Event Guide: U.S. Non-Farm Payrolls Report for May 2023

Will the U.S. employment situation report for May 2023 turn things around for the dollar this week?

Here are a few data points to know if you’re planning on trading the event:

Event in Focus:

U.S. Monthly Employment Situation Summary from the U.S. government for May 2023

When Will it Be Released:

June 2, Friday: 12:30 pm GMT, 1:30 pm London, 8:30 am New York, 9:30 pm Tokyo

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- U.S. Non-Farm Payrolls Change m/m: 193K forecast vs. 253K previous

- U.S. Average Hourly Earnings m/m: +0.3% m/m forecast vs. 0.5% m/m previous

- U.S. Unemployment Rate: 3.5% forecast vs. 3.4% previous

Another slight slowdown in hiring is expected for Uncle Sam for the month of May, as number crunchers predict a lower 193K increase compared to April’s 253K gain.

This likely translates to an uptick in the jobless rate from 3.4% to 3.5%, which would highlight signs that the U.S. labor market is cooling down.

Even wage growth is projected to have ticked lower, with the average hourly earnings figure slated to show a 0.3% monthly rise versus the earlier 0.5% increase.

Now this pay growth data point might be a key driver for dollar direction since it is seen as a factor for inflation forecasts, as well as expectations for workers returning to the workforce or switching jobs.

Leading jobs indicators such as the S&P Global flash PMI readings suggested solid employment growth for the month, as manufacturing and services firms reported higher workforce numbers working through their backlogs from the previous months.

Relevant U.S. Data Since the Last U.S. Non-Farm Payrolls Report:

🟢 Arguments for Strong Jobs Update / Bullish USD

- S&P flash manufacturing PMI survey for May indicated that “firms continued to hire new workers as the availability of candidates improved. Employment growth was solid overall and the quickest since last September.”

- S&P flash services PMI for May also showed that “The rate of job creation was the fastest for ten months, with firms recording broadly unchanged levels of unfinished business as a result of greater capacity improvements.”

🔴 Arguments for Weak Jobs Update / Bearish USD

- Weekly initial jobless claims accelerated in the first couple of weeks of May (229K to 242K in the week ending April 27, then to 264K in the week ending May 4) before coming in below estimates in the weeks that followed

- CB consumer confidence index pointed to a more downcast assessment of the labor market, with 43.5% of respondents saying jobs were “plentiful” in May, down from 47.5% in April, and 12.5% saying jobs were “hard to get,” up from 10.6% last month

Note: U.S. Challenger job cuts, ADP non-farm employment change,

and the ISM manufacturing PMI jobs component will be released Thursday, June 1st, likely giving further clues on where the May U.S. jobs report data may land.

Previous Releases and Risk Environment Influence on USD

May 5, 2023

Action / results: The U.S. non-farm payrolls reading for April came in at 253K, beating the 190K consensus and bringing the jobless rate down from 3.5% to 3.4% instead of rising to the projected 3.6% reading.

Average hourly earnings also beat estimates, as wage growth came in at 0.5% versus the 0.3% forecast.

However, the March reading suffered a significant downgrade from the initially reported 236K figure to just 165K.

Risk environment and intermarket behaviors: This particular trading week started off slow, thanks to thin liquidity and market jitters stemming from banking sector troubles and recession fears.

Volatility eventually picked up when central banks like the RBA, Federal Reserve, and ECB took the spotlight with their policy announcements.

A general shift to a more cautious policy tone, combined with a couple of downbeat U.S. leading jobs indicators, led to a pickup in risk appetite and expectations of a potentially weak NFP – both of which resulted to steady losses for the Greenback prior to the official jobs release.

This was likely why the U.S. dollar enjoyed quite the relief rally when the actual NFP beat estimates. Fed tightening hopes were probably revived after the headline readings came in all green, although the rally fizzled out on profit-taking before the trading week came to a close.

