EURUSD Bounces Back Above 1.09 Despite US Shoppers’ Vigor

EUR/USD Price, Chart, and Analysis

- EUR/USD powered back above the 1.09 mark having lost it in the previous session

- Chinese surprise rate cut and some stronger US retail numbers might have been expected to support the US Dollar a little more

- Eurozone growth figures are now in focus

Recommended by David Cottle

How to Trade EUR/USD

The Euro is back above the $1.09 handle in Tuesday’s European session, having slipped below that level on Monday for the first time since July.

The currency has admittedly been at the mercy of non-Eurozone factors with some heavyweight Asian economic data largely serving to support the ‘USD’ side of EUR/USD. The Peoples’ Bank of China sprang a surprise interest rate cut on the markets as one more piece of key economic data from that country missed forecasts; this time retail sales.

That cut saw the Yuan slide to nine-month lows against an already perky greenback. Meanwhile, Japan’s Gross Domestic Product growth surged way ahead of forecasts in the year’s second quarter, largely thanks to the Yen’s secular weakness which has boosted the appeal of Japanese exports around the world.

The only significant Eurozone numbers were Germany’s important ZEW sentiment survey. This revealed an improvement in confidence in August, albeit from a seven-month low in July, but firms’ assessment of current conditions remained extremely gloomy. Not much support for the Euro there.

US retail sales posted their biggest increase for six months in July, according to official figures, rising 0.7% on the month, well ahead of forecasts. The Euro actually ticked up after this release, with some of the implicit Dollar-supportive good news negated perhaps by the Empire manufacturing index out of New York State. It collapsed by a little over 20 points in August.

Learn How to Trade FX News

Recommended by David Cottle

Trading Forex News: The Strategy

The Euro has been struggling against the Dollar since July, helping to push the overall Dollar index up to highs not seen since May, but perhaps a little exhaustion is setting in among Dollar bulls.

The remainder of Tuesday’s session doesn’t offer much in the way of likely scheduled trading cues, with Wednesday’s release of Eurozone growth data likely to be the next one. GDP within the twenty-member currency bloc is expected to have risen by 0.3% over the second quarter, for a very tepid annualized rise of 0.6%. The Euro could be in trouble if these expectations are met, or missed as that outcome would crystalize expectations that the European Central Bank won’t be raising interest rates much further.

Still, the Euro is well into the green for the day against the Dollar, but some caution is probably warranted given the absence of many major European markets for the Assumption Day public holiday, and the fact the US Treasury yields remain close to their highs for this year.

EUR/USD Technical Analysis

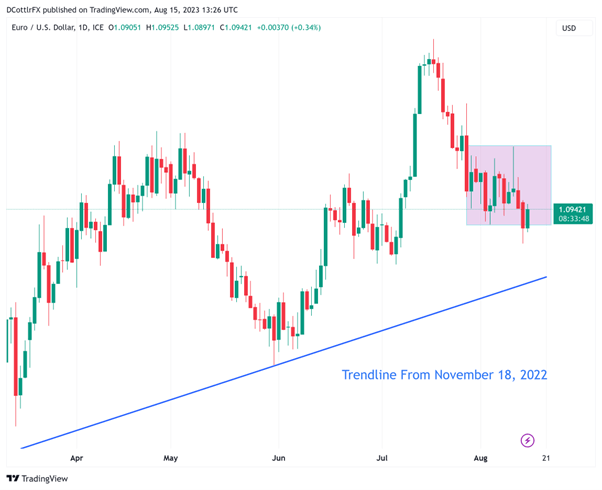

EUR/USD Daily Chart Compiled Using TradingView

EUR/USD has traded briskly back into the broad daily-chart trading band in place since July 31. It briefly slipped below that level on Monday but the psychological support level of 1.09 is proving a tough one for Euro-bears to get through.

The range offers support just above that level at 1.09116, August 3’s intraday low. For as long as that hold, Euro bulls will try to recapture resistance in the 1.10219 region where the market topped out in early August. They’ll need to rebuild a platform there if they’re going to try for the year’s highs.

However, a retest of this week’s lows looks more likely in the near term, with July 6’s low of 1.08282 lying in wait should they give way again. Below that lies important trendline support from mid-November last year which comes in at 1.0800.

Download the Full EUR/USD Sentiment Report Below

| Change in | Longs | Shorts | OI |

| Daily | 0% | 10% | 5% |

| Weekly | -14% | 1% | -7% |

Sentiment toward EUR/USD is quite bullish according to IG’s own gauge. At current levels 71% of respondents are net long. Of course, that very dominance may suggest that a bearish rethink could be in the cards, but EUR bears will need to keep the currency below its current trading range if they’re going to successfully press their case.

–By David Cottle for DailyFX

Comments are closed.