FX Weekly Recap: May 22 – 26, 2023

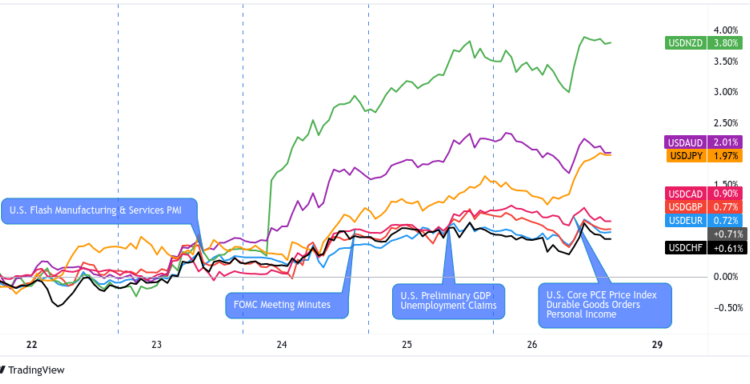

Major forex pairs were off to a slow start this week, then volatility kicked in thanks to a few market surprises.

In particular, the Kiwi chalked up the biggest moves in a bearish way when the RBNZ’s policy decision turned out less hawkish-than-expected. Bulls were quick to jump off their long positions when the central bank revealed that the interest rate hiking cycle is likely nearing its peak.

At first, dollar traders seemed unsure on how they should factor in rate expectations and the lack of progress in U.S. debt ceiling negotiations, but risk aversion eventually propped the U.S. currency higher towards the latter part of the week.

USD Pairs

Overlay of USD vs. Major Currencies Chart by TV

The dollar was stuck in ranges early in the week, as traders were likely bracing for the release of the FOMC May meeting minutes and any significant updates from debt ceiling talks.

Bulls barely budged even after a few Fed officials still expressed openness to tightening past June, especially after Powell suggested last Friday that a pause could be on the table next month.

Pretty soon, all the uncertainty from a potential U.S. government default tipped the scales in favor of the safe-haven dollar as risk-off flows took over midweek on negative debt ceiling deal developments.

🟢 Bullish Headline Arguments

FOMC official Bullard says he is seeing “two more (tightening) moves” this year while Kashkari said that rates “have to go north of 6%”

U.S. flash services PMI improved from 53.6 to 55.1 to signal faster industry growth in May

U.S. new home sales rose from downgraded 656K in March to 683K in April vs. estimated 665K figure, reflecting ongoing rebound in housing market

U.S. preliminary Q1 GDP upgraded from 1.1% growth to 1.3% expansion instead of holding steady as expected, price index also revised higher from 4.0% to 4.2% quarter-on-quarter

Reports hit the wires on Friday that Biden and McCarthy are “edging close” to a U.S. debt ceiling deal

U.S. Core PCE for April: +0.4% m/m (+0.3% m/m forecast) vs. +0.3% m/m previous; +4.7% y/y vs. 4.5% y/y forecast

U.S. Durable Goods Orders in April: +1.1% m/m (-1.1% m/m forecast / 3.3% m/m previous; Core Durable Goods Orders came inline with expectations at -0.2% m/m vs. +0.3% m/m previous

🔴 Bearish Headline Arguments

Over the weekend, White House official says that debt ceiling negotiations will resume early this week, although House Speaker McCarthy says talks have “moved backwards” in Biden’s absence

U.S. flash manufacturing PMI slipped from 50.2 to 48.5 to reflect contraction in May vs. estimated dip to 50.0

U.S. Richmond manufacturing index declined from -10 to -15 to indicate worsening conditions in May instead of expected improvement to -8

FOMC meeting minutes showed that members are “uncertain” about how much tightening may be needed, with “several” committee members figuring that it might be time to pause

Credit rating Fitch put U.S. on “negative watch” on account of debt ceiling impasse

U.S. Consumer Sentiment Index for May: 59.2 vs. 63.5 previous

EUR Pairs

Overlay of EUR vs. Major Currencies Chart by TV

Economic data from the euro region turned out mixed, as PMI readings from its top economies gave mixed signals on how manufacturing and services industries are faring.

There were some notable weak spots in Germany, though, with indices of consumer and business sentiment still pointing to worsening conditions. It didn’t help that the country’s Q1 GDP reading was negatively revised to put the economy in a technical recession.

🟢 Bullish Headline Arguments

French flash manufacturing PMI improved from 45.6 to 46.1 as expected in May to reflect slower contraction

German flash services PMI rose from 56.0 to 57.8 vs. 55.0 forecast to indicate stronger expansion

Germany’s consumer confidence index rose from -25.8 to -24.2, marking the strongest level since April 2022 and eighth consecutive increase thanks to higher wage expectations

🔴 Bearish Headline Arguments

German May flash manufacturing PMI fell from upgraded 44.5 figure to 42.2 vs. 44.9 forecast

French flash services PMI slipped from downgraded 54.6 figure to 52.8 vs. 54.0 consensus

German Ifo business climate index down from 93.6 to 91.7 in May vs. projected 93.0 reading, suggesting worsening economic conditions

Germany’s Q1 2023 GDP was revised from 0.0% to -0.3%, following Q4’s 0.5% decline

GBP Pairs

Overlay of GBP vs. Major Currencies Chart by TV

Data was mostly downbeat for the U.K. economy, as any upside surprises in inflation figures were weighed against the possibility of a wage-price spiral.

