Euro remains on the defensive despite hawkish ECB-speak

- The Euro extends the beraish note into the European midday.

- Stocks in Europe accelerate the daily recovery.

- EUR/USD hovers around the 1.095/60 band amidst risk-off mood.

- Germany’s Consumer Confidence worsens in July.

- Investors will closely follow events from the ECB Forum.

The recent two-day advance of the Euro (EUR) was somewhat limited due to renewed buying interest in the US Dollar (USD), leading to a partial retracement of the weekly gains for EUR/USD. As a result, the pair revisited the 1.0930 region early in the morning on Wednesday, where some initial contention appears to have turned up.

The positive performance of the Greenback also provided some relief to the USD Index (DXY), which had experienced negative performance earlier in the week. That said, the index keeps hovering around the interim 55-day SMA near 102.60.

The current knee-jerk in the pair is also accompanied by the lack of a clear direction in both the US and German bond markets. This uncertainty occurs amidst expectations of a quarter-point interest rate hike by both the European Central Bank (ECB) and the Federal Reserve (Fed) at their respective meetings in July.

Moving forward, the potential future actions of the Fed and the ECB in normalizing their monetary policies remain a topic of ongoing debate. This discussion takes place against the backdrop of increasing speculation about an economic slowdown on both sides of the Atlantic.

Regarding monetary policy, a notable event on Wednesday will be a Policy Discussion Panel at the ECB Forum on Central Banking in Sintra, Portugal. The panel will feature Chief Jerome Powell and ECB President Christine Lagarde, participating in the European afternoon.

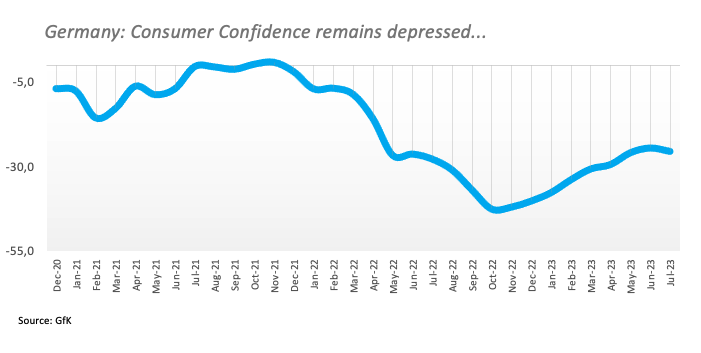

In terms of data, consumer confidence in Germany, as measured by GfK, weakened to -25.4 for the month of July. In Italy, preliminary inflation figures see the CPI rising 6.4% YoY in June, coming in short of expectations and lower than May's 7.6% yearly advance.

Across the Atlantic, the usual weekly Mortgage Applications tracked by the Mortgage Bankers Association (MBA) will be released, followed by preliminary figures for the Goods Trade Balance.

Daily digest market movers: Euro remains focused on the ECB Forum

- The EUR runs out of steam on USD recovery.

- Germany’s Consumer Confidence disappoints expectations in July.

- ECB Lagarde-Fed Powell will take centre stage later on Wednesday.

- ECB’s Vice-President Luis De Guindos favours a rate hike in July.

- ECB’s Boris Vujcic leaves the door open to a September hike.

- Board member Bostjan Vasle advocated for further tightening.

Technical Analysis: Euro faces immediate hurdle at the June high

EUR/USD appears under pressure and should the selling bias gather impulse it could face initial support at the transitory 55-day SMA at 1.0883. The loss of this level exposes a deeper pullback to the June low at 1.0844 (June 23) ahead of the provisional 100-day SMA at 1.0814. South from here emerges the May low of 1.0635 (May 31) prior to the March low of 1.0516 (March 15) and the 2023 low of 1.0481 (January 6).

If bulls regains the upper hand, the next hurdle is then expected at the June peak of 1.1012 (June 22) prior to the 2023 high of 1.1095 (April 26), which is closely followed by the round level of 1.1100. North from here emerges the weekly top of 1.1184 (March 31, 2022), which is supported by the 200-week SMA at 1.1181, just before another round level at 1.1200.

The constructive view of EUR/USD appears unchanged as long as the pair trades above the crucial 200-day SMA, today at 1.0578.

ECB FAQs

What is the ECB and how does it influence the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region.

The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

What is Quantitative Easing (QE) and how does it affect the Euro?

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro.

QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

What is Quantitative tightening (QT) and how does it affect the Euro?

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Comments are closed.