EURO STOXX 50 Technical Outlook: Rally to Stall?

EURO STOXX 50 Index, SX5E – Technical Outlook:

- Breadth market data and charts suggests that the index has scope to rise further.

- However, the index’s rally is showing signs of fatigue in the near term.

- What is the outlook and what are the key levels to watch?

Recommended by Manish Jaradi

How to Trade the “One Glance” Indicator, Ichimoku

EURO STOXX 50 INDEX TECHNICAL FORECAST – BULLISH

Breadth market indicators and technical charts suggest that the Euro Stoxx 50 index could have some more upside, albeit after a brief pause.

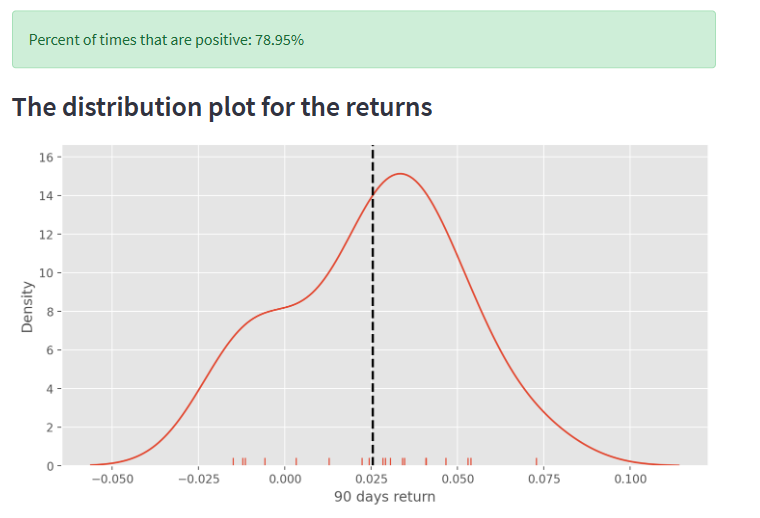

Since the start of this month, about 90%-94% of the members in the Euro Stoxx 50 index have been at their respective 200-day moving averages. Data from 2002 shows that when 90%-94% of index constituents have been above the long-term moving average, the index has been up 79% of the time over the subsequent 90 days (see distribution plot).

Source Data: Bloomberg; Chart Created by Manish Jaradi Using Python. Note: The study is done with a minimum 5-month gap between two readings above 90%.

