FX Weekly Recap: August 28 – September 1, 2023

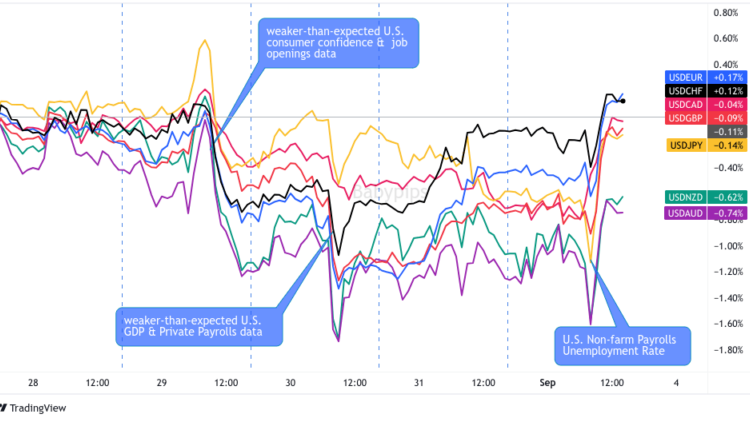

Shifting rate hike and recession odds moved the major currencies around this week, mainly sparked by U.S. reports that pointed to a less hawkish Fed.

Meanwhile, talks of higher interest rates in the Eurozone while the region is still printing weak growth markers weighed on European currencies like EUR, GBP, and CHF.

Missed the major forex headlines? Here’s what you need to know from last week’s FX action:

USD Pairs

Overlay of USD vs. Major Currencies Chart by TV

The first batch of weak U.S. economic reports on Tuesday supported the idea that the Fed plans to “proceed carefully” with its next rate hikes.

USD dropped sharply and broadly and saw additional losses on Wednesday when the ADP and 2nd GDP readings were released.

The Greenback looks set to end the week lower against its major counterparts after ranging near its intraweek lows after an arguably net negative Friday employment situation report, but the damage was softened thanks to a better-than-expected ISM manufacturing update just ahead of the London close.

🟢 Bullish Headline Arguments

FHFA House Price Index for Q2: 3.1% y/y (2.9% forecast / previous); 0.3% m/m (0.6% m/m forecast; 0.7% m/m previous)

Goods Trade Balance for June 2023: -$91.18B (-$94.0B forecast; -$68.3B previous); Year-to-date, the goods and services deficit decreased by $117.7B (22.3%)

Pending home sales index surprised with a +0.9*% m/m gain vs. -0.4% m/m forecast / 0.3% m/m previous

Core PCE Price Index for July: 0.2% as expected; Inflation-adjusted consumer spending rose by 0.6% m/m

Challenger Jobs Cuts for August: 75K (26K forecast; 23.7K previous)

Personal income in July ticked lower to 0.2% from 0.3% previous, while personal spending increased significantly to 0.8% vs. 0.5% previous

ISM Manufacturing PMI for August: 47.6 (47.0 forecast; 46.4 previous)

🔴 Bearish Headline Arguments

Job Openings and Labor Turnover Survey showed open job openings decreased from 9.17M in June to 8.83M in July

Conference Board U.S. consumer confidence: 106.1 (116.0 forecast; 117.0 previous)

ADP Private Payrolls Change for August: +177K (210K forecast). July revised higher to 371K

The second estimate for U.S. GDP Growth for Q2 2023 came in lower at 2.1% y/y vs. 2.2% forecast; quarterly core PCE Prices Index change at 3.7% (3.8% forecast, 4.9% previous)

Weekly Jobless claims for the week ending Aug. 25: 228K (236K forecast; 232K previous); continuing claims rose from 1.69M to 1.725M

U.S. Non-Farm Payrolls for August: 187K (180K forecast) and the July read revised lower to 157K from 209K; unemployment rate ticked higher to 3.8% from 3.5% unexpectedly; average hourly earnings grew by +0.2% m/m (+0.4% m/m forecast/previous)

EUR Pairs

Overlay of EUR vs. Major Currencies Chart by TV

The euro was trading as a countercurrency until Wednesday when Germany and Spain’s CPI releases supported further rate hikes from the ECB.

The tides turned sharply on Thursday, however, thanks to hawkish expectations getting mixed with growth concerns after a couple of disappointing Eurozone data releases.

