Fed Pivot Reversal or Damage Control? Key Levels for XAU/USD

GOLD PRICE OUTLOOK

- Gold prices stall their advance as New York Fed President John Williams contradicts Powell’s pivot

- Williams’ pushback may be more about damage control than a complete reversal of the existing strategy

- This article analyzes XAU/USD’s technical prospects, analyzing pivotal price thresholds that could act as support or resistance in the coming days

Most Read: Gold Price Forecast – Fed Pivot May Open Pathway for New Record, XAU/USD Levels

Gold's bullish momentum faded on Friday after New York Fed President John Williams pushed back against Chairman Powell's dovish posture earlier in the week at the last FOMC meeting. Against this backdrop, XAU/USD was largely unchanged heading into the weekend, moving between small gains and losses around the $2,035 level.

For context, Williams said rate cuts are premature and not a topic of discussion at this moment, contradicting the Fed chief who indicated that the central bank has begun talking about slashing borrowing costs. While odd, this contradiction does not necessarily imply that policymakers are backtracking; instead, it may be more about damage control – a strategy to prevent financial conditions from loosening further.

In the absence of a complete reversal of the “pivot,” bond yields and the U.S. dollar are likely to continue their downward trajectory as traders try to front-run the easing cycle, which is expected to begin at some point in the first quarter of 2024. This could mean more upside for precious metals and possibly a new record high for gold prices.

Eager to gain insights into gold's future path? Discover the answers in our complimentary quarterly trading guide. Request a copy now!

Recommended by Diego Colman

Get Your Free Gold Forecast

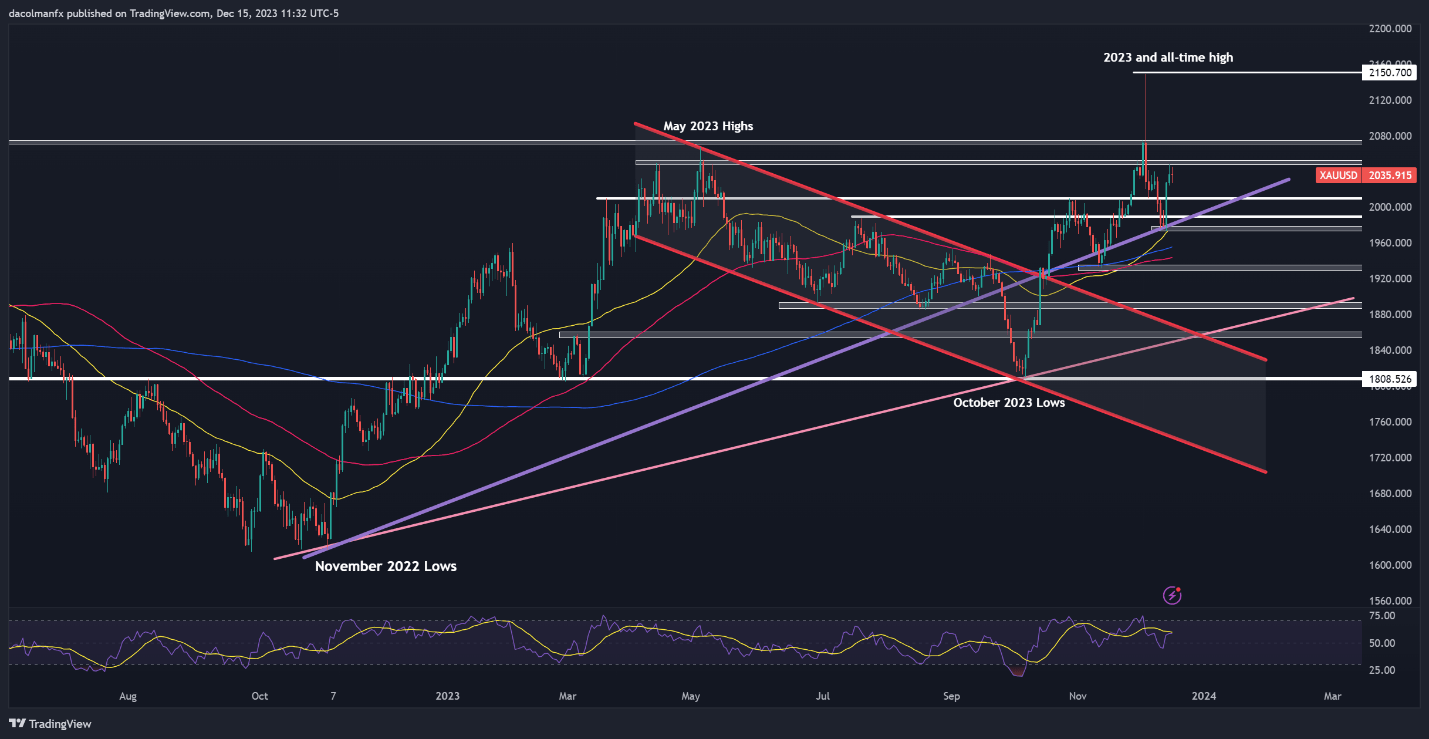

Directing attention to technical analysis, XAU/USD maintains a constructive profile, but its upward journey may encounter short-lived obstacles. This means there could be temporary retracements within the broader uptrend, particularly if markets get overextended. The RSI indicator may give clues when overbought conditions are reached.

In terms of major price thresholds worth watching, initial resistance appears at $2,050, followed by May’s peak around $2,075. Previous attempts to breach this ceiling on a sustained basis have been unsuccessful, so history could repeat itself on a retest. Nevertheless, in the event of a clear breakout, a rally toward the 2023 swing high becomes a plausible scenario.

On the flip side, if sellers return in droves and trigger a meaningful reversal, the first line of defense against a bearish assault is located near $2,010. Safeguarding this floor is imperative; a failure to do so could reinforce selling pressure, exposing trendline support near $1,990. Below this level, scrutiny will shift to the 50-day simple moving average.

Wondering how retail positioning can shape gold prices? Our sentiment guide provides the answers you are looking for—don't miss out, get the guide now!

| Change in | Longs | Shorts | OI |

| Daily | -1% | 2% | 0% |

| Weekly | -5% | -2% | -4% |

GOLD PRICE TECHNICAL CHART

Gold Price Chart Created Using TradingView

Comments are closed.