Euro keeps the selling bias intact around the 1.0620 zone

- The Euro appears offered against the US Dollar near 1.0620, while the DXY USD Index flirts with 106.00.

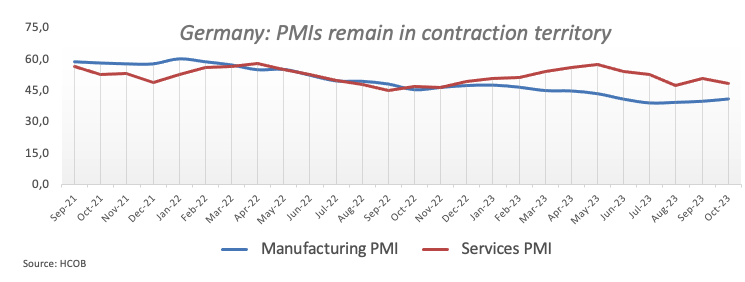

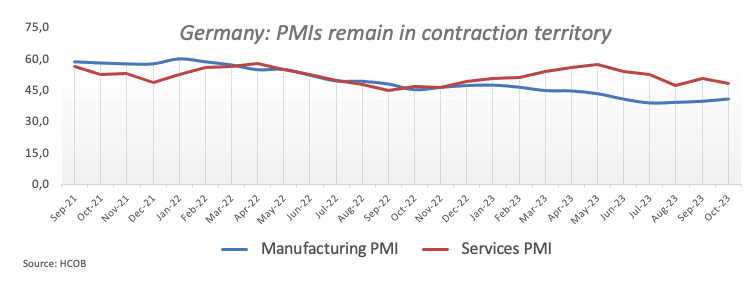

- Consumer Confidence in Germany is set to worsen in November, while German and Eurozone PMIs remained in contraction.

- Manufacturing and Services PMIs are also due in the US later in the session.

The sellling pressure in the Euro (EUR) is gathering extra steam against the US Dollar (USD) after the publication of subdued Purchasing Managers Index (PMI) data for the Eurozone and Germany, resulting in EUR/USD retreating to the 1.0620 zone after earlier tops in levels just shy of 1.0700 on Tuesday.

The Greenback, on the flip side, is managing to regain some equilibrium and rebound from earlier four-week lows in the 105.40 zone in terms of the USD Index (DXY) against the backdrop of a small advance in US yields and some loss of momentum in risk sentiment.

With regards to monetary policy, participants foresee the Federal Reserve (Fed) maintaining its present stance of leaving rates unchanged at the November 1 event. This perspective was reinforced by remarks from Fed Chair Jerome Powell during his appearance at the Economic Club of New York last week.

Concurrently, investors are contemplating the potential of the European Central Bank (ECB) discontinuing its tightening cycle. This occurs in spite of inflation levels surpassing the bank's target and developing concerns regarding the risk of an economic slowdown or stagflation in the eurozone's economy.

In the domestic calendar, Consumer Confidence in Germany tracked by GfK worsened to -28.1 for November. Still in Germany, flash Manufacturing and Services PMI came in at 40.7 and 48.0, respectively, for the current month. In the broader eurozone, those gauges came in at 43.0 and 47.8, respectively.

Across the pond, US flash Manufacturing and Services PMIs for the current month are also in the pipeline.

Daily digest market movers: Euro comes under selling pressure on disappointing data

- The EUR gives away the initial advance against the USD on Tuesday.

- US and German yields trade mostly with losses early in Europe.

- Markets expect the Fed to extend its impasse in November.

- Investors see the ECB entering a pause in its tightening campaign.

- ECB's Christine Lagarde said the battle to tacke inflation is going well (what?).

- Geopolitical concerns in the Middle East appear somewhat diminished.

- UK jobs report surprised to the downside.

- RBA Governor Michele Bullock suggested inflation could hit the target later than estimated.

Technical Analysis: Euro meets initial resistance around 1.0700

EUR/USD runs out of steam near the key round level of 1.0700 on Tuesday, sparking a marked corrective decline sponsored by discouraging results from the euro calendar.

If the bullish trend continues, EUR/USD may challenge the transitory hurdle at the 55-day Simple Moving Average (SMA) at 1.0702 prior to the September 20 high of 1.0736 and the important 200-day SMA of 1.0816. A break above this level might signal a push to the August 30 top of 1.0945, just ahead of the psychological mark of 1.1000. Any more gains might re-establish a challenge to the August 10 peak of 1.1064 before hitting the July 27 high of 1.1149 and possibly the 2023 top of 1.1275 seen on July 18.

If the selling trend resumes, there is immediate support around the October 13 low of 1.0495, which is just ahead of the 2023 low of 1.0448 from October 3, before the round level of 1.0400. If this zone is breached, the pair could slip back to weekly lows of 1.0290 (November 30, 2022) and 1.0222 (November 21, 2022).

As long as the EUR/USD continues below the 200-day SMA, the possibility of continuous bearish pressure exists.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%.

If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank.

If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure.

Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Comments are closed.