Euro now targets the 2022 highs near 1.1500

- Euro trades within a tight range vs. the US Dollar.

- Stocks in Europe maintain the mixed tone on Friday.

- EUR/USD treads water around 1.1240/45 amidst the monthly rally.

- EMU Balance of Trade showed a €0.3B deficit in May.

- Flash US Consumer Sentiment takes centre stage across the pond.

The Euro (EUR) seems to have met some initial resistance around the 1.1240 region vs. the US Dollar (USD) so far on Friday.

In fact, after reaching new highs in the 1.1240/45 band earlier in the Asian trading hours, EUR/USD now seems to have taken a breather amidst a marginal recovery attempt in the Greenback.

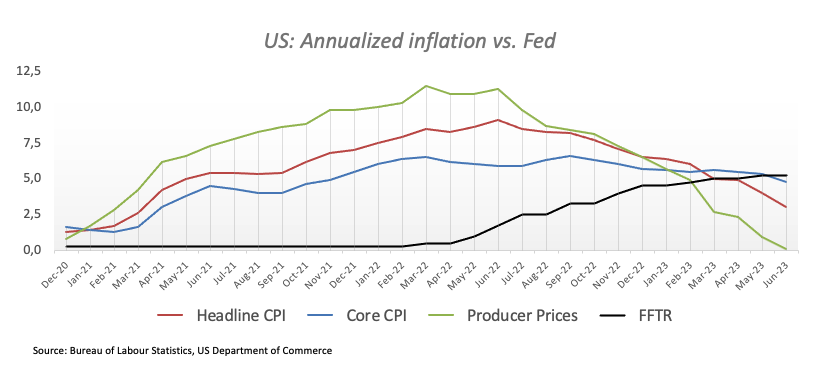

Despite the so-far lacklustre bounce, the US Dollar remains under heavy pressure as investors continue to anticipate the likelihood that the Federal Reserve might be nearing the end of its tightening campaign. This view has been reinforced as of late on the back of further signs of cooling US consumer prices as well as the persistent downtrend in producer prices.

In the meantime, comments by the FOMC’s Governor Christopher Waller late on Thursday fell in line with the persevering hawkish narrative from his colleagues at the Committee after he suggested that the Fed might need two more rate hikes this year.

The strong upside impulse in the pair has been reinvigorated in response to lower-than-expected US inflation figures for the month of June, which, firstly, confirm that disinflationary forces remain well in place in the US economy and, secondly, underpin expectations that the Federal Reserve might end its ongoing hiking campaign sooner rather than later.

So far, market participants have already largely priced in a quarter-point rate hike by both the European Central Bank (ECB) and the Fed at their meetings later in the month, in a context where the potential future actions of the Fed and the ECB in normalizing their monetary policies continue to be a topic of discussion, especially with increasing concerns about an economic slowdown on both sides of the Atlantic.

In the domestic calendar, the euro area printed a €0.3B deficit in May in what was the sole publication in the old continent at the end of the week. In the US docket, all the attention is expected to be on the preliminary readings of the Michigan Consumer Sentiment for the current month.

Daily digest market movers: Euro keeps the trade north of 1.1200 amidst low volatility

- The EUR maintains the trade near 1.1250 vs. USD on Friday.

- Fed’s Waller favoured two more rate hikes by the Fed this year.

- The USD Index drops to new 15-month lows near 99.60.

- The Fed and the ECB are seen hiking rates by 25 bps this month.

- Oil, Gold retreats modestly during the European morning.

Technical Analysis: Euro risks a technical correction due to overbought conditions

The ongoing price action in EUR/USD hints at the idea that further gains might be in store in the short-term horizon. However, the current pair’s overbought condition (as per the daily RSI well above 70) opens the door to a potential near-term corrective move.

The pair printed a new 2023 high at 1.1243 on July 14. Once this level is cleared, there are no resistance levels of significance until the 2022 peak of 1.1495 recorded on February 10.

On the downside, the 1.1000 region emerges as a psychological support seconded by interim contention at the 55-day and 100-day SMAs at 1.0881 and 1.0852, respectively, ahead of the July low of 1.0833 (July 6) . The breakdown of this region should meet the next contention area not before the May low of 1.0635 (May 31), which also looks underpinned by the crucial 200-day SMA (1.0651). South from here emerges the March low of 1.0516 (March 15) prior to the 2023 low of 1.0481 (January 6).

Furthermore, the constructive view of EUR/USD appears unchanged as long as the pair trades above the key 200-day SMA.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%.

If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank.

If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure.

Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Comments are closed.