Euro surrenders gains as Dollar picks up pace

- Euro gives away part of Friday’s gains vs. the US Dollar.

- Stocks in Europe advance on a firmer foot.

- EUR/USD's upside falters around the 1.0970/75 band so far.

- EMU Investor Confidence surprised to the downside in July.

- Fedspeak will grab all the attention later in the session.

After the release of the June Nonfarm Payrolls, the Euro (EUR) faced some selling pressure, causing EUR/USD to retreat towards 1.0950/40 at the beginning of the week.

On this, the June employment figures catered to various interests. Individuals focused on growth would emphasize the lowest monthly job gain in 30 months (209K) and the downward adjustment of 110K for the previous two months. On the other hand, those optimistic about the resilient economy would highlight the strong hiring indicated by the household survey, a decrease in the unemployment rate, and notable growth in wages. Considering all factors, the report likely favours a 25 basis points increase in July.

Meanwhile, the US dollar (USD) is attempting a bounce after Friday's drop to 2-week lows in the 102.20 zone, as measured by the USD Index (DXY). This is occurring against the backdrop of further weakness in yields in the short end of the curve and extra gains in the belly and the long end.

The potential future actions of the Federal Reserve and the European Central Bank (ECB) in normalizing their monetary policies continue to be a topic of discussion, especially with increasing concerns about an economic slowdown on both sides of the Atlantic.

The recent robust results from key US fundamentals have reinforced the likelihood of a 25 basis point rate hike by the Fed at its July meeting. These results have continued to show a resilient US economy and a tight labour market.

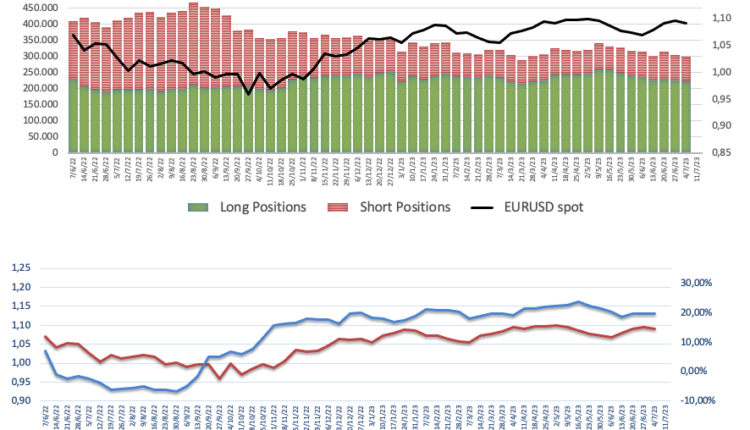

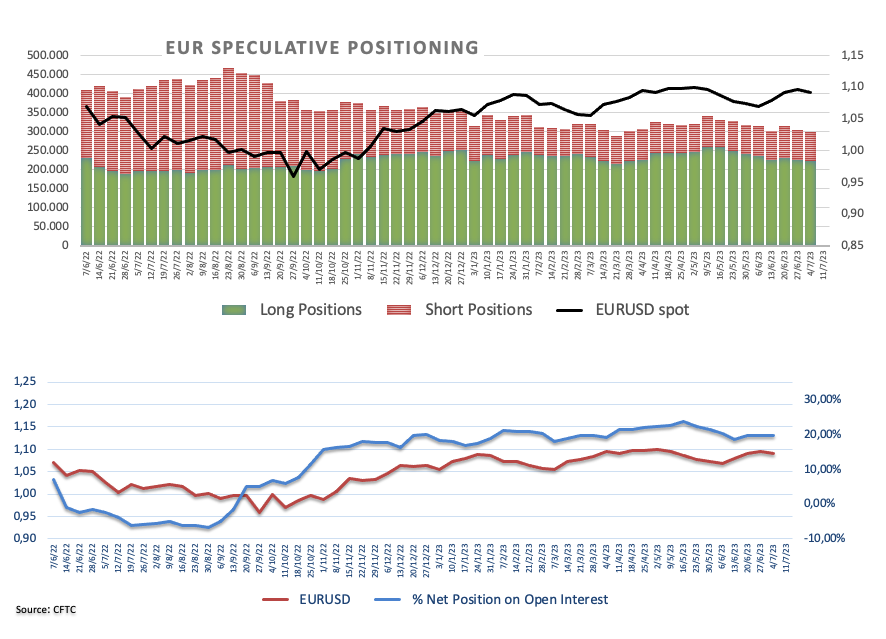

On another front, data from the CFTC Positioning report for the week ended on July 3 saw the speculative community trimming their EUR net longs to levels last seen in mid-March near 143K contracts, as the single currency continued to correct lower from peaks past the key 1.1000 the figure (June 22).

