Euro Area Inflation Slows Hitting February 2022 Lows, EUR/USD Bid

EURO AREA CORE INFLATION FLASH KEY POINTS:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

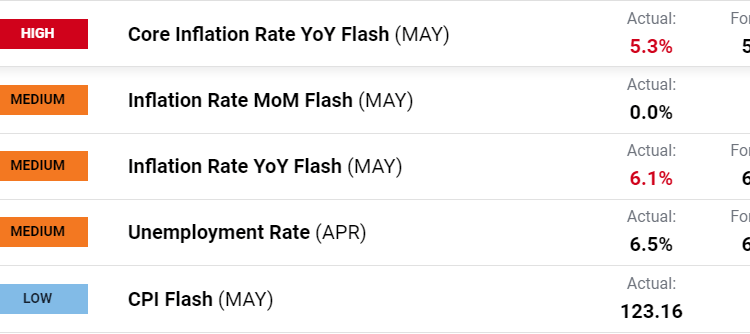

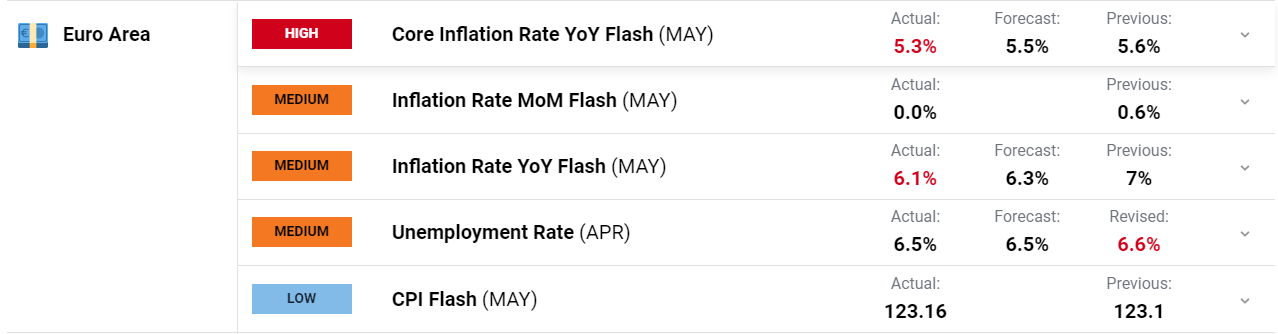

The core inflation rate in the Euro Area is estimated to have retreated to 5.3% in May down from last month’s print of 5.6%. The core CPI which excludes prices of energy, food, alcohol and tobacco went down 0.3%, recording its lowest reading since January in what will most definitely be seen as a positive by the ECB.

For all market-moving economic releases and events, see the DailyFX Calendar

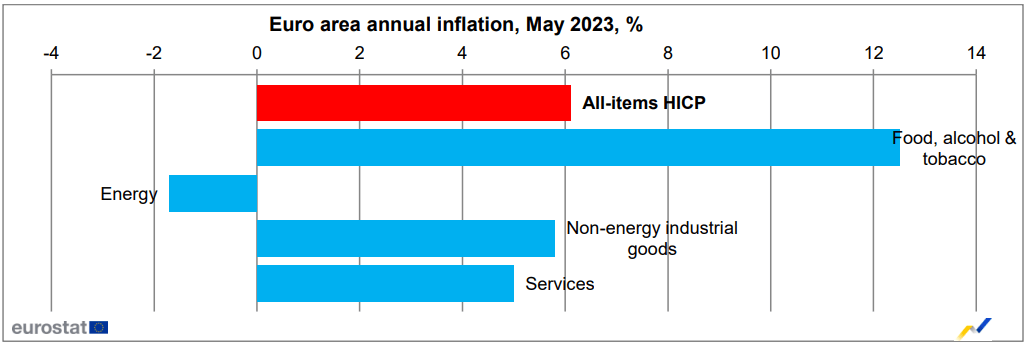

The YoY inflation rate is expected to be 6.1% in May 2023, down from 7.0% in April according to a flash estimate from Eurostat, the statistical office of the European Union. This is the lowest print since February 2022 and the decline in food prices will be particularly satisfying to the ECB and Euro Area consumers. The breakdown of components revealed that the decrease was largely driven by by a 1.7% decline in energy prices, following a 2.4% increase in April. Additionally, there was a slowdown in cost pressures for food, alcohol, and tobacco (12.5% vs 13.5%), non-energy industrial goods (5.8% vs 6.2%), and services (5.0% vs 5.2%). Furthermore, the core inflation rate, which excludes energy, food, alcohol, and tobacco, also eased more than anticipated, reaching 5.3 percent.

The labor market meanwhile remains robust with unemployment coming in at 6.5% in line with forecasts. The number of unemployed declined by 33 thousand from a month earlier to 11.088 million, the lowest level since comparable records began in 1995.

