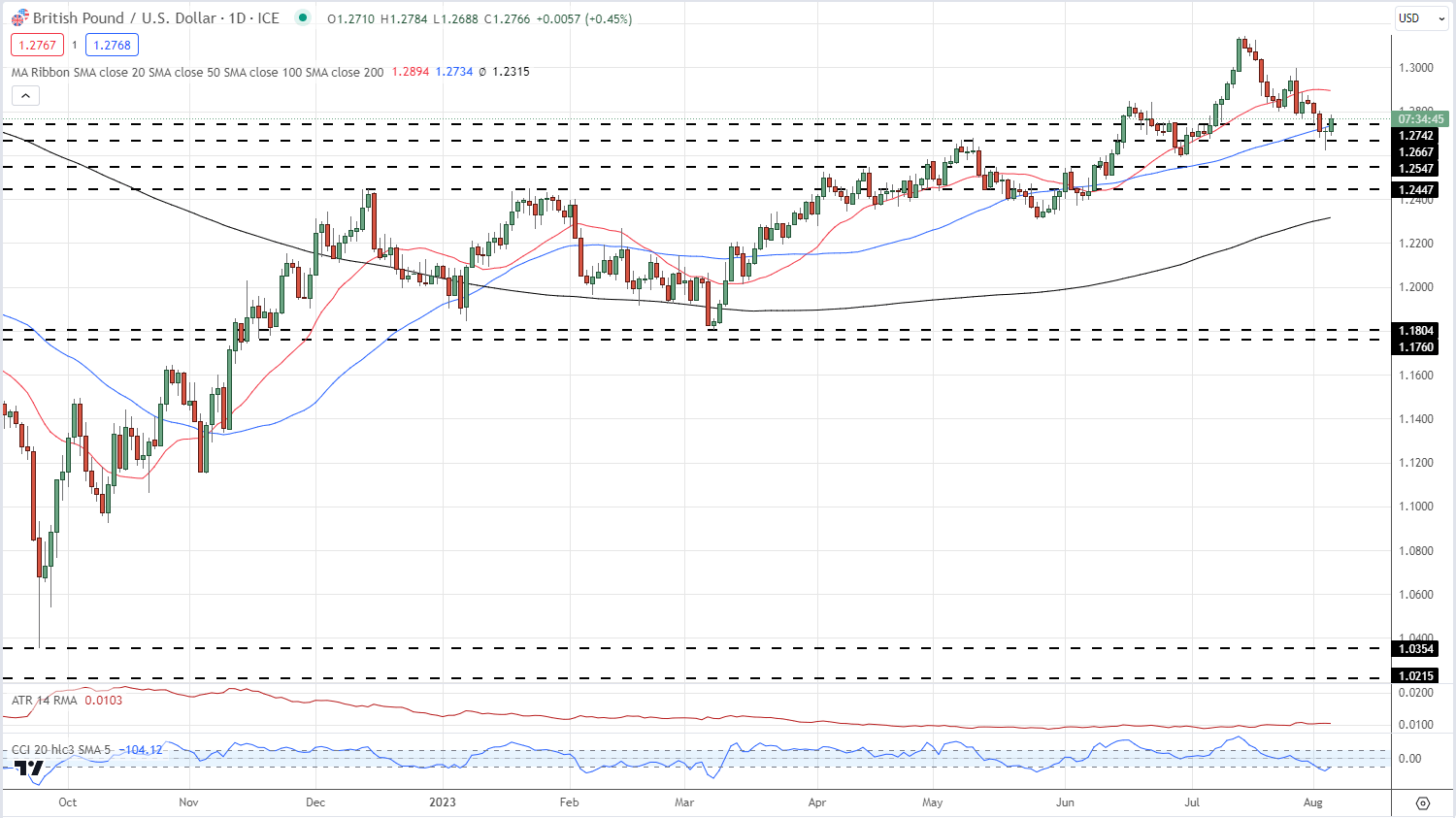

The daily chart shows a mixed cable outlook with the pair sitting on the 50-day simple moving average and between the 20- and 200-day moving averages. Support at 1.2666 was briefly broken yesterday and may not hold a re-test. On the upside, if GBP/USD can close and open above 1.27546, then it may have the impetus to push back towards 1.2900 although this may need some fundamentals drivers.

GBP/USD Daily Price Chart – August 4, 2023

Retail trader data shows 57.33% of traders are net-long with the ratio of traders long to short at 1.34 to 1.

