Euro remains offered well south of 1.0900 ahead of US PCE

- The Euro fades most of Wednesday's advance vs. the US Dollar.

- The upside bias in European stocks runs out of steam.

- EUR/USD revisits the 1.0860 region amidst USD recovery.

- The USD Index (DXY) rebounds markedly and revisits 103.50.

- US, German yields trade slightly on the defensive.

- Germany’s labour market report came in mixed in August.

- Flash CPI in France rose 1.0% MoM and 4.8% YoY in August.

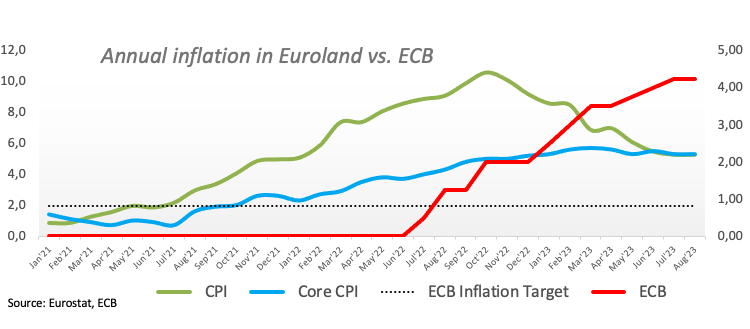

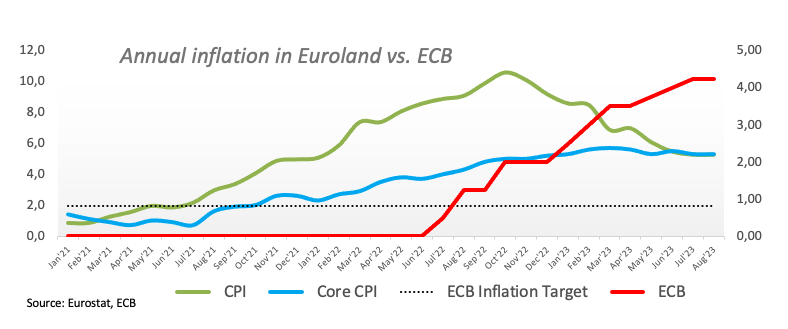

- EMU advanced figures showed inflation remained sticky in August.

The selling pressure around the Euro (EUR) remains well and sound against the US Dollar (USD), forcing EUR/USD to break below the key 1.0900 figure and revisit the vicinity of the 1.0860 zone on Thursday.

In the meantime, the Greenback recovers, prompting the USD Index (DXY) to bounce off Wednesday’s two-week lows in the 103.00 neighbourhood and challenge the 103.50 region. Furthermore, US yields are declining across the curve, as investors’ reprice a pause in the Fed’s normalization process for the next few months.

In the meantime, the narrative surrounding the Federal Reserve’s (Fed) tighter-for-longer stance appears to have dwindled following the recent weaker-than-expected economic data.

By contrast, there is no news around the European Central Bank (ECB) regarding its potential decision on rates once the summer season is over.

In the domestic calendar, Retail Sales in Germany contracted 0.8% MoM in July and 2.2% over the last twelve months. Still in Germany, the Unemployment Change increased by 18K individuals in August and the Unemployment Rate ticked higher to 5.7%. Looking at the broader euro area, advanced inflation figures saw the headline CPI rise 5.3% YoY and 5.3% YoY when it comes to the Core CPI. Later in the session, the ECB will publish its Accounts for the July 27 meeting.

In the US docket, all the attention will be on the release of inflation tracked by the PCE and Core PCE for August, seconded by usual Initial Jobless Claims, Personal Income, Personal Spending and the speech by Boston Fed Chair Susan Collins.

Daily digest market movers: Euro risks a deeper knee-jerk

- The EUR surrenders part of the recent strong advance against the USD.

- Fundamentals in Germany continue to deteriorate amidst stagflation talks.

- Investors see the Fed keeping rates on hold in the next few months.

