Euro looks for direction, still below 1.0900 ahead of ECB

- Euro extends the daily consolidation near the 1.0900 hurdle.

- Stocks in Europe remain on the defensive so far on Monday.

- EUR/USD hovers around the 1.0900 neighbourhood amidst a flattish mood.

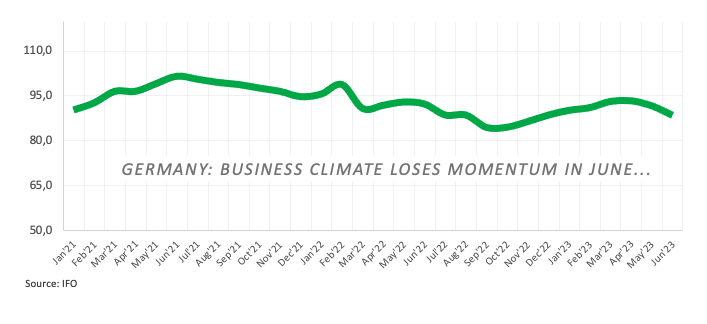

- Germany’s Business Climate misses estimates in June.

- Markets’ attention now shifts to the ECB Forum in Portugal.

After two consecutive daily retracements, the Euro (EUR) has regained some stability and rebounded from last week's lows near 1.0840 against the US Dollar, with its initial target being the key 1.0900 level. This so far inconclusive start to the week for EUR/USD is in line with the equally range bound theme surrounding the Greenback, which has caused the USD Index (DXY) to retreat from its multi-day highs above 103.00 seen towards the end of last week.

Market participants are expected to closely monitor the annual ECB Forum on Central Banking in Sintra, Portugal, as well as a series of speeches by ECB officials, including President Christine Lagarde.

Regarding the ECB, investors are still anticipating another 25 bps rate hike in July, while the Federal Reserve is widely expected to follow suit, according to recent comments and testimony by Chair Jerome Powell.

On the broader macroeconomic front, the potential next steps by both the Federal Reserve and the European Central Bank in normalizing their monetary policies are the subject of ongoing debate, against the backdrop of increasing speculation of an economic slowdown on both sides of the Atlantic.

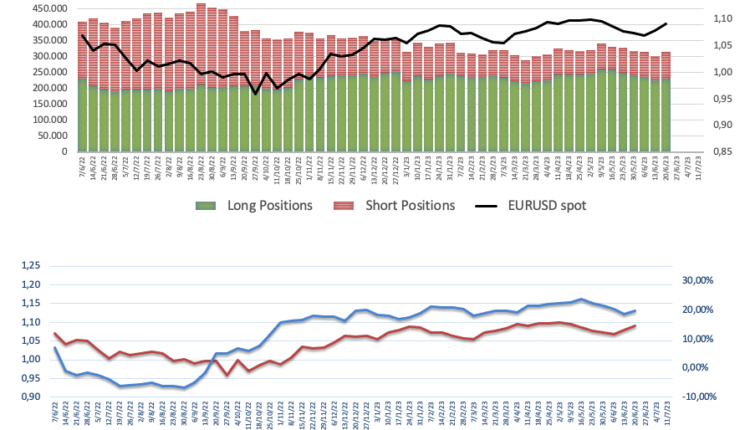

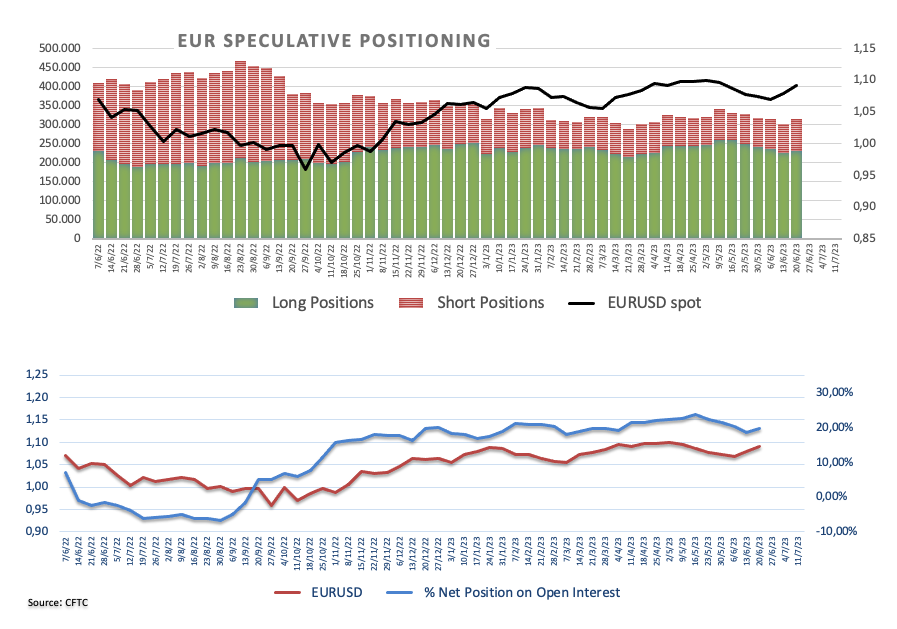

From the latest CFTC Positioning Report, speculators trimmed their net long exposure in EUR to levels last seen in early April around 144.6K contracts in the week leading to June 20, a period including the 25 rate hike by the ECB at its gathering on June 15.

In terms of data, the IFO Institute reported that the Business Climate in Germany fell to 88.4 in June from 91.7.

Across the Atlantic, the only scheduled release will be the Dallas Fed Manufacturing Index for June.

Daily digest market movers: The FX universe appears stuck in a range

- The EUR and the rest of the risk complex appears sidelined.

- Germany’s Business Climate came in short of expectations in June.

- ECB Lagarde and other policymakers speak in Sintra this week.

- Investors will closely follow any hints regarding the ECB next steps.

- US, German yields extend the decline at the beginning of the week.

Technical Analysis: Euro faces initial support near 1.0840

EUR/USD remains under pressure, and the breakdown of the June low at 1.0844 (June 23) could open the door to a probable test of the interim 100-day SMA at 1.0809. The loss of the latter exposes a deeper pullback to the May low of 1.0635 (May 31) ahead of the March low of 1.0516 (March 15) and the 2023 low of 1.0481 (January 6).

If bulls regains the upper hand, the next hurdle is then expected at the June peak of 1.1012 (June 22) prior to the 2023 high of 1.1095 (April 26), which is closely followed by the round level of 1.1100. North from here emerges the weekly top of 1.1184 (March 31, 2022), which is supported by the 200-week SMA at 1.1181, just before another round level at 1.1200.

The constructive view of EUR/USD appears unchanged as long as the pair trades above the crucial 200-day SMA, today at 1.0567.

ECB FAQs

What is the ECB and how does it influence the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region.

The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

What is Quantitative Easing (QE) and how does it affect the Euro?

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro.

QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

What is Quantitative tightening (QT) and how does it affect the Euro?

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Comments are closed.