Euro on Offer as German Industrial Production Contracts

EUR/USD ANALYSIS

- USD rebounds.

- German industrial production withers by 1.5%.

- Fed speakers under the spotlight later today.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

After Friday’s rally post-NFP, the euro lost some of its gains as the US dollar regained some support and European growth comes into question once again. The initial kneejerk reaction to the US labor data has been quelled due to the decline in unemployment and increase in average hourly earnings (key contributor to inflation) that could keep central banks on their toes.

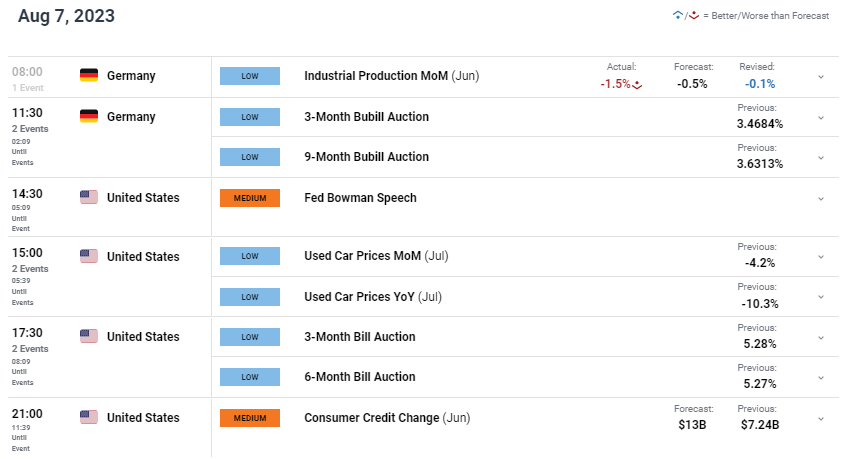

German industrial production (see economic calendar below) fell once again but this time missing estimates by 1%, exacerbating concerns around the largest economic contributor to the eurozone. Major contributors to the negative print stemmed from the automotive industry (-3.5%) and the construction sector (-2.5%).

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

Later today, the focus will be on US centric factors including Fed speak (Bowman and Bostic) who were previously conflicted in their outlooks. It will be interesting to see whether or not there is any change since then

The week ahead is relatively but does include German CPI, US CPI, US PPI and Michigan consumer sentiment data with attention firmly on US CPI that could provide some short-term volatility. In summary, a rather quiet week expected for EUR/USD that could leave the pair lingering around the 1.1000 psychological handle.

EUR/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

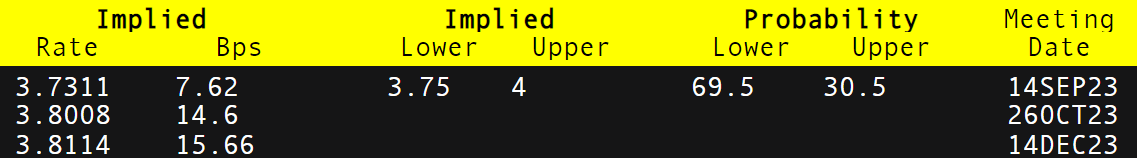

At present, money markets (refer to table below) price in roughly 15bps of additional interest rate hikes by the European Central Bank (ECB) and with dwindling eurozone economic data, ECB pricing and guidance has been ‘dovishly’ repriced.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

EUROPEAN CENTRAL BANK INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

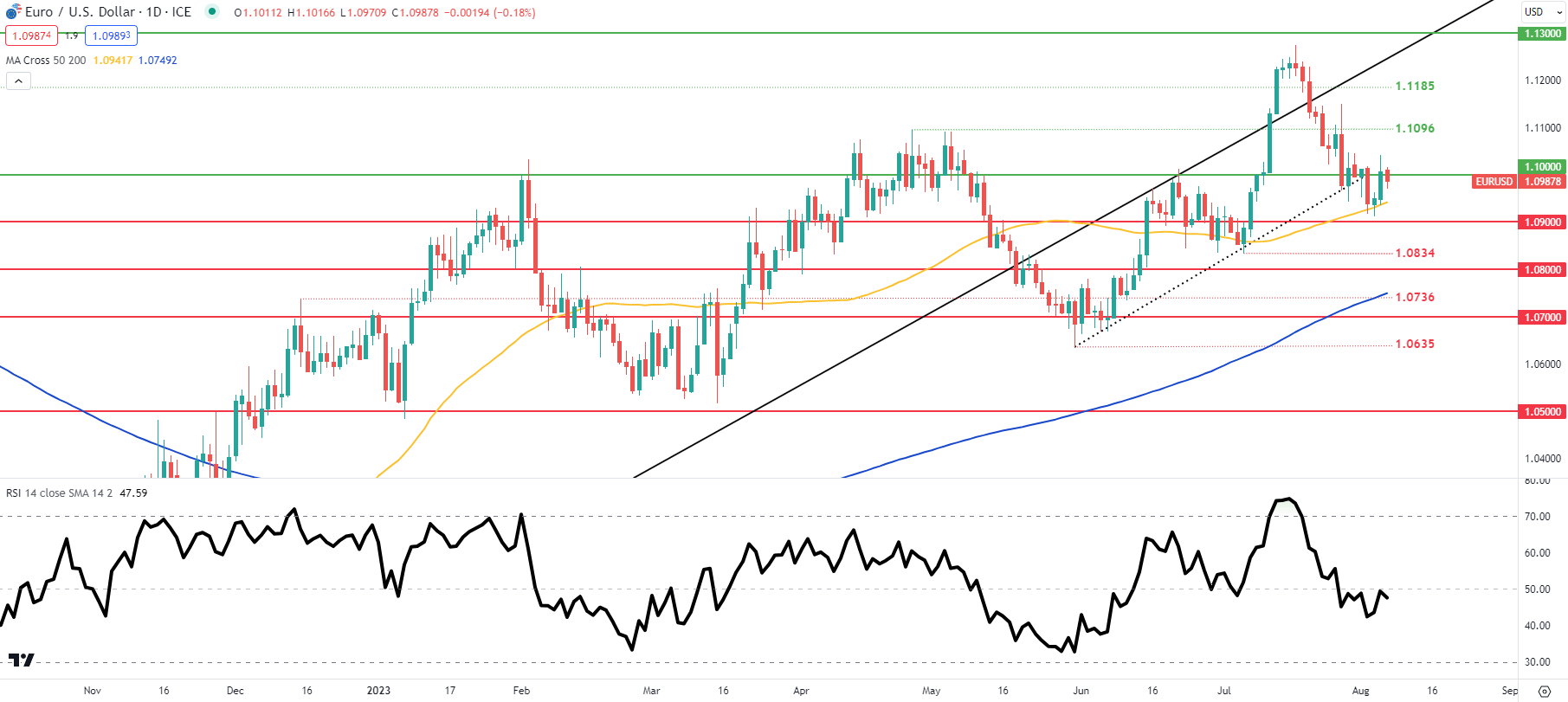

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily EUR/USD price action shows uncertainty from market participants as the Relative Strength Index (RSI) remains around its midpoint favoring neither bullish nor bearish momentum. Fundamental catalysts will be the primary drivers for the pair this week but I do not expect significant fluctuations from scheduled data.

Resistance levels:

Support levels:

- 50-day moving average (yellow)

- 1.0900

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently neither NET LONG NOR NET SHORT on EUR/USD, with 50% of traders currently holding both long & short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term cautious bias.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.