- BoE’s Huw Pill said the country is facing second-round effects from inflation.

- Investors see the Fed on hold for the remainder of the year.

- ECB's Isabel Schnabel said there is uncertainty around the peak rate.

- ECB's Robert Holzmann advocated for 1-2 extra rate hikes.

- Further stimulus measures are likely to be taken by the PBoC in the near term.

- BoJ’s Toyoaki Nakamura said economic recovery is needed to end the loose policy.

- The focus now shifts to US PCE, weekly Claims.

Technical Analysis: Euro could slip back to the 1.0800 zone

The three-day rebound in EUR/USD seems to have met quite a decent obstacle ahead of the 1.0950 region.

In case bulls regain the upper hand and EUR/USD surpasses the weekly top of 1.0945, the pair is expected to meet the provisional 55-day Simple Moving Average (SMA) at 1.0967 prior to the psychological 1.1000 barrier and the August top at 1.1064 (August 10). Once the latter is cleared, spot could challenge the July 27 peak at 1.1149. If the pair surpasses this region, it could alleviate some of the downward pressure and potentially visit the 2023 peak of 1.1275 seen on July 18. Further up comes the 2022 high at 1.1495, which is closely followed by the round level of 1.1500.

The resumption of the downward bias could motivate the pair to initially test the key 200-day SMA at 1.0813 ahead of the August low of 1.0765 (August 25). The breach of the latter exposes the May 31 low of 1.0635 prior to the March 15 low of 1.0516 and the 2023 low at 1.0481 seen on January 6.

Furthermore, sustained losses are likely in EUR/USD once the 200-day SMA is breached in a convincing fashion.

German economy FAQs

The German economy has a significant impact on the Euro due to its status as the largest economy within the Eurozone. Germany's economic performance, its GDP, employment, and inflation, can greatly influence the overall stability and confidence in the Euro. As Germany's economy strengthens, it can bolster the Euro's value, while the opposite is true if it weakens. Overall, the German economy plays a crucial role in shaping the Euro's strength and perception in global markets.

Germany is the largest economy in the Eurozone and therefore an influential actor in the region. During the Eurozone sovereign debt crisis in 2009-12, Germany was pivotal in setting up various stability funds to bail out debtor countries. It took a leadership role in the implementation of the ‘Fiscal Compact' following the crisis – a set of more stringent rules to manage member states’ finances and punish ‘debt sinners’. Germany spearheaded a culture of ‘Financial Stability’ and the German economic model has been widely used as a blueprint for economic growth by fellow Eurozone members.

Bunds are bonds issued by the German government. Like all bonds they pay holders a regular interest payment, or coupon, followed by the full value of the loan, or principal, at maturity. Because Germany has the largest economy in the Eurozone, Bunds are used as a benchmark for other European government bonds. Long-term Bunds are viewed as a solid, risk-free investment as they are backed by the full faith and credit of the German nation. For this reason they are treated as a safe-haven by investors – gaining in value in times of crisis, whilst falling during periods of prosperity.

German Bund Yields measure the annual return an investor can expect from holding German government bonds, or Bunds. Like other bonds, Bunds pay holders interest at regular intervals, called the ‘coupon’, followed by the full value of the bond at maturity. Whilst the coupon is fixed, the Yield varies as it takes into account changes in the bond's price, and it is therefore considered a more accurate reflection of return. A decline in the bund's price raises the coupon as a percentage of the loan, resulting in a higher Yield and vice versa for a rise. This explains why Bund Yields move inversely to prices.

The Bundesbank is the central bank of Germany. It plays a key role in implementing monetary policy within Germany, and central banks in the region more broadly. Its goal is price stability, or keeping inflation low and predictable. It is responsible for ensuring the smooth operation of payment systems in Germany and participates in the oversight of financial institutions. The Bundesbank has a reputation for being conservative, prioritizing the fight against inflation over economic growth. It has been influential in the setup and policy of the European Central Bank (ECB).

Comments are closed.