EURUSD Grinds Higher Despite Industrial Production Slump

EUR/USD PRICE, CHATS AND ANALYSIS:

Recommended by Zain Vawda

Get Your Free EUR Forecast

READ MORE: BRITISH POUND (GBP) WEEKLY FORECAST: GBP Bulls Eye Fresh Catalyst with UK Employment Data

EUR/USD FUNDAMENTAL BACKDROP

EURUSD has enjoyed a moderate bounce to start the week as a key support level at 1.0840 holds firm. Last week’s saw EURUSD face a late week selloff as a return of US Dollar strength and a souring of market sentiment weighed on the pair.

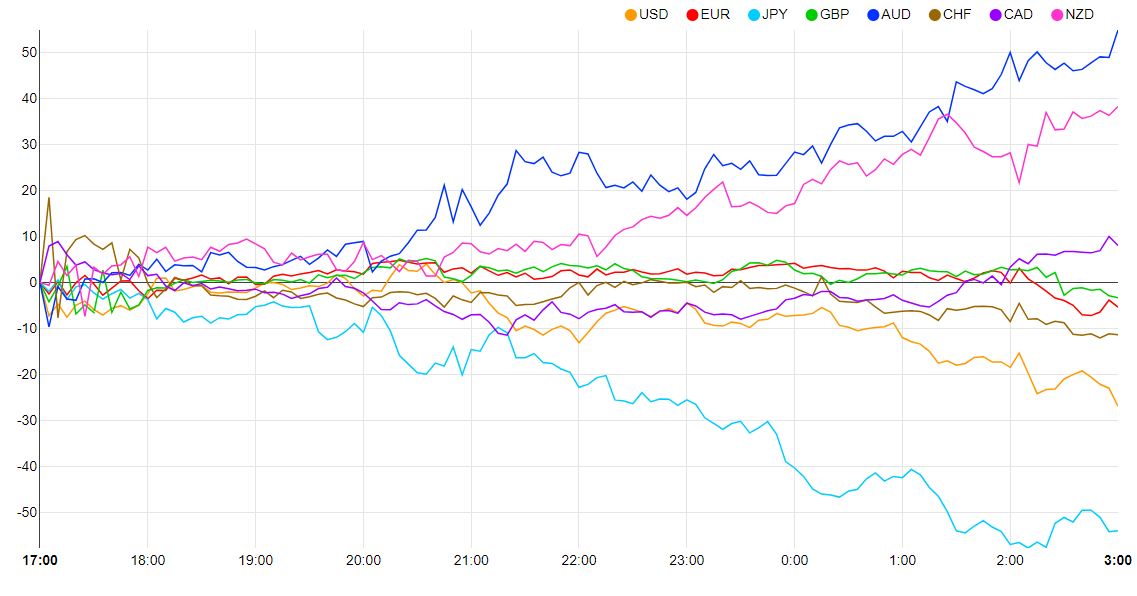

Currency Strength Chart: Strongest – AUD, Weakest – JPY.

Source: FinancialJuice

The weekend brough some notable indecision as we heard comments from European Central Bank (ECB) policymakers who struck different chords. ECB Vice President Luis De Guindos stated that the ECB have now entered the homestretch of the tightening cycle while policymaker Kazimir struck a hawkish tone. Kazimir stated that the ECB may need to raise rates longer than previously thought in a bid to tame inflationary pressures. Like many Central Banks at the moment the correct monetary policy path seems a game of ‘flipping the coin’ with policymakers having varying thoughts on the way forward. This is evidenced by the changes seen in the EU Commission Forecast which now sees 2023 inflation at 5.8% up from 5.5% in the February forecast while GDP growth is seen at 1.1% up from 0.9%. Given the recent slowdown and demand fears the feasibility of growth increasing in the second half of 2023 remains up for debate in my opinion.

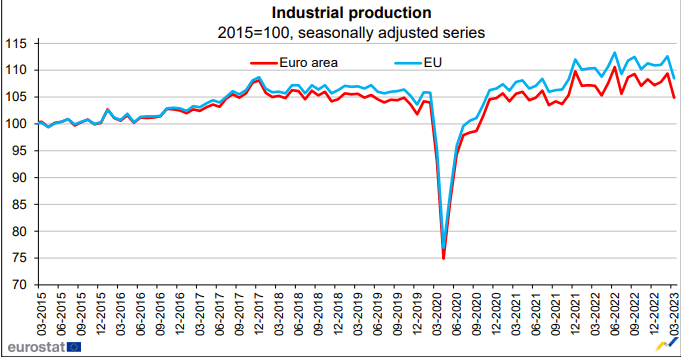

Eurozone industrial production showed a 4.1% drop MoM in March reaching its lowest level since October 2021. Part of the decline was attributable to a 50% production drop in Irish computer, electronics and optical products, a sector notorious for its volatility. Despite this however, the larger economies in the Eurozone experienced a slowdown as well with Germany experiencing a 3.1% MoM decline. As we continue to see demand concerns grip markets todays Eurozone data will do little to allay those fears as new orders continue to dwindle.

