Event Guide: U.K. CPI Report (June 2023)

Ready for another round of U.K. CPI data?

Here’s what the upcoming release might mean for the BOE’s policy path and GBP price action.

Event in Focus:

U.K. Consumer Price Index (CPI) and inflation data for June 2023

When Will it Be Released:

July 19, 2023 (Wednesday), 6:00 am GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- Headline CPI y/y: +8.2% y/y forecast vs. +8.7% y/y previous

- Core CPI y/y: +7.1% y/y forecast vs. +7.1% y/y previous

- PPI input m/m: +0.2% m/m forecast vs. -1.5% m/m previous

- PPI output m/m: -0.3% m/m forecast vs. -0.5% m/m previous

Relevant Data Since Last Event/Data Release:

- Average earnings index accelerated to 6.9% for three-month period ending in May vs. 6.8% consensus, index for April period upgraded from 6.5% to 6.7%

- S&P Global manufacturing PMI for June reflected another month of declines for input costs, chalking up the steepest fall since February 2016, as “weaker demand for inputs, reduced fuel costs, commodity price decreases and improved supply chains” came in play

- S&P Global services PMI for June showed that input cost inflation eased to lowest level since May 2021, but output costs increased due to higher wages

- In May, producer input prices slumped by 1.5% month-over-month while output prices slipped 0.2% vs. projected 0.1% dip

Previous Releases and Risk Environment Influence on GBP

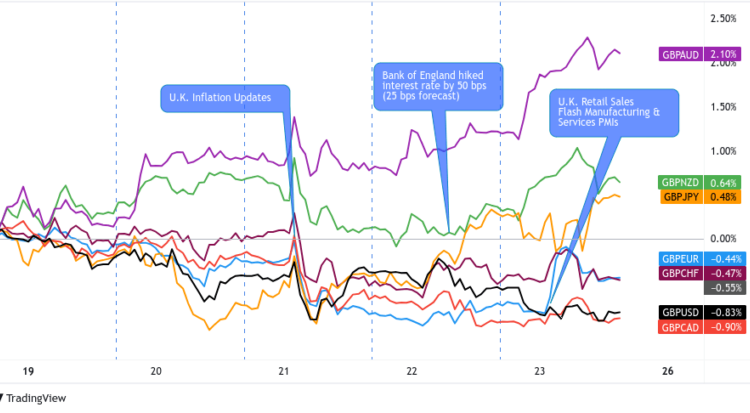

June 21, 2023

Event results / Price Action:

The May inflation report came in stronger than expected on most fronts, as the headline CPI held steady at 8.7% year-over-year instead of dipping to the projected 8.4% reading.

Core inflation even picked up from 6.8% year-over-year to 7.1% instead of staying unchanged while the retail price index and housing price index also beat estimates.

The only downside to the report was that producer input and output prices fell way below expectations and pointed to subdued inflationary pressures down the line.

Surprisingly, the upbeat CPI figures still spurred a sharp decline for pound pairs, as traders worried that these would force the BOE to hike rates to recession-inducing levels. However, the BOE doled out yet another surprise by increasing borrowing costs by 0.50% and allowed GBP to recover against some of its peers.

Risk environment and intermarket behaviors:

Market watchers had already been bracing for hot inflation data from most major economies, which might then push central banks to tighten policy and possibly put overall growth at risk.

Higher-yielding currencies were already on shaky footing early in the week, following downgrades to Chinese data over the weekend. Things managed to turn around for the better midweek when Fed head Powell sounded sketchy about the timing of future U.S. rate hikes, triggering a rally for U.S. equities and crude oil.

Then again, it wasn’t long before risk aversion popped its ugly head back in the markets when June flash PMI readings were rolled out on Friday.

May 24, 2023

Event results / Price Action:

The April U.K. headline CPI beat market estimates, even as the reading fell from 10.1% to 8.7% year-over-year. Analysts had been pricing in a steeper decline to 8.2% but inflationary pressures turned out to be more sticky than that.

The core CPI also came in better than expected, as the reading rose from 6.2% year-over-year to 6.8% instead of holding steady. Underlying measures of inflation came in mixed, as the retail price index also beat estimates while producer prices pointed to weaker input costs.

Overall, the pound still rallied against its forex peers during the CPI release since these pointed to stronger chances of more BOE interest rate hikes in the coming months.

Stronger than expected retail sales data printed on Friday even allowed GBP to extend its gains, as this reassured traders that stagflation risks might be avoided.

Risk environment and intermarket behaviors:

There was a lot of consolidation in play during this particular trading week, as market watchers were playing it safe while U.S. debt ceiling negotiations were ongoing.

At that time, talks broke down in U.S. President Biden’s absence over the weekend, leading Treasury Secretary Yellen to reiterate that the June 1 deadline is fast-approaching. This kept a lid on risk rallies while propping up safe-havens like the dollar and yen.

Not even the pickup in U.S. equities on Thursday was enough to whet broad risk appetite, as Fitch’s decision to put the U.S. on “negative watch” left investors on edge towards the end of the week.

Price action probabilities:

Risk sentiment probabilities:

This busy trading week kicked off with a handful of data points from China, with the most notable read, GDP, coming in below expectations. This seems to have brought on a little bit of a risk-off lean into the markets through a mostly quiet trading session.

This muted bias will likely hold until we get U.S. retail sales on Tuesday, which could influence broad market sentiment. Expectations are for the U.S. retail sales data to come in above previous reads, but whatever the case may be, look for it to likely drive broad risk sentiment into Wednesday’s trade.

British pound scenarios:

Potential Base Scenario:

It could be high-time for a dip in U.K. price pressures, as most leading indicators like the PMIs and PPIs are hinting at declining costs. After all, the BOE has been working hard at keeping inflation contained through its consecutive interest rate hikes.

If market dynamics between inflation data and risk appetite remain the same as in the previous week, the pound might actually be in for a pop higher if CPI figures disappoint.

Even though this might spell an eventual end to the BOE’s tightening cycle, it could get pound bulls hopeful for much better growth prospects for the U.K. economy.

In this case, look out for possible long GBP plays against commodity currencies, especially if risk-off flows come in play after U.S. retail sales data. The pound might also chalk up gains against safe-havens like the dollar or yen, especially since the Fed and BOJ aren’t exactly being hawkish these days.

Potential Alternative Scenario:

Yet another strong U.K. inflation report would make it the FOURTH consecutive monthly upside surprise, which might once again revive recession fears for the U.K. economy due to possibly higher borrowing costs.

Keep in mind that the average earnings index for May still reflected stubborn wage growth, putting upside pressure on business output costs and overall consumer inflation.

With that, the BOE might have no choice but to keep tightening monetary policy, toeing the line between maintaining price stability and risking a downturn in economic activity.

In this scenario, watch out for a GBP selloff similar to that of the May CPI release, possibly leading to declines against the Swiss franc and the euro whose central banks seem to be balancing things well lately.

Comments are closed.