Even BOE Governor Bailey himself expressed concerns about sticky price pressures since these would likely force the central bank to hike rates again at the expense of economic growth.

🟢 Bullish Headline Arguments

U.K. Rightmove HPI shows 1.8% month-over-month gain in house prices in May, reflecting increased confidence in the market, following earlier 0.2% uptick

U.K. headline CPI fell from 10.1% to 8.7% year-over-year in April vs. estimated 8.2% figure to reflect stubborn inflationary pressures, core CPI up from 6.2% to 6.8% instead of holding steady

U.K. Retail Sales for April: +0.5% m/m (+0.3% m/m forecast / -1.2% m/m previous); Core Retail Sales came in at +0.8% m/m (+0.5% m/m forecast / -1.4% m/m previous

🔴 Bearish Headline Arguments

U.K. May flash manufacturing PMI fell from upgraded 47.8 figure to 46.9 vs. 47.9 estimate, flash services PMI tumbled from upgraded 55.9 reading to 55.1 vs. 55.5 forecast to indicate slower growth

U.K. producer input prices fell 0.3% month-over-month in April vs. projected 0.1% uptick, output prices stayed flat instead of showing 0.2% gain

BOE Governor Bailey expressed concern over “sticky” inflation amid tight labor market but still denied that the U.K. is in a wage-price spiral

CHF Pairs

Overlay of CHF vs. Major Currencies Chart by TV

No economic updates or news from Switzerland of note on Friday. Swiss franc moves were mainly driven by counter currency flows and broad risk sentiment.

AUD Pairs

Overlay of AUD vs. Major Currencies Chart by TV

Persistent concerns about China‘s economic rebound, mostly weaker-than-expected economic figures from Australia, and risk-off flows dragged the higher-yielding AUD south in the latter half of the week.

PMI readings and a drop in consumer spending suggested that RBA tightening is already starting to bear fruit, possibly leading Aussie traders to reaffirm expectations that policymakers will sit on their hands for a while.

🔴 Bearish Headline Arguments

Australia’s flash manufacturing PMI unchanged at 48.0 in May, flash services PMI dipped from upgraded 53.7 reading to 51.8 to reflect slower industry expansion

Australian retail sales fell flat in April instead of posting the estimated 0.3% monthly uptick, following earlier 0.4% gain

Chinese CB leading index chalked up 0.6% month-over-month decline in April, following earlier upgraded 0.3% figure

CAD Pairs

Overlay of CAD vs. Major Currencies Chart by TV

There wasn’t much on the docket for the Canadian economy this week, leaving the Loonie to take directional cues from crude oil prices and overall market sentiment. Unfortunately for the Loonie, risk aversion kicked in as the week rolled along.

🟢 Bullish Headline Arguments

EIA crude oil inventories revealed surprise drop of 12.5 million barrels in stockpiles, following back-to-back weeks of sharp gains

Canada Wholesale Sales for April: +1.6% m/m (-0.4% m/m forecast) vs. -0.1% m/m previous

🔴 Bearish Headline Arguments

Canadian corporate profits tumbled 5.6% quarter-over-quarter in Q1, erasing part of earlier 7.3% increase

NZD Pairs

Overlay of NZD vs. Major Currencies Chart by TV

The Kiwi took a sharp tumble across the board when the RBNZ announced its policy decision midweek.

Even though the central bank still hiked rates by 0.25% as expected, officials dropped a bombshell on the markets by suggesting that interest rates have peaked and that they actually had a split vote to tighten this month.

Their accompanying statement noted that global growth remains weak while inflationary pressures are subsiding. On the domestic front, they also pointed out that businesses are reporting slower demand conditions.

🔴 Bearish Headline Arguments

New Zealand headline retail sales slumped 1.4% in Q1 2023 vs. estimated 0.2% uptick, previous quarter’s reading revised down from -0.6% to -1.0%

RBNZ hiked interest rates by 0.25% as expected from 5.25% to 5.50% but signaled possibility of pausing soon, as policymakers had a split decision to tighten

JPY Pairs

Overlay of JPY vs. Major Currencies Chart by TV

Yen pairs had a mixed run, as the lower-yielding currency managed to squeeze out some gains versus higher-yielding counterparts thanks to risk aversion. Still, it wound up on much weaker footing against the U.S. dollar in the safe-haven race.

🟢 Bullish Headline Arguments

Japanese May flash manufacturing PMI improved from 49.5 to 50.8 to signal a shift from contraction to industry growth

BOJ core CPI climbed from 2.9% to 3.0% year-over-year in April versus estimated dip to 2.8%, underscoring BOJ views of improving inflation

🔴 Bearish Headline Arguments

Japanese core machinery orders down 3.9% month-over-month in March, marking back-to-back declines after earlier 4.5% slump

Tokyo core CPI down from 3.5% to 3.2% year-over-year in May versus projected dip to 3.4%

Comments are closed.