Event Guide: FOMC Statement – June 2023

Are you ready to trade what’s probably THE most awaited economic calendar this week?

I’m talking about the Fed’s monetary policy decision on Wednesday!

Here are major points you need to know if you’re planning on trading the event:

Event in Focus:

Federal Open Market Committee (FOMC) Monetary Policy Statement

When Will it Be Released:

June 14, Wednesday: 6:00 pm GMT

Fed Chairman Powell will conduct a presser 30 minutes later.

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- Fed to hold its Fed funds rate range steady at 5.00% – 5.25% (CME Fed Watch tool sees 75.8% probability as of Jun. 12)

- Fed will provide new “dot plot” forecasts and economic projections

- Chairman Powell will likely adopt a “hawkish skip” and hint at further rate hikes as soon as the next meeting

Relevant U.S. Data Since Last FOMC Statement:

🟢 Arguments for Tighter Monetary Policy / Bullish USD

S&P Global US Services PMI for May: 54.9 vs. 53.6; “Sharpest rise in new business since April 2022”; “The rate of charge inflation eased from April but was the second-fastest since September 2022 and sharper than the long-run series average.”

Non-Farm payrolls for May: +339K (+180K forecast) vs. upwardly revised 294K in April; Unemployment Rate rose to 3.7% (3.5% forecast, 3.4% previous); Average hourly earnings: +0.3% (+0.4% forecast/previous)

On May 25, Federal Reserve Governor Christopher Waller said on Thursday that he doesn’t think the Fed should pause until we see clear evidence of cooling inflation conditions

On May 22, Federal Reserve Bank President James Bullard backed two more interest-rate increases for 2023

Preliminary GDP read for Q1 2023: 1.3% q/q; price index came in at 4.2% q/q (4.0% q/q forecast) vs. 3.9% q/q previous

Core PCE for April: +0.4% m/m (+0.3% m/m forecast) vs. +0.3% m/m previous; +4.7% y/y vs. 4.5% y/y forecast

Consumer Price Index for April: +0.4% m/m (+0.3% m/m forecast) vs. +0.1% previous; +4.9% y/y as expected vs. 5.0% y/y previous

Retail Sales for April: +0.4% m/m (+0.7% m/m forecast) vs. -0.7% m/m previous

Industrial Production for April: +0.5% m/m (-0.1% m/m forecast) vs. 0.0% m/m previous

🔴 Arguments for Looser Monetary Policy / Bearish USD

On June 2, Fed official Harker pointed out that consumers aren’t spending as much as they used to, so it might be time to pause in June

Federal Governor Jefferson signaled on June 1 that the Fed may skip a rate hike in June while still keeping open the option of further rate hikes later

S&P Global US Manufacturing PMI read for May: 48.4 vs. 50.2 in April

Fed’s quarterly Senior Loan Officer Opinion survey noted the respondents’ expectations of tighter credit conditions, lower customer demand, and a further tightening of credit conditions likely throughout the year.

On May 19, Fed Chair Powell said that the policy rate may not need to rise as much to achieve goals due to tighter credit conditions in the banking sector

On May 16, Thomas Barkin, president of the Federal Reserve Bank of Richmond, stated that he wanted more evidence that inflation rates are slowing and that he would support hiking interest rates further if data showed it’s needed.

On May 15, Federal Reserve officials Kashkari and Goosbee both signal interest rate policy caution due to credit and price pressures

Previous Releases and Risk Environment Influence on USD

May 3, 2023

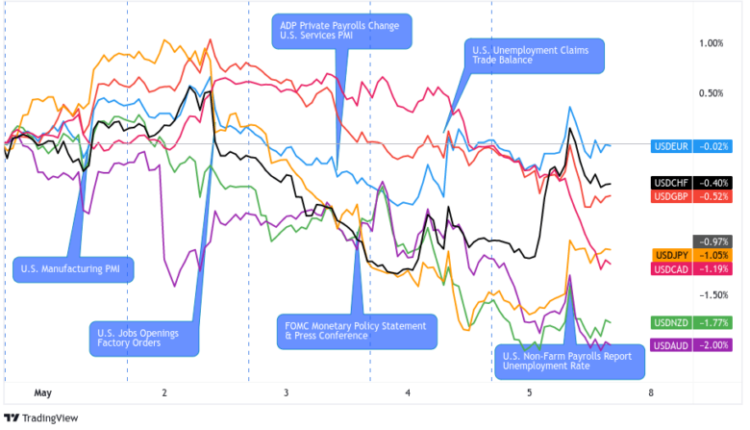

Overlay of USD Pairs: 1-Hour Forex Chart by TV

Action/results: As expected, the Fed hiked its rates by 25 bps to the 5.00% – 5.25% range, which is the “terminal rate” FOMC members marked on their March dot plot projections.