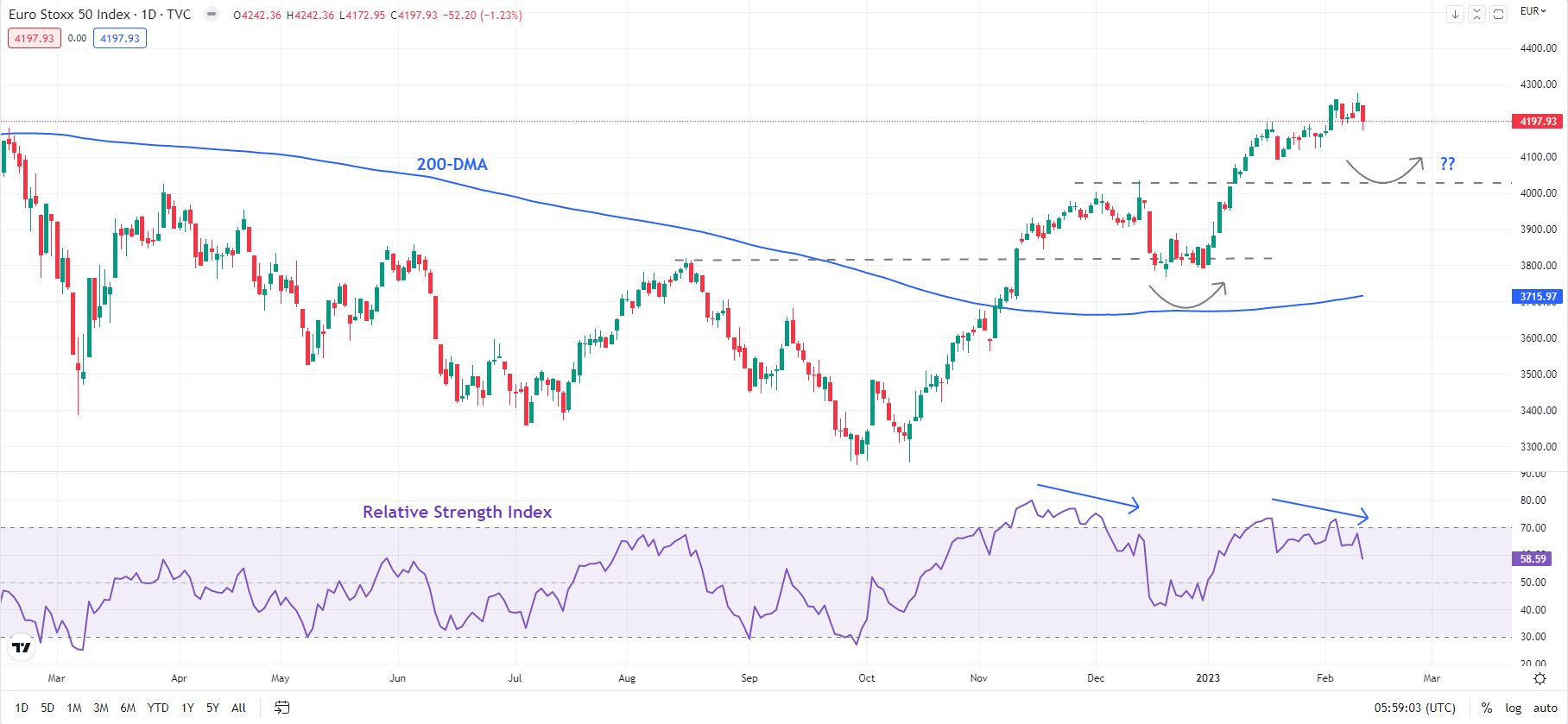

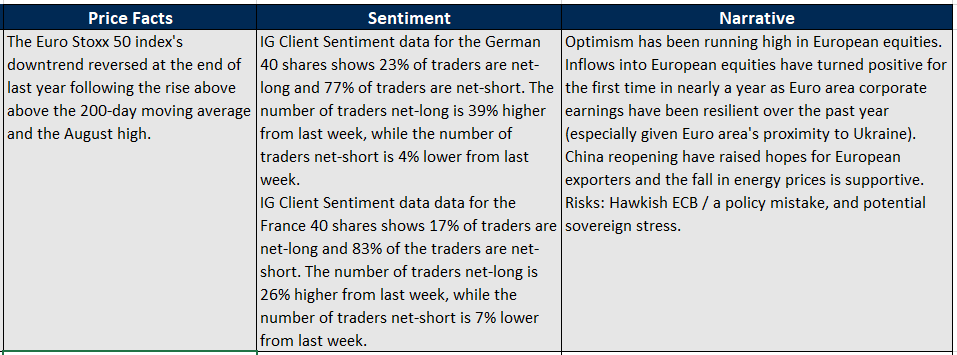

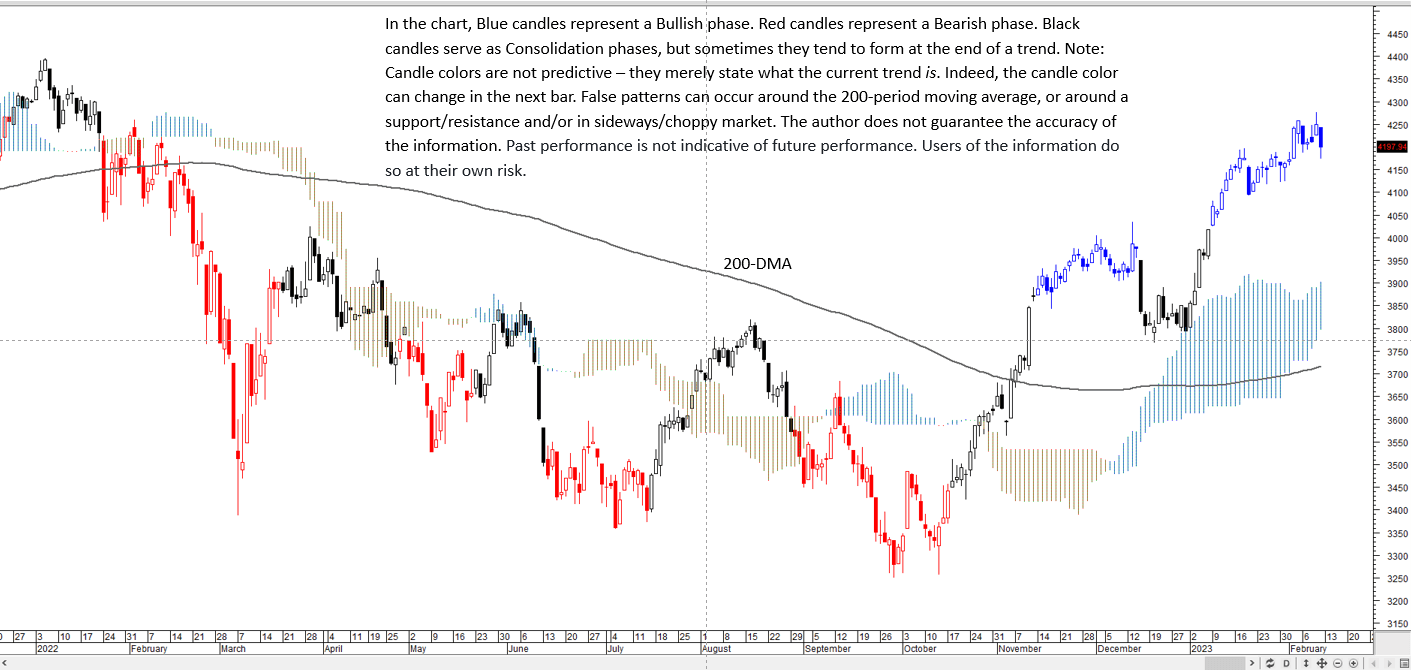

On technical charts, the index’s break toward the end of last year above a tough ceiling on the 200-day moving average and the August high of 3819 confirmed that the 2022’s downtrend has reversed. The higher-top-higher-bottom formation since the break indicates that the trend is up.

Euro Stoxx 50 Index Daily Chart

Chart Created by Manish Jaradi Using Metastock

However, a negative momentum (as measured by the 14-day Relative Strength Index) divergence on the daily chart suggests that the rally is losing steam. A bearish divergence occurs when rising index levels are associated with declining/flattening momentum readings. A pause/minor retreat can’t be ruled out in the short term.

Euro Stoxx 50 Index Daily Chart

Chart Created by Manish Jaradi Using TradingView

On the downside, there is immediate support at the January low of 4093, followed by stronger support at the December highs of 4000-4035. The brief retreat in November-December was associated with a similar divergence and followed by a rebound from resistance-turned-support at the August high. Only a break below 4000-4035 would indicate that the upward pressure had faded in the interim.

— Written by Manish Jaradi, Strategist for DailyFX.com

Comments are closed.