Recommended by Zain Vawda

How to Trade EUR/USD

IMPLICATION FOR THE ECB MOVING FORWARD

The ECB’s job remains a tough one given the economic backdrop of the various countries in the Euro area. European Central Bank (ECB) policymakers have adopted a largely hawkish rhetoric of late with policymaker Luis de Guindos reiterating that recent inflation data is a positive but remains a long way from the Central Banks target.

The inflation referred to by de Guindos is not todays print but rather the inflation data out of France and Germany yesterday. Italian inflation ticked higher but the French and German prints indicated significant declines with French PPI MoM coming in at -5.1%. We may finally be seeing the effects of rate hikes as the “lag effect” appears to have run its course.

The data is still unlikely to sway the ECB just yet on the rate hike front as we enter a key summer period. Services inflation has remained sticky in the Euro Area and with tourism expected to peak in the summer months this could pose a upside risk to inflation and may be worth monitoring. A positive though remains the steep declines in energy prices which is expected to continue as the warm weather kicks into full gear around Europe. All in all, a mixed bag moving forward for the ECB proving just how hard forecasting has become in the current macro environment globally.

MARKET REACTION

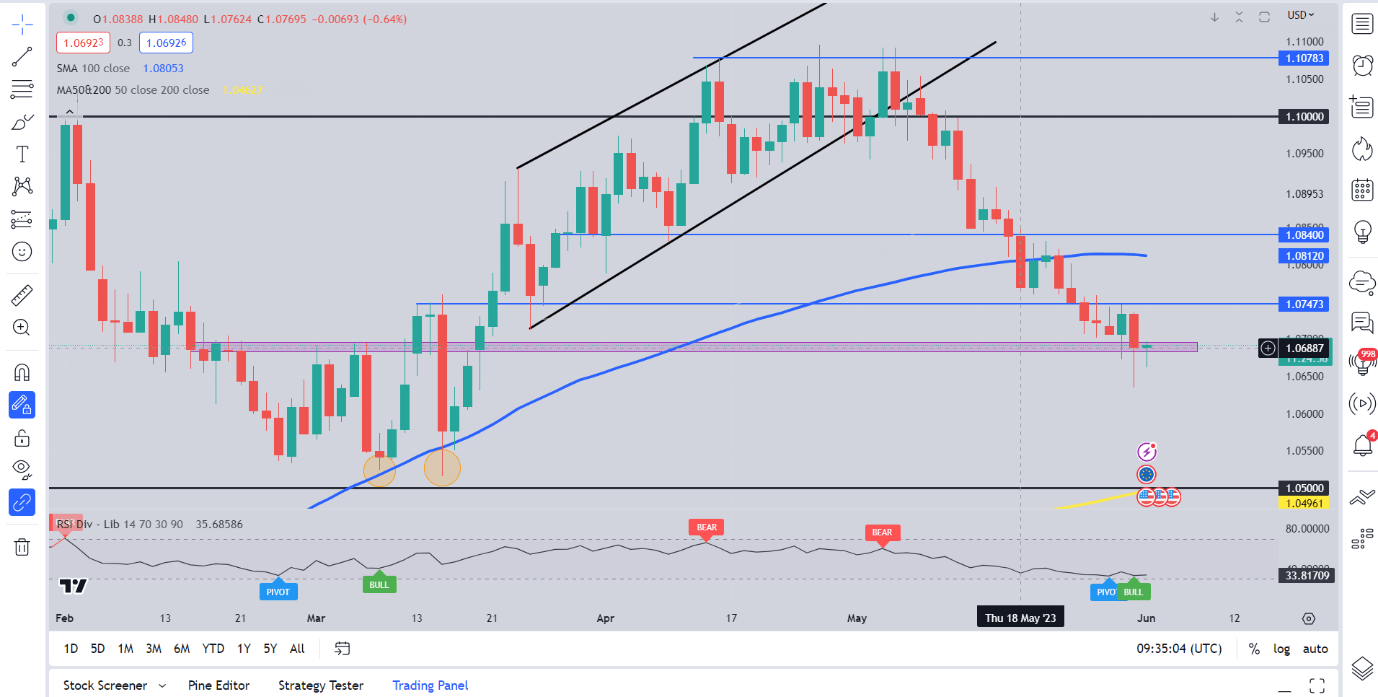

EURUSD Daily Chart

Source: TradingView, prepared by Zain Vawda

EURUSD initial reaction saw a 20-pip spike higher toward the 1.0700 handle. The longer-term picture for EURUSD remains abit unclear at present as we hover around a key support area just below the 1.0700 handle. Tuesdays hammer candle close off the support area hinted at a bullish recovery for EURUSD which failed to materialize. There are still signs that a bounce could be in store for EURUSD as we have yet to see daily candle close below the support area (pink block on the chart). The RSI is also back in oversold territory which will no doubt keep bears cautious around current price levels.

Key Levels to Keep an Eye on:

Resistance Levels:

- 1.0700

- 1.0750

- 1.0810 (100-day MA)

Support Levels:

- 1.0635

- 1.0575

- 1.0500 (psychological level)

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.