Event Guide: Australia’s CPI Report (June 2023)

Will the Reserve Bank of Australia carry on with its tightening moves?

The upcoming Australian CPI release is probably the place to look to determine what the central bank’s next moves may be.

Here are points to know if you’re planning on trading Australia’s inflation data:

Event in Focus:

Australia Consumer Price Index (CPI) and inflation data for June 2023

When Will it Be Released:

July 26, 2023 (Wednesday), 1:30 am GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- Headline CPI y/y: +5.5 % forecast vs. +5.6% previous

- Trimmed mean CPI q/q: +1.1% forecast vs. +1.2% previous

Relevant Data Since Last Event/Data Release:

- July RBA minutes indicated that “Sticky services price inflation also reflected high wages growth” and that “Market measures of short-term inflation expectations had declined from their peaks but also remained high”

- June MI inflation expectations held steady at 5.2% for the next 12 months

- June MI inflation gauge posted a meager 0.1% month-over-month uptick vs. previous 0.9% gain

- June RBA commodity prices index posted a 21.5% year-over-year decline, unchanged from the previous month

- Judo Bank Flash Australia Manufacturing PMI for June: “Overall input cost inflation remained unchanged from May with higher service cost inflation offsetting a slowdown in manufacturing input price increases; private sector firms continued to share cost burdens with clients, raising selling price inflation.

- Judo Bank Flash Australia Service PMI for June: Inflationary pressures intensified in the service sector due to higher demand and higher input cost inflation.

Previous Releases and Risk Environment Influence on AUD

June 28, 2023

Event results / Price Action:

The Australian May CPI slumped from 6.8% to 5.6% year-over-year vs. an estimated dip to 6.1%, sealing the deal for an RBA pause for most Aussie traders.

Downgraded Chinese growth forecasts earlier in the week kept AUD on weak footing, along with weaker prospects of additional PBOC stimulus. After all, Chinese Premier Li Qiang reassured that the country is still on course to achieve its 5% economic growth target in 2023.

Still, the Australian dollar managed to pull higher towards the end of the week when upbeat retail sales data was released, followed by a strong private sector credit report.

Risk Environment and Intermarket Behaviors:

The trading week started with strong risk-off flows that carried over from the previous one. It didn’t help that S&P downgraded China’s GDP estimates, keeping safe-havens supported, while central bankers still seemed inclined to maintain restrictive monetary policies.

Although the PBOC’s moves to set the yuan reference rate stronger than expected lifted stimulus hopes and commodity currencies midweek, mostly stronger than expected U.S. data still spurred expectations of higher global borrowing costs.

May 31, 2023

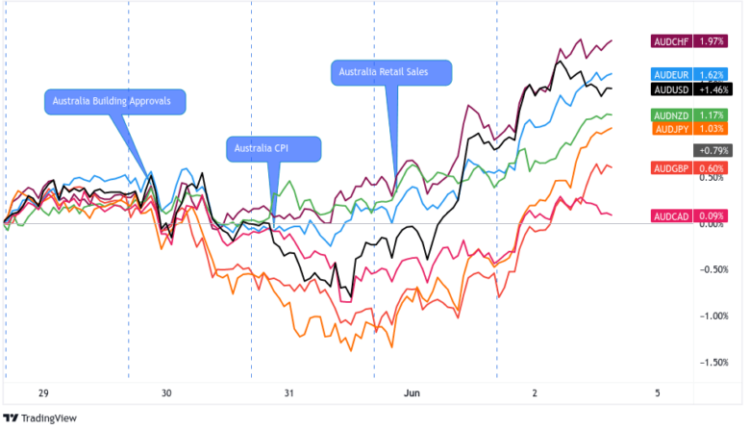

Overlay of AUD vs. Major Currencies Charts by TV

Event results / Price Action:

Australia’s April CPI reading turned out much stronger than expected at a 6.8% year-over-year versus the earlier 6.3% reading. Underlying components revealed that a surge in transport prices led the inflation report to print its first acceleration since December last year.

Not surprisingly, AUD had a sharp bullish reaction upon seeing the headline figures since these buoyed RBA tightening expectations. However, the commodity currency was forced to return its gains when China printed a couple of disappointing PMI figures.

Later on, the Aussie was able to back on its feet when RBA head Lowe reiterated their plans to address stubborn inflationary pressures. The rally managed to sustain its momentum after China printed an upbeat Caixin PMI reading.

Risk Environment and Intermarket Behaviors:

Higher-yielding assets and currencies started the week on the back foot since market watchers were extra jittery about the U.S. debt ceiling deal. Adding to risk-off flows were China’s downbeat official PMI readings that cast doubts on the country’s economic rebound.

Fortunately for riskier holdings, market sentiment fared better in the latter half of the week. A number of factors, including Fed officials bringing up the idea of a “June pause” and stronger than expected Chinese Caixin PMI, spurred risk-taking.

Price action probabilities:

Risk sentiment probabilities: The new trading week is kicking off with the release of global flash PMI readings, most of which were disappointing to those looking for signs of a soft landing. Instead, contractionary conditions worsened in many parts of the world.

The risk sentiment reaction so far has been mixed, likely due to other intermarket narratives in play like oil’s strong rally (possibly on China stimulus hopes and tight supply), and strong corporate earnings expectations lifting equities, but there are signs of risk-off type behavior with crypto and bond yields turning lower on the session while gold and the U.S. Dollar index moved higher.

This sentiment may hold leading up to the Australian CPI release with a lack of major catalysts between now and then, but pay attention to fresh headlines from Fed officials as that could shift broad sentiment quickly as we approach the highly anticipated FOMC statement on Wednesday.

Australian dollar scenarios:

Potential Base Scenario: Market expectations are pointing to an arguably inline to slightly lower number as economic updates conflict what business surveys see.

If we do see a slightly lower or inline read with previous, then broad risk sentiment is likely to be the main directional driver for the Aussie after a likely period of elevated volatility after the release.

As discussed above, risk-off sentiment could be in play thanks to disappointing PMIs and risk reduction ahead of the FOMC event, raising the odds of Aussie traders leaning bearish if that scenario plays out.

In this case, look for a possible AUD move lower against “safe haven” / lower-yielding currencies; setups against the JPY and CHF make the most sense for a short-term play at the moment.

Potential Alternative Scenario: Another upside CPI surprise is a possibility given sentiment from business surveys, and could raise bets of another 0.25% interest rate hike from the RBA in their upcoming policy statement, possibly keeping traders on edge about a growth slowdown as a result.

If risk aversion is in play right around the CPI release (and barring a major upside surprise in the CPI data), look out for possible AUD short setups against safe-haven currencies or lower-yielding ones like the Japanese yen, and Swiss franc after initial surprise reaction and volatility fades. But if risk sentiment is leaning positive, check AUD against CAD, as Loonie price has been well supported by rising oil prices recently (but be aware that EIA oil inventories data may influence CAD & oil in the short-term).

Also remember to stay on your toes and/or adjustment your risk management plan quickly as the market is likely to shift focus to the FOMC release later in the Wednesday session, an event that has the potential to turn the whole market upside down.

Comments are closed.