Euro has already faded July’s rally to 1.1275

- Euro trades in an inconclusive fashion vs. the US Dollar.

- Stocks in Europe extend the weekly leg lower on Friday.

- EUR/USD met some support near 1.0850 earlier in the week.

- The USD Index (DXY) looks flattish near 103.50.

- No surprises from EMU final inflation figures in July.

- The US calendar appears empty at the end of the week.

The Euro (EUR) navigates within a narrow trading range vs. the US Dollar (USD), motivating EUR/USD to orbit around the 1.0870 region amid the broad-based inconclusive trends in the risk-associated universe on Friday.

At the same time, the Greenback trades in a steady form, although the multi-week rally appears to have bumped into a decent resistance area near 103.60 (August 16) when measured by the USD Index (DXY). The loss of traction in the Dollar also comes in line with the corrective decline in US yields across different maturities.

When looking at the broader context of monetary policy, there is renewed discussion about the Federal Reserve's stance of maintaining a tighter policy for an extended period. This is driven by the resilience of the US economy, despite some easing in the labor market and lower inflation readings in recent months.

Within the European Central Bank (ECB), there are internal disagreements among its Council members regarding the continuation of tightening measures after the summer period. These disagreements are causing renewed weakness in the Euro.

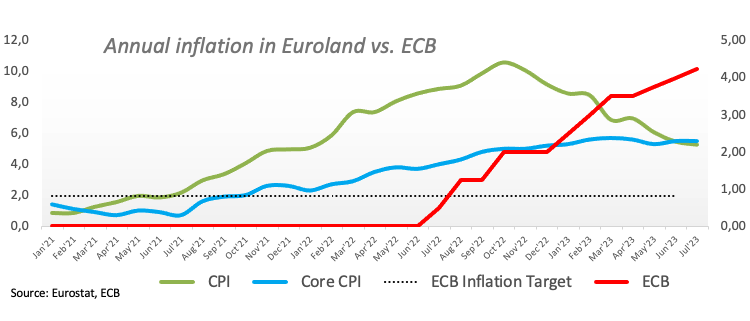

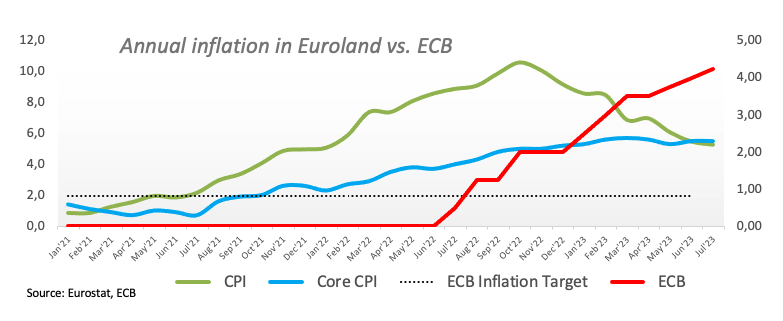

Turning to economic data, the only release of note saw the final Inflation Rate in the broader euro bloc rising 5.3% in the year to July and 5.5% when it comes to the Core reading.

Daily digest market movers: Euro looks unmotivated near 1.0870

- The EUR exchanges ups and downs vs. the USD at the end of the week,

- Investors remain worried about China's sluggish recovery.

- Inflation in Japan came in above estimates for the month of July.

- Retail Sales in the UK missed expectations during last month.

- The persistent Fed's tighter-for-longer narrative keeps markets cautious.

- Inflation in the euro area remains sticky and well above the ECB's target.

Technical Analysis: Euro could face extra weakness in the near term

In case of further losses, EUR/USD could retest the July low of 1.0833 (July 6) ahead of the significant 200-day SMA at 1.0790, and eventually the May low of 1.0635 (May 31). Deeper down, there are additional support levels at the March low of 1.0516 (March 15) and the 2023 low at 1.0481 (January 6).

Occasional bullish attempts, in the meantime, are expected to meet initial hurdles at the August high at 1.1064 (August 10) prior to the weekly top at 1.1149 (July 27). If the pair clears the latter, it could alleviate some of the downward pressure and potentially visit the 2023 peak of 1.1275 (July 18). Once this region is surpassed, significant resistance levels become less prominent until the 2022 high at 1.1495 (February 10), which is closely followed by the round level of 1.1500.

Furthermore, the positive outlook for EUR/USD remains valid as long as it remains above the important 200-day SMA.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region.

The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro.

QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Comments are closed.