Event Guide: Australia’s CPI Report (July 2023)

The RBA recently shared that there’s already a “credible path back to the inflation target” with the current interest rate levels.

Is the central bank right to be chill about its current policies?

Here are points you need to know if you’re planning on trading Australia’s July inflation figures:

Event in Focus:

Australia Consumer Price Index (CPI) and inflation data for July 2023

When Will it Be Released:

August 30, 2023 (Wednesday), 1:30 am GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- Headline CPI y/y: +5.1% forecast vs. +5.4% previous

Relevant Data Since Last Event/Data Release:

- Australia lost a net of 14,600 jobs in July; full-time jobs dropped by 24,200 while part-time jobs gained by 9,600; the unemployment rate ticked up from 3.5% to 3.7% and the labor force participation rate edged lower from 66.8% to 66.7%

- Melbourne Institute’s inflation gauge showed a 0.8% price acceleration in July, much higher than June’s 0.1% uptick

- Australia’s MI inflation expectations fell from 5.2% to 4.9% in July, suggesting weaker price pressures over the next 12 months

- Judo Bank flash manufacturing PMI (July) rose to a five-month high of 49.6 in July; “The pace of input cost inflation ticked higher at the start of the third quarter but remained relatively muted“

- Judo Bank flash services PMI (July) dropped from 50.3 to 48.0; “The service sector inflation indicators remain elevated, consistent with inflation of around 4-5%“

- Judo Bank flash composite PMI (August): “The price indexes jumped in July as the new financial year brought with it a host of upward price adjustments across the economy“

Previous Releases and Risk Environment Influence on AUD

July 26, 2023

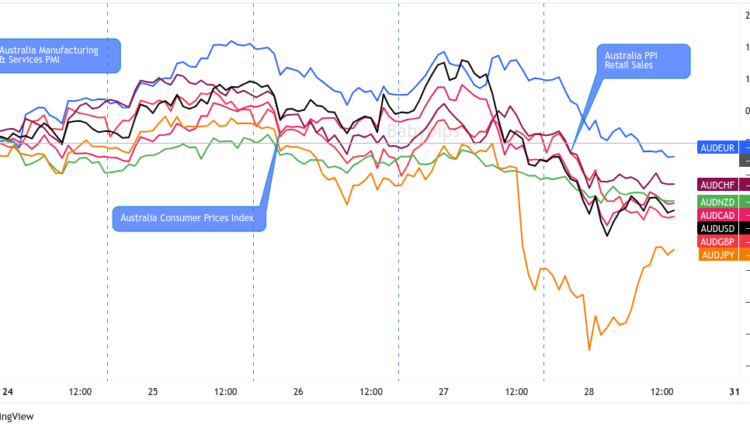

Overlay of AUD vs. Major Currencies Charts by TV

Event results / Price Action:

After a bullish run in the earlier trading sessions, the Aussie sold off sharply across the board when the Land Down Under’s CPI readings were released during Asian market hours.

Both the headline reading and trimmed mean CPI came in weaker than expected, dashing hopes of more interest rate hikes from the RBA. The Kiwi also tumbled against its counterparts upon seeing the news.

AUD recovered more than half of its event candlestick losses in the next few hours, but the Aussie-selling resumed at the start of European session trading and didn’t see pullbacks until the U.S. session started.

Risk Environment and Intermarket Behaviors:

Weaker-than-expected PMI readings from the major economies set a risk-off tone early in the week. Luckily for risk assets, speculations of Chinese stimulus also limited their losses.

But the weak PMI reports were soon joined by soft Australian inflation and hawkish statements from the Fed and the ECB. They contributed to a risk-off environment that weighed on “risky” bets like the comdolls.

June 28, 2023

Event results / Price Action:

The Australian May CPI slumped from 6.8% to 5.6% year-over-year vs. an estimated dip to 6.1%, sealing the deal for an RBA pause for most Aussie traders.

Downgraded Chinese growth forecasts earlier in the week kept AUD on weak footing, along with weaker prospects of additional PBOC stimulus. After all, Chinese Premier Li Qiang reassured that the country is still on course to achieve its 5% economic growth target in 2023.

Still, the Australian dollar managed to pull higher towards the end of the week when upbeat retail sales data was released, followed by a strong private sector credit report.

Risk Environment and Intermarket Behaviors:

The trading week started with strong risk-off flows that carried over from the previous one. It didn’t help that S&P downgraded China’s GDP estimates, keeping safe havens supported, while central bankers still seemed inclined to maintain restrictive monetary policies.

Although the PBOC’s moves to set the yuan reference rate stronger than expected lifted stimulus hopes and commodity currencies midweek, mostly stronger-than-expected U.S. data still spurred expectations of higher global borrowing costs.

Price action probabilities:

Risk sentiment probabilities: Risk assets sentiment is likely to be driven by U.S. consumer confidence and job openings data, which is set to release during the Tuesday U.S. trading session. The consumer confidence data is the likely to be the bigger driver and if it falls from previous levels, it would likely bring in fundamental traders looking to price in higher odds of recession as well as lower odds of Fed hawkishness ahead.

These two narratives contradict each other, but overall, global recession fears are likely to be the top driver of broad sentiment, especially if U.S. consumers are feeling less optimistic and given the lackluster response to this weekend’s efforts from China to boost confidence in their economy.

Australian dollar scenarios:

Potential Base Scenario: Based on the surprise misses in the labour market in July and weaknesses in the August PMIs, we’ll likely see even slower price increases in July even as they remain at elevated levels. This may be enough to keep RBA rate hikes on the table but also discourage AUD bulls from pricing in immediate interest rate increases.

If we see another slowdown in consumer prices, then AUD may weaken against popular counterparts like USD, JPY, and NZD and against currencies with hawkish central banks like EUR and GBP.

Potential Alternative Scenario: If July consumer prices surprise to the upside, then the RBA would have one major reason to consider another interest rate hike.

The RBA would join the uber-hawkish club, which may push AUD higher against counterparts like USD and JPY and currencies with less hawkish central banks like NZD and CAD.

Just remember that the U.S. will print its August ADP report and second reading of Q2 GDP later that day, so AUD’s price reaction to either scenario may see profit-taking before the start of the U.S. session.

Comments are closed.