Event Guide: Australia’s CPI Report (September 2023)

Inflation updates have been the trading rage as of late, and we’ll get another opportunity to see volatility with the latest update from Australia.

Will it signal sticky price rises to keep the Reserve Bank of Australia on their toes, or will we get a surprise number lower to give’em some breathing room?

Here are points you need to know if you’re planning on trading Australia’s August inflation figures:

Event in Focus:

Australia Consumer Price Index (CPI) and inflation data for August 2023

When Will it Be Released:

September 27, 2023 (Wednesday), 1:30 am GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- Headline CPI y/y: +5.1% forecast vs. +4.9% previous

Relevant Data Since Last Event/Data Release:

🟢 Arguments for Higher CPI update

- Australia’s unemployment rate remained at 3.7% in August; Participation rate edged up from 66.9% to 67.0%; Employment positively gained at 64.9K (vs. 25.4K expected, -1.4K previous) but part-time gains (+62.1K) outpaced full-time job increases (+2.8K)

- NAB Monthly Business Survey for August: Cost and price growth moderated but remained elevated, including a sticky labor cost growth rate of 3.2% q/q

- Australia’s flash manufacturing PMI: Manufacturing input cost inflation rate accelerated but still remains relatively subdued

🔴 Arguments for Lower CPI update

- Australia’s MI inflation gauge slowed from 0.8% m/m to 0.2% in August to reflect weakening inflationary pressures

- Australia’s flash services PMI survey saw price pressures ease in August.

- Melbourne Institute inflation expectations fell from 4.9% y/y to 4.6% y/y in September

Previous Releases and Risk Environment Influence on AUD

August 29, 2023

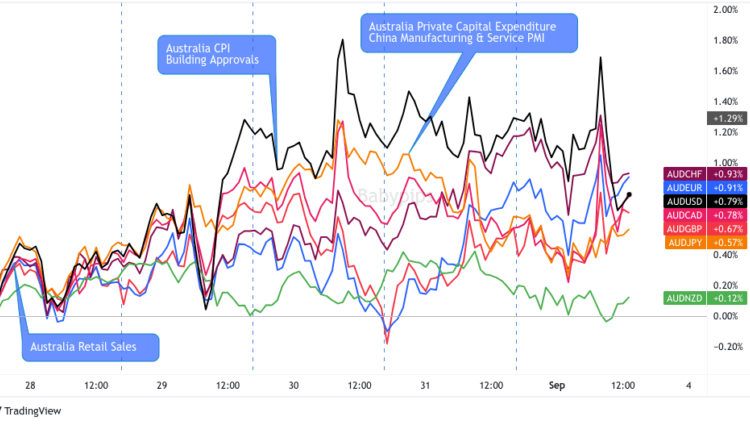

Overlay of AUD vs. Major Currencies Charts by TradingView

Event results / Price Action:

In August, the July headline read of the Australian consumer price index change came in below both expectations and the previous read at 4.9%. The core CPI read also came in below both forecast and previous read at 5.8%. This quickly turned back early Aussie strength and prompted a steady decrease in value against the majors through the rest of the Wednesday trading session.

The focus on this event appears to have been short-term as traders found their next directional cue from the latest Chinese business survey updates. They arguably came in net positive as manufacturing PMI improved over forecast / previous, while the services sector remained optimistic, and correlates with the beginning of a bounce back in the Aussie to hold its gains for the week.

Risk Environment and Intermarket Behaviors:

This trading week was in net anti-dollar mode as traders saw signs of the U.S.’ resilience cracking, but also arguably in risk-on mode as China signaled stimulus measures to support their equities markets, including reductions in stamp duties, margin rates, and selling restrictions.

July 26, 2023

Overlay of AUD vs. Major Currencies Charts by TradingView

Event results / Price Action:

After a bullish run in the earlier trading sessions, the Aussie sold off sharply across the board when the Land Down Under’s CPI readings were released during Asian market hours.

Both the headline reading and trimmed mean CPI came in weaker than expected, dashing hopes of more interest rate hikes from the RBA. The Kiwi also tumbled against its counterparts upon seeing the news.

AUD recovered more than half of its event candlestick losses in the next few hours, but the Aussie-selling resumed at the start of European session trading and didn’t see pullbacks until the U.S. session started.

Risk Environment and Intermarket Behaviors:

Weaker-than-expected PMI readings from the major economies set a risk-off tone early in the week. Luckily for risk assets, speculations of Chinese stimulus also limited their losses.

But the weak PMI reports were soon joined by soft Australian inflation and hawkish statements from the Fed and the ECB. They contributed to a risk-off environment that weighed on “risky” bets like the comdolls.

Price action probabilities:

Risk sentiment probabilities: The outlook for financial markets appears to be leaning towards a dollar bullish and risk-averse sentiment. Last week, several central banks have recently confirmed their intentions to maintain restrictive monetary policies for an extended period. Most notable was the Federal Reserve event where they hinted at one more hike in 2023 and lowered expectations of a significant rate cut in 2024.

Additionally, the absence of major catalysts on this week’s early economic calendar means that there are no imminent factors likely to shift this sentiment. This combination of central bank messaging and a lack of market-moving events suggests that the dollar’s bullish trend and risk-averse stance in financial markets are likely to persist around the release of the Australian CPI update.

Australian dollar scenarios:

Potential Base Scenario: As mentioned above, markets are in a bit of risk-off lean due to last week’s central bank events. And if that sentiment persists, we may see the Aussie drift lower ahead of the Australian CPI release.

If that’s the case and we see the better-than-expected update that the market currently expects, it’s possible that the Aussie could pop on the event as this scenario would draw in likely short AUD profit takers, fundie bulls on raised odds of a potential interest rate hike or “tighter-for-longer” policy stance, or even fresh bulls against the other comdolls if broad sentiment is still leaning risk-off on Wednesday.

Potential Alternative Scenario: While most countries are showing sticky inflation updates, that doesn’t mean we won’t get the occasional surprise weaker-than-expected read like we saw in the U.K. last week. With the services sector seeing slower inflation rates, there is a case of a small possibility that the trend of slowing inflation rates may continue.

This would be a surprise scenario and if broad risk sentiment does remain in risk-off mode during the release, intraweek trend sellers and fundie bears (pricing rising odds of no further hikes / hawkish rhetoric) may step in to push the Aussie lower. This may especially be seen against safe havens like the U.S. dollar, and possibly the Canadian dollar which has been the best major currency performer this month with rising oil prices and strong economic updates from Canada supporting it higher.

This content is strictly for informational purposes only and does not constitute as investment advice. Trading any financial market involves risk. Please read our Risk Disclosure to make sure you understand the risks involved.

Comments are closed.