Chairman Powell also shared that the Fed will be data-dependent going forward, which traders took as dovish.

USD spiked higher at the release but then started trading lower in the next 15-minute candlestick. The Greenback eventually made new intraday lows against all of its major counterparts but the Japanese yen.

Risk Environment and Intermarket Behaviors: A combination of mixed labor market numbers, regional bank contagion fears, and recession concerns were dragging the dollar into a downtrend for most of the week.

The actual rate hike initially gave the dollar a boost, but the dovish nature of the decision gave USD traders the license to extend the dollar’s intraweek downtrend until Friday.

Mar. 22, 2023

Overlay of USD Pairs: 1-Hour Forex Chart by TV

Action/results: As expected, the Fed raised its interest rates by 25 basis points to the 4.75% – 5.00% target range, citing tighter bank lending conditions as one of the reasons for not taking its rates even higher.

FOMC members didn’t change their dot plot forecasts, but new projections showed that they’re expecting higher inflation and lower GDP and unemployment rate in 2023 compared to their December forecasts.

The Fed raised its interest rates by “only” 25 basis points and shifted its tightening bias from “ongoing rate increases will be appropriate” to “some additional policy firming may be appropriate” which translated to “dovish rate hike” during the U.S. session.

Risk Environment and Intermarket Behaviors: Markets were coming off from their bank jitters and coordinated central bank action on Monday. This made it easier to sell USD and buy “riskier” bets when markets took “dovish hike” from the Fed event.

USD dropped sharply across the board at the statement’s release but only retained its weakness against its fellow safe havens before the end of the day.

Price action probabilities

Risk sentiment probabilities: Easing concerns over the U.S. debt ceiling, banking sector, and global growth has been pushing “risk” assets higher since the start of the month.

Traders will likely stay on the sidelines, though, until the U.S. CPI report which may shift expectations on the FOMC decision, which means U.S. CPI data could have influence on broad risk sentiment itself.

Then, we’ll get the big event of the FOMC decision on Wednesday to shake up risk sentiment once again. Risk sentiment going for the rest of the week will likely largely depend on whether the Fed pauses or hikes and how different the Fed’s forward guidance is from market expectations.

The latest monetary policy decisions from the European Central Bank and Bank of Japan are on the schedule as well, but aren’t likely to have a major influence on broad risk sentiment unless we do get a major surprise from either of those events.

U.S. Dollar scenarios

Base case: As with the last three FOMC decisions, the Fed could do what the markets are expecting; and this time it’s expecting to keep its interest rates steady at the 5.00% – 5.25% range.

In his presser, Powell will likely recognize the tightening effects of stricter banking standards and the demand destruction from persistently higher consumer prices.

But to discourage interest rate cut speculation, Powell could also point to uncomfortably high inflation and hint at further rate hikes this year. He will also probably reinforce the Fed’s dot plot projections of not raising rates until 2024.

Based on high expectations of a pause, a history of the Greenback falling when expectations were met, and IF the U.S. dollar sees broad gains ahead of the FOMC decision, there’s a decent chance that we could see profit taking on USD longs once again on the event release if expectations were met once again..

Overall, though, this is an event where it makes sense to wait for the actual FOMC statement and the press conference before making a directional bias on the U.S. dollar.

Not only could we get unexpected rhetoric (especially from the FOMC press conference), but directional moves held through at least the next session in the last two releases, meaning there is a possibility of catching a good chunk of the pips with more certainty/conviction in the trend after all information is known.

Alternative Scenario: The Fed could take cues from the RBA and BOC’s books and surprise markets with a 25 bps rate hike (CME Fed Watch tool sees a 24.2% probability of 25 bps raise as of Jun. 12)

You know, for the drama… but more likely to underscore the central bank’s commitment to controlling Uncle Sam’s high inflation environment and using a persistently strong employment environment as justification.

In this scenario of a surprise rate hike, USD may jump the most against currencies with less hawkish central banks like JPY, CHF, and GBP. But it’s possible it’ll likely gain against all the majors IF risk sentiment sours and the Fed hints at more hikes ahead.

Comments are closed.