Unless we see more upside surprises for the Eurozone’s growth markers, the prospect of more ECB rate hikes slowing Euro area growth may continue to weigh on the common currency in the foreseeable future.

🟢 Bullish Headline Arguments

ECB Governing Council member Robert Holzmann said on Monday that they likely need to raise interest rates again in September

Euro area M3 money supply for July: -0.4% m/m vs. 0.6% m/m in June; Adjusted loans to households: -1.3% y/y vs. 1.7% y/y in June

Spanish inflation rose again in August, up by 2.4% y/y vs. 2.1% in July thanks to a rise in fuel prices

Germany Preliminary CPI read for August: 0.3% m/m as forecasted vs. 0.3% m/m previous

ECB’s Isabel Schnabel said risk-free rates “are now back to February’s levels…This decline could counteract our efforts to bring inflation back to target in a timely manner.”

Germany’s retail sales slipped by 0.8% m/m in July (vs. 0.3% expected, -0.2% previous)

Euro area Flash core CPI estimate for August: 5.3% y/y (5.3% y/y forecast; 5.5% y/y in July)

Euro area unemployment rate for July 2023: 6.4% (6.4% forecast/previous)

🔴 Bearish Headline Arguments

GfK: Germany’s consumer climate worsened from -24.4 to -25.5 over declining income expectations and declining propensity to buy in August

Germany’s Import Prices Index change for July: -13.2% y/y & -0.6% m/m (0.0% m/m forecast; -1.6% m/m previous)

Germany’s Unemployment rate held at 2.9% in July 2023; job growth was relatively flat m/m

GBP Pairs

Overlay of GBP vs. Major Currencies Chart by TV

The U.K. didn’t print a lot of top-tier economic releases this week, but that didn’t stop traders from making short-term plays British pound in either direction this week.

GBP spent Monday and Tuesday trading as a countercurrency before receiving the risk-taking treatment on Wednesday.

The prospect of higher interest rates in Europe (as well as fresh USD weakness) supported the European currencies until risk-taking turned into growth concerns for the region.

GBP gave up much of its intraweek gains but still close among the top three major currencies before the Friday close.

🟢 Bullish Headline Arguments

On Thursday, BoE Chief Economist Huw Pill said the Bank of England will “see the job through,” a comment on its fight against inflation and the likelihood of borrowing remaining high for some time.

🔴 Bearish Headline Arguments

British Retail Consortium: Annual shop price inflation cooled from 7.6% to 6.9% in August, marking its slowest price increase since October 2022

U.K. M4 Money Supply for July: -0.5% (-0.2% m/m forecast; -0.1% m/m previous)

U.K. Net mortgage approvals fell to 49.4K in July vs. 54.6K in June

U.K.’s net individual lending slipped from 1.7B GBP to 1.4B GBP in July; up for a third consecutive month

CHF Pairs

Overlay of CHF vs. Major Currencies Chart by TV

Switzerland released a few economic updates this week, arguably signaling slowing conditions as we exit the Summer. But for the most part, traders mostly priced in the franc’s as a safe haven status as broad risk sentiment shift, as well as some weighting as European currency.

This was characterized by CHF gains on Tuesday after the weak U.S. reports pointed to a less hawkish Fed tightening plan.

CHF gave up its weekly gains later in the week when the prospect of higher interest rates spooked investors who are already concerned about the region’s growth.

🟢 Bullish Headline Arguments

Swiss Inflation Rate for August 2023: 0.2% m/m (0.1% m/m forecast; -0.1% m/m previous)

🔴 Bearish Headline Arguments

KOF economic barometer weakened from 92.2 to 91.1 in August, as “the indicators on the employment situation developed negatively” for the month

Swiss retail sales for July: -2.2% y/y (2.0% y/y forecast; 1.0% y/y previous)

AUD Pairs

Overlay of AUD vs. Major Currencies Chart by TV

It was a topsy-turvy week for the Australian dollar, which had reacted to China’s stimulus measures and data releases during the Asian session while trading as a “risk asset” in the European and U.S. sessions.

AUD saw its intraweek highs on Thursday after the U.S. core PCE data supported a less hawkish rate hike schedule for the Fed.

The comdoll has seen pullbacks, though, even as it remains on track to cap the week higher against all of its major counterparts.

