Fed’s Favorite Inflation Gauge Slows More than Expected in June, US Dollar Subdued

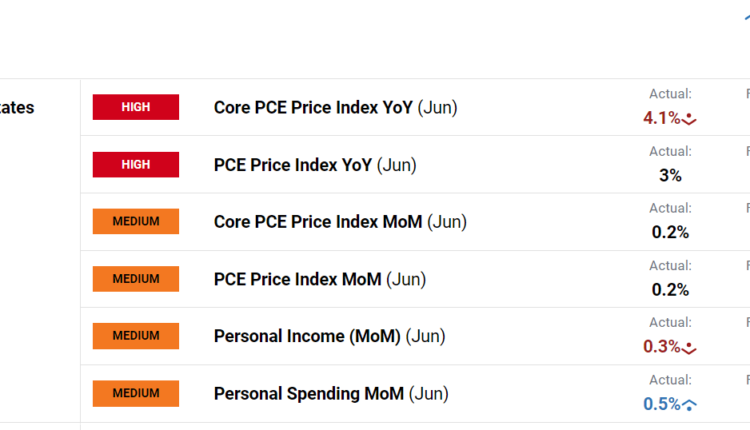

PCE REPORT KEY POINTS:

- June U.S. consumer spending climbs 0.5% m-o-m in June, slightly above forecasts

- Core PCE rises 0.2% on a monthly basis, bringing the annual rate to 4.1%, one-tenth of a percent below market estimates

- The U.S. dollar retraces some losses after this morning’s data, but remains in negative territory

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: Fed Hikes Rates After Short Pause, Gold and US Dollar Forge Separate Paths

The U.S. Bureau of Economic Analysis this morning released June income and outlays data. According to the government agency, personal consumption expenditures, which account for approximately 70% of the country’s output, grew 0.5% last month versus a forecast of 0.4%, a sign that the American consumer remains extraordinarily resilient despite elevated inflation and interest rates.

Elsewhere in the report, the price indexes were very encouraging given their positive directional improvement. Having said that, headline PCE rose 0.2% m-o-m, allowing the annual rate to ease to 3.0% from 3.8% previously. Meanwhile, core PCE, the Federal Reserve's favorite inflation indicator, which reflects the overall price trend in the economy, advanced 0.2% monthly, bringing the year-on-year reading to 4.1%, one-tenth of a percent below expectations.

US PERSONAL INCOME AND PCE DATA

Source: DailyFX Calendar

Today's report will be a mixed bag for the Fed. On the one hand, easing inflationary pressures give reason for optimism, but on the other, robust household spending may prevent policymakers from adopting a dovish stance in the near term. For this reason, the June PCE results will not significantly change the current market dynamics.

Immediately after today’s data crossed the wires, the U.S. dollar, as measured by the DXY index, retraced some losses, but remained in negative territory, with Treasury yields slightly lower on the session, but attempting to rebound. For further guidance on the outlook, traders should continue to pay attention to incoming data, including last month's NFP figures, which are scheduled for release next Friday. If macroeconomic numbers surprise to the upside, both yields, and the dollar could push higher.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

US DOLLAR (DXY) AND YIELDS CHART

Source: TradingView

Comments are closed.