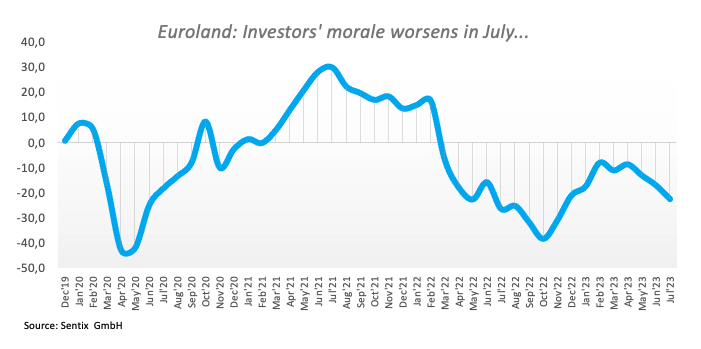

In the euro docket, Investor Confidence tracked by the Sentix Index in the euro area weakened to -22.5 in Jul in what was the sole release at the beginning of the week.

Across the ocean, Wholesale Inventories is only due along with speeches from FOMC Michael Barr (permanent voter, centrist), San Francisco Fed Mary Daly (2024 voter, hawk), Cleveland Fed Loretta Mester (2024 voter, hawk), and Atlanta Fed Raphael Bostic (2024 voter, hawk).

Daily digest market movers: Euro meets a new hurdle around 1.0970

- The EUR keeps the offered bias in place so far on Monday.

- The EMU Sentix Index deteriorated further in July.

- Chinese inflation figures came in short of estimates in June.

- Bets for a 25 bps rate hike by the Fed, ECB in July remain steady.

- Fed speakers will take centre stage later on Monday.

Technical Analysis: Euro needs to rapidly clear 1.1012

The ongoing price action shows EUR/USD facing decent resistance around the 1.0970 region, or July peaks.

That said, the continuation of the uptrend should rapidly clear the July top at 1.0973 (July 7) prior to the psychological 1.1000 hurdle. North from here emerges the June peak of 1.1012 (June 22) ahead of the 2023 high of 1.1095 (April 26), which is closely followed by the round level of 1.1100. Further up comes the weekly top of 1.1184 (March 31, 2022), which is supported by the 200-week SMA at 1.1180, just before another round level at 1.1200.

On the downside, the loss of the interim 55-day SMA at 1.0871 could spark further losses to, initially, the weekly low at 1.0833 (July 6), which appears reinforced by the provisional 100-day SMA. The breakdown of this region should meet the next contention area not before the May low of 1.0635 (May 31) ahead of the crucial 200-day SMA at 1.0624, which is followed by the March low of 1.0516 (March 15) and the 2023 low of 1.0481 (January 6).

Looking at the broader picture, the constructive view of EUR/USD appears unchanged as long as the pair trades above the key 200-day SMA.

German economy FAQs

The German economy has a significant impact on the Euro due to its status as the largest economy within the Eurozone. Germany's economic performance, its GDP, employment, and inflation, can greatly influence the overall stability and confidence in the Euro. As Germany's economy strengthens, it can bolster the Euro's value, while the opposite is true if it weakens. Overall, the German economy plays a crucial role in shaping the Euro's strength and perception in global markets.

Germany is the largest economy in the Eurozone and therefore an influential actor in the region. During the Eurozone sovereign debt crisis in 2009-12, Germany was pivotal in setting up various stability funds to bail out debtor countries. It took a leadership role in the implementation of the ‘Fiscal Compact' following the crisis – a set of more stringent rules to manage member states’ finances and punish ‘debt sinners’. Germany spearheaded a culture of ‘Financial Stability’ and the German economic model has been widely used as a blueprint for economic growth by fellow Eurozone members.

Bunds are bonds issued by the German government. Like all bonds they pay holders a regular interest payment, or coupon, followed by the full value of the loan, or principal, at maturity. Because Germany has the largest economy in the Eurozone, Bunds are used as a benchmark for other European government bonds. Long-term Bunds are viewed as a solid, risk-free investment as they are backed by the full faith and credit of the German nation. For this reason they are treated as a safe-haven by investors – gaining in value in times of crisis, whilst falling during periods of prosperity.

German Bund Yields measure the annual return an investor can expect from holding German government bonds, or Bunds. Like other bonds, Bunds pay holders interest at regular intervals, called the ‘coupon’, followed by the full value of the bond at maturity. Whilst the coupon is fixed, the Yield varies as it takes into account changes in the bond's price, and it is therefore considered a more accurate reflection of return. A decline in the bund's price raises the coupon as a percentage of the loan, resulting in a higher Yield and vice versa for a rise. This explains why Bund Yields move inversely to prices.

The Bundesbank is the central bank of Germany. It plays a key role in implementing monetary policy within Germany, and central banks in the region more broadly. Its goal is price stability, or keeping inflation low and predictable. It is responsible for ensuring the smooth operation of payment systems in Germany and participates in the oversight of financial institutions. The Bundesbank has a reputation for being conservative, prioritizing the fight against inflation over economic growth. It has been influential in the setup and policy of the European Central Bank (ECB).

Comments are closed.