Euro Breaking News – Euro Area Headline Inflation Falls Sharply, EUR/USD Little Changed

EUR/USD Price, Chart, and Analysis

- Euro Area inflation falls, all eyes on Thursday’s ECB decision.

- EUR/USD is unlikely to make a move ahead of tonight’s FOMC policy meeting.

Recommended by Nick Cawley

Get Your Free EUR Forecast

Most Read: EUR/USD Tests 1.0900 – ECB Rate Decision, Inflation and Growth Data Ahead

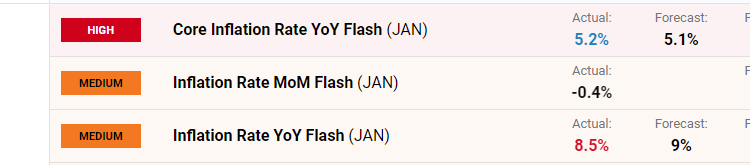

Euro Area headline inflation fell sharply in January, while the core figure remained unchanged from last month, according to preliminary data from the statistical office of the European Union, Eurostat.

Energy is expected to have the highest annual rate in January – 17.2% compared with 25.5% in December – followed by food, alcohol, and tobacco – 14.1% compared with 13.8% last month.

For all market-moving events and economic data releases, see the real-time DailyFX Calendar

Earlier in the session, the final Euro Area manufacturing PMI release hit a five-month high of 48.8 compared to 47.8 in December. While the manufacturing sector remains in contraction territory (below 50), a slower rate of contraction, ‘suggests that the worst of the sector’s slump has passed’, according to data provider S&P Global.

EUR/USD is little changed post-release with the pair rangebound and stuck below 1.0900 for now. The first level of resistance is seen around 1.0937, a recent multi-month high print, while support is seen between 1.0790 and 1.0800. Traders will now be preparing for a slew of central bank policy decisions, starting with the FOMC rate decision at 19:00 GMT today, followed 30 minutes later by Fed chair Powell’s press conference, before the Bank of England and the ECB announce their latest decisions tomorrow at 12:00 GMT and 13:15 GMT respectively.

EUR/USD Daily Price Chart – February 1, 2023

Charts via TradingView

| Change in | Longs | Shorts | OI |

| Daily | -19% | 18% | 1% |

| Weekly | 5% | 3% | 4% |

Retail Trading Bias is Mixed

Retail trader data show 36.20% of traders are net-long with the ratio of traders short to long at 1.76 to 1.The number of traders net-long is 21.72% lower than yesterday and 13.27% higher from last week, while the number of traders net-short is 13.62% higher than yesterday and 2.66% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.