Fed Making Headway as US Inflation Slows, S&P 500 Edges Higher

US CPI KEY POINTS:

Recommended by Zain Vawda

Get your Q3 Forecast on the US Dollar Now

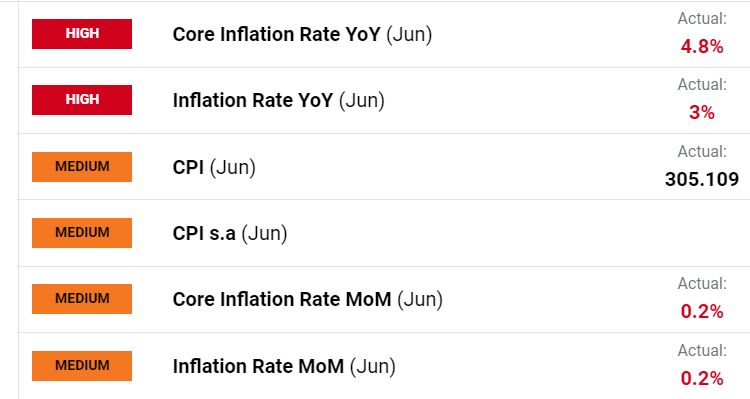

US headline inflation YoY in June declined to 3% beating estimates of 3.1% while Core CPI YoY which had been proving a problem for the Federal Reserve also beat forecasts of 5%. The headline YoY inflation print is the lowest since March 2021 and concludes 12 consecutive months of declines. The Core CPI which had proved rather sticky of late dropped to 4.8%, the lowest since October of 2021.

Customize and filter live economic data via our DailyFX economic calendar

The largest contributors to the decline in the headline figure came about as energy costs slumped 16.7% vs -11.7% in May, with prices falling 36.6% for fuel oil, 26.5% for gasoline and 18.6% for utility gas service. Food prices had been another pain point for the Federal Reserve but provided another surprise today as prices increased by 5.7%, below the 6.7% print in May.

Source: US Bureau of Labor Statistics

JULY FOMC MEETING AND THE OUTLOOK MOVING FORWARD

Heading into the July FOMC meeting markets were pricing in around an 88% chance of a 25bps hike with the Fed unlikely to be swayed by todays CPI print. US labor markets continue to display resilience even with a slight drop in last week's NFP print, coupled with a rising trend of part-time workers over permanent ones.

Fed policymakers reiterated their hawkish stance this week with many feeling it would be appropriate to continue on the hiking path. We did see signs of disagreement between Fed members in the June FOMC minutes on the optimal path moving forward, however I still expect the Fed to deliver a rate hike in July. If we are to see any surprise, I believe it could come in the size of the hike with a potential 10-15bps hike a possibility.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

MARKET REACTION

S and P 500 Daily Chart

Source: TradingView, prepared by Zain Vawda

The initial reaction saw the Dollar Index fall with risk assets enjoying a bounce. The SP500 gained around 25 points in the immediate aftermath. Looking at the bigger picture and the SP500 did give signs that we could be in for a bearish correction with a potential double-top pattern in early June. However, no such move materialized and now it seems the pattern has been made irrelevant with an upside break of the previous highs. There is key resistance up ahead though with the psychological 4500 level which could prove a tough nut to crack.

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.