Euro appears consolidative in the lower end of the weekly range

- The Euro maintains the offered stance against the US Dollar.

- Stocks in Europe reverse course and advance modestly on Thursday.

- EUR/USD remains under scrutiny and close to the 1.0700 neighbourhood.

- The USD Index (DXY) flirts with the key 105.00 zone.

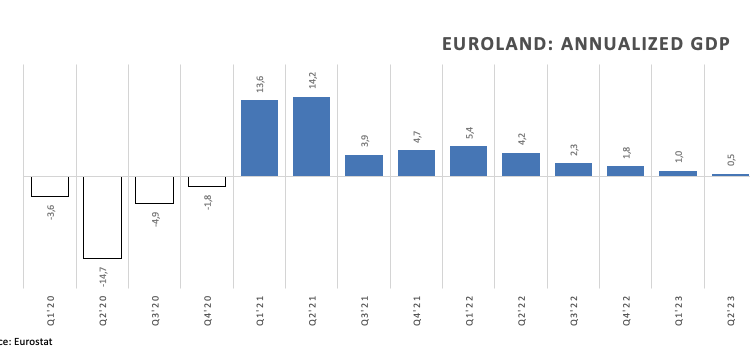