Source: Eurostat

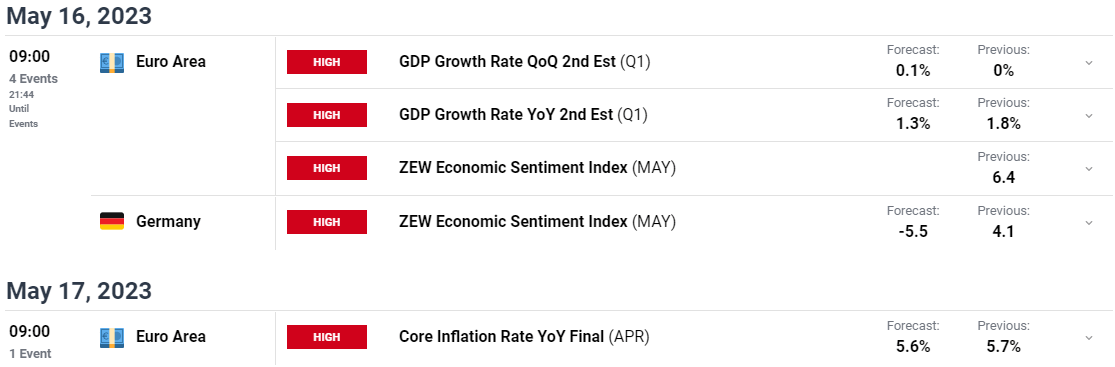

KEY ECONOMIC DATA AHEAD

We have had two blockbuster weeks from a risk event point of view and yet the Eurozone still has some key data releases ahead. Fed policymakers kick things off today before tomorrow brings GDP Growth Rate QoQ 2nd Estimate as well as ZEW Economic Sentiment Index and Current Conditions followed by the final inflation data for April on Wednesday.

For all market-moving economic releases and events, see the DailyFX Calendar

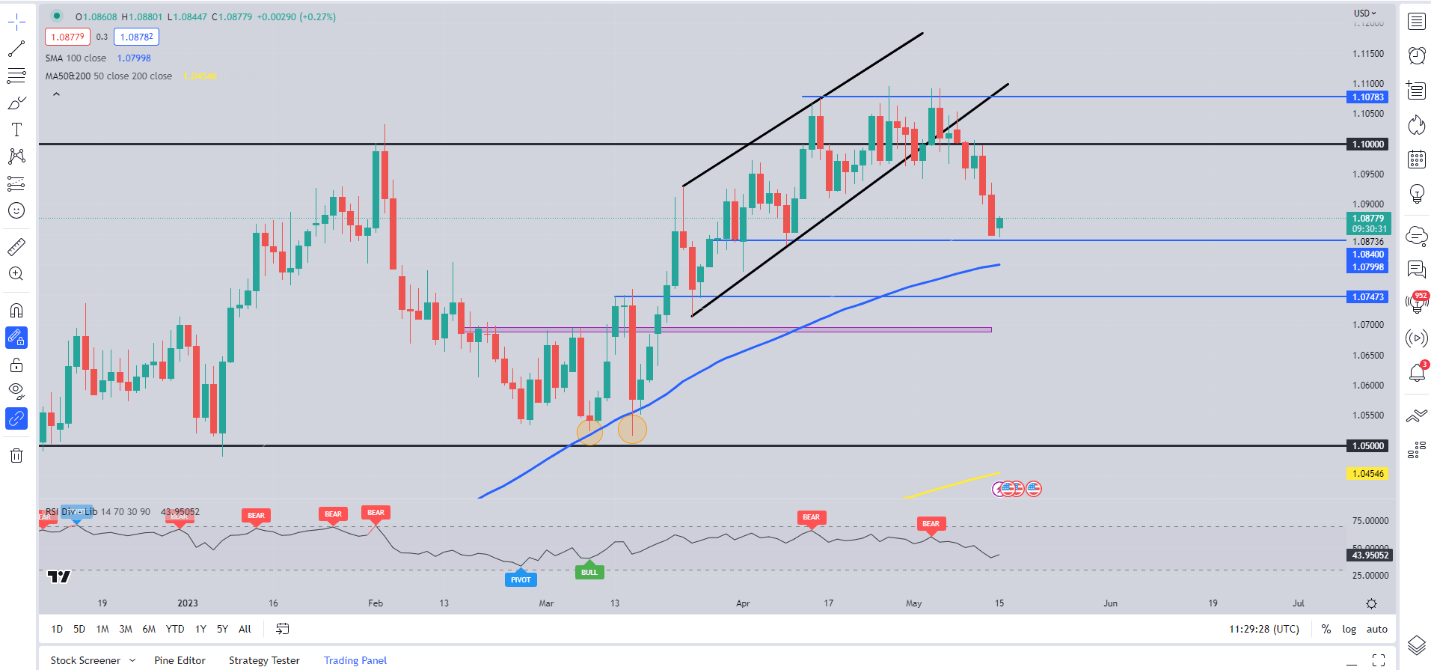

TECHNICAL OUTLOOK AND FINAL THOUGHTS

Looking at EURUSD and the long-term picture still favors further upside for the pair. With the differing paths expected by the ECB and the US Fed coupled with some strong technicals, any further downside on EURUSD is likely to be short lived.

From a technical perspective, EURUSD has broken the ascending channel which had been holding price since March 24. Downside risk remain in play at present with the overall picture for this week resting on the movements of the US Dollar. US President Joe Biden is expected to meet House Speaker Kevin McCarthy on Tuesday regarding the deb ceiling. Any key takeaways here and effects on the US dollar could be the key driving factor for EURUSD this week.

No clear decision on the US debt ceiling and we could see a push lower on EURUSD below the 1.0840 support area with the 100-day MA at around 1.0800 the first area of interest. A break below the 100-day MA and the 1.0750 level comes into focus. For now, intraday resistance rests around the 1.0940 mark with a retest likely t provide potential shorts with the best risk-to-reward opportunities.

EUR/USD Daily Chart – May 15, 2023

Source: TradingView

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.