For a more in-depth look at GBP/USD sentiment, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | -12% | 7% | -5% |

| Weekly | 25% | -10% | 7% |

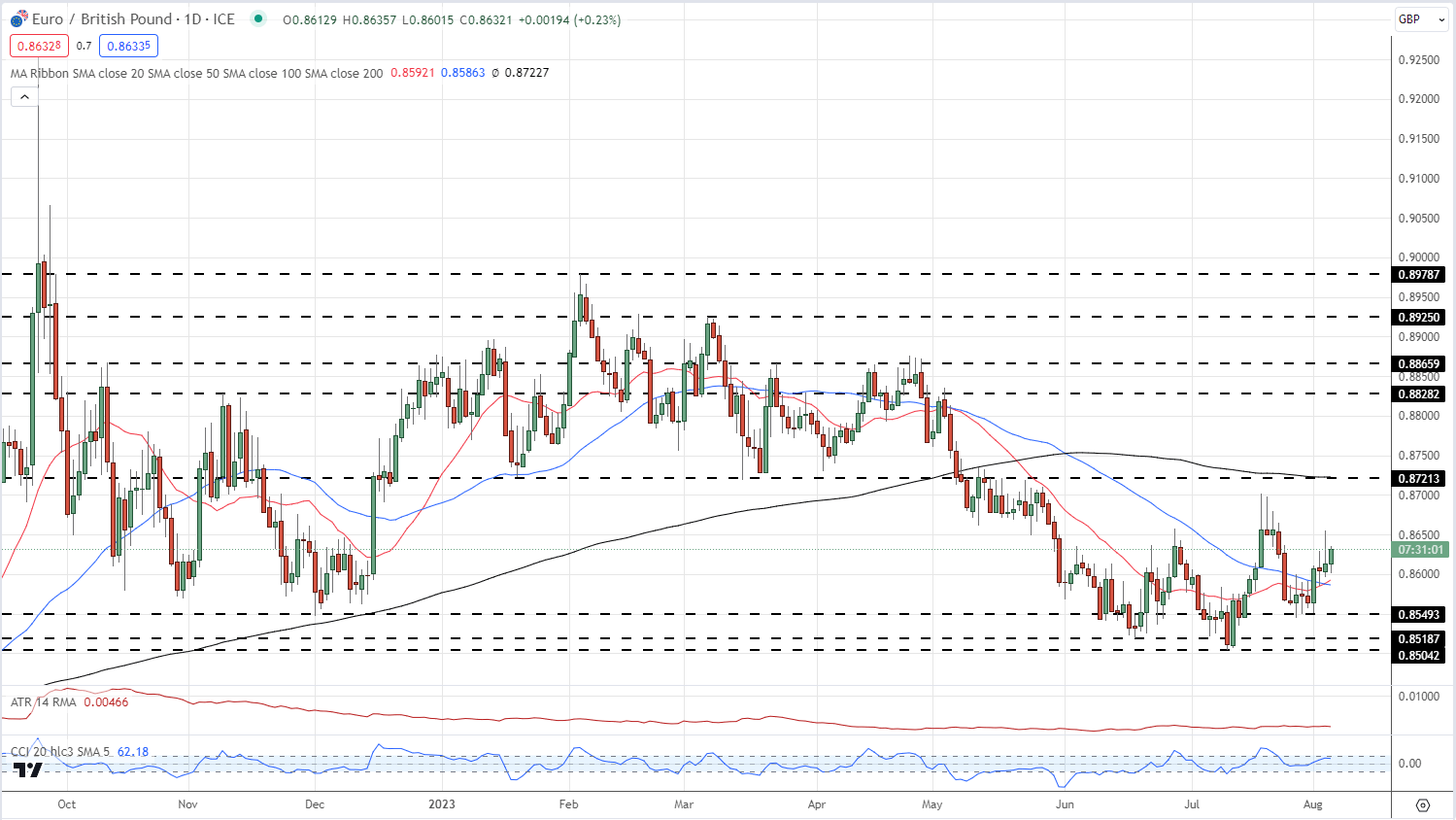

EUR/GBP remains stuck in a 0.8504 to 0.8721 range and will likely stay there in the coming weeks. The pair are back above the 20- and 50-day simple moving averages but remain below the longer-dated indicator. Again a major fundamental shift will be needed to break this range.

EUR/GBP Daily Price Chart – August 4, 2023

You can learn about range trading from the guide below.

Recommended by Nick Cawley

The Fundamentals of Range Trading

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.