Apr 7, 2023

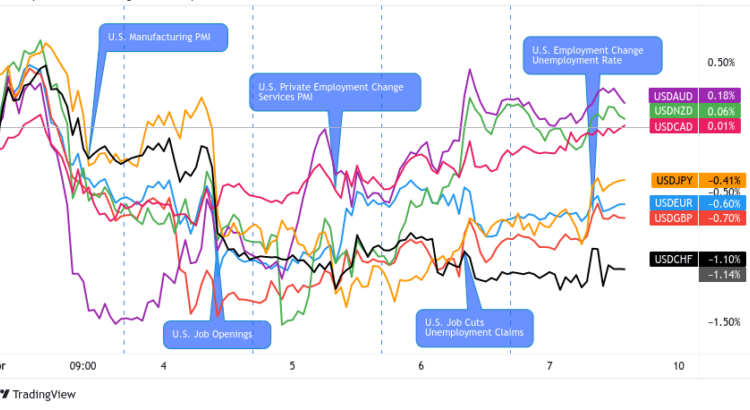

Overlay of USD Pairs: 1-Hour Chart by TV

Action / results: The U.S. employment report for March came in closely in line with expectations at 236K (238K forecast) versus the upgraded February reading at 326K .

The unemployment rate ticked lower to 3.5% from 3.6% and the average hourly earnings rate posted a 0.3% monthly gain.

For many, this reflected resilience in the U.S. employment environment and upped the odds for more Fed interest rate hikes, resulting to a general uptrend for the dollar when the report was released.

Still, volatility remained muted in comparison to the Greenback’s price action earlier in the week, likely due to the numbers simply coming in close to expectations.

Risk environment and intermarket behaviors: This trading week was choc full of top-tier catalysts, most notable of which was the slew of U.S. economic survey results that pointed to slowing activity.

For the most part of the week, risk assets spent their time in the red, except for crude oil that was able to benefit from the OPEC+ surprise announcement to curb output starting in May.

Price action probabilities

Risk sentiment probabilities:

So far this week, the U.S. dollar has been drawing support from the debt ceiling agreement struck over the weekend. Liquidity has been picking up now that traders are back from their Memorial Day and Whit Monday (Europe) holidays.

In addition, safe-haven assets are taking advantage of downbeat Chinese PMI data, with most higher-yielding currencies sliding lower against the Greenback and U.S. equity futures in the red. Crude oil has been in the red as well, as commodity traders are bracing for the OPEC meeting this week.

USD scenarios

Will the U.S. economy carry on with its streak of stronger-than-expected NFP results this time? Or will it finally confirm the long-standing assessment that a slowdown has been in play for a while?

Based on the earlier releases, traders might still have a pronounced reaction to the headline figures, especially if they blow expectations out of the water again, before taking revisions to previous data into account.

Wage growth will also likely be a main factor in dictating the dollar’s direction, as market watchers are keen to find out if price pressures are likely to be sustained.

Base Case:

Leading indicators still seem to be hinting at resilience in the U.S. labor market for yet another month, so a strong NFP read might be enough to keep Fed tightening hopes supported.

Note that FOMC officials have been reiterating the possibility of a June hike lately while the latest Fed decision remained mum on a potential pause, so a pickup in average hourly earnings add fuel to the rate hike fire.

If you think the USD rally has room to keep going, you could look into a potential long play against currencies whose central banks are juuust shifting into a less hawkish stance, like NZD and EUR.

Alternative Scenario:

If the actual figures do show the slightest sign of a peak in hiring or warning signs of a downturn in the jobs market, dollar traders could start buzzing about a Fed tightening pause as early as June.

After all, Fed head Powell mentioned that their policy decisions remain data-dependent and that officials haven’t really committed to hiking or pausing in their next decision just yet.

Keep in mind that the dollar has been gaining ground as of this writing, so it might be a challenge for bulls to sustain this climb as the week progresses, especially if other jobs indicators point to weakness or if risk appetite makes a strong comeback.

Don’t forget that the U.S. debt ceiling bill has yet to advance to the House for voting midweek, so clearing this hurdle might ease some of the uncertainty in the financial markets and therefore spur risk-taking.

In this scenario, look for potential USD shorts against currencies whose central banks are likely to pursue more tightening efforts (GBP) or might be at least approaching an end to easing sooner or later (CHF and JPY).

Comments are closed.