🟢 Bullish Headline Arguments

On Monday, China halved stamp duty on securities transactions; and lowered margin requirement for buying stocks to boost capital markets

Australia’s retail sales rebounded by 0.5% m/m in July (vs. 0.3% expected, -0.8% previous); annual sales up by 2.1% – the lowest since August 2021

Australia’s construction work done up by 0.4% q/q in Q2 (vs. 1.0% expected, 1.8% previous)

On Tuesday, the PBOC kept up its support for the yuan with a midpoint rate setting at 7.1851 against USD – over 1,000 pips stronger than the market consensus

China’s manufacturing PMI at 49.7 in August (vs. 49.1 expected, 49.3 previous)

PBOC announced a cut to its FX RRR by 200 bps from 6% to 4% from September 15, reducing the amount of foreign currency reserves required for banks to keep in vaults

🔴 Bearish Headline Arguments

Australian inflation slowed from 5.4% y/y to a 17-month low of 4.9% y/y in July driven by declines in holiday travel and fuel prices

Australia’s building approvals dropped by 8.1% m/m in July (vs. -0.8% expected, -7.9% previous)

Australia’s private capital expenditure rose by 2.8% q/q in Q2 (vs. 1.1% expected, 3.7% previous) led by investment in new equipment and machinery

China’s non-manufacturing PMI at 51.0 (vs. 51.3 expected, 51.5 previous); data marked its fifth consecutive weakening in August

China’s Caixin manufacturing PMI rose from 49.2 to 51.0 in August instead of dipping to 49.0, reflecting a return to expansion

CAD Pairs

Overlay of CAD vs. Major Currencies Chart by TV

Despite rising crude oil prices, the oil-related Loonie saw downtrends against most of its counterparts except USD and JPY early in the week.

Thankfully for CAD bulls, the comdoll found a bottom in late Wednesday and was inching higher across the board ahead of Friday’s GDP read, U.S. NFP update, most likely supported by the steady rise in oil prices all week.

Friday turned out to be a big volatility day for the Loonie as trader balanced a better-than-expected Canadian GDP read against broad market sentiment highly influenced by the U.S. major data releases.

🟢 Bullish Headline Arguments

Canada GDP on July: 0.2% m/m (-0.2% m/m forecast; 0.2% m/m previous)

🔴 Bearish Headline Arguments

Current Account deficit grew by C$3.5B to C$6.6B in Q2 2023, much better than the -C$9.0 deficit forecast

Canada Manufacturing PMI for August: 48.0 vs. 49.6 in July

NZD Pairs

Overlay of NZD vs. Major Currencies Chart by TV

Much like the Aussie, Kiwi was all over the charts every day this week as the comdoll reacted to risk-related headlines from different trading sessions.

NZD saw wide ranges but peaked on Thursday after the U.S. core PCE and initial jobless claims reports were released.

For now, the comdoll looks set to end the week higher against most of its major counterparts.

🟢 Bullish Headline Arguments

New Zealand business confidence lifted another 9 points to -3.7, the highest reading since mid-2021 as inflation indicators continued to ease

🔴 Bearish Headline Arguments

Building consents dipped by 5.2% m/m (-25.4% y/y) in July vs. 3.4% m/m uptick in June

JPY Pairs

Overlay of JPY vs. Major Currencies Chart by TV

Talks of the Fed possibly becoming less hawkish caused a bullish spike for the yen on Tuesday.

JPY then spent Wednesday trading lower after a BOJ member implied that the central bank may reconsider its dovish stance as soon as January to March next year.

Luckily for JPY bulls, risk aversion took over on Thursday lift the yen away from its intraweek lows, almost enough to put it in the green against most of the majors before the weekend despite a net negative week of headlines from Japan.

🟢 Bullish Headline Arguments

Retail sales accelerated from 5.5% y/y to 6.8% y/y in July (vs. 5.6% in June); monthly increase at 2.1% from June’s 0.4% uptick

🔴 Bearish Headline Arguments

Over the weekend, BOJ Gov. Ueda shared that Japan’s underlying inflation “is expected to decline” despite it remaining “a bit below our target”

The unemployment rate rose for the first time in four months, up from 2.5% m/m to 2.7% m/m in July

Consumer confidence slipped from 37.1 to 36.2 in August (vs. 37.5 expected)

Industrial production fell 2.0% from June to July (vs. 1.4% drop, 2.4% gain in June); manufacturing machinery and electronic components are the biggest drags

Housing starts down by 6.7% y/y (vs. -1.3% expected, -4.8% previous); down for a second consecutive month in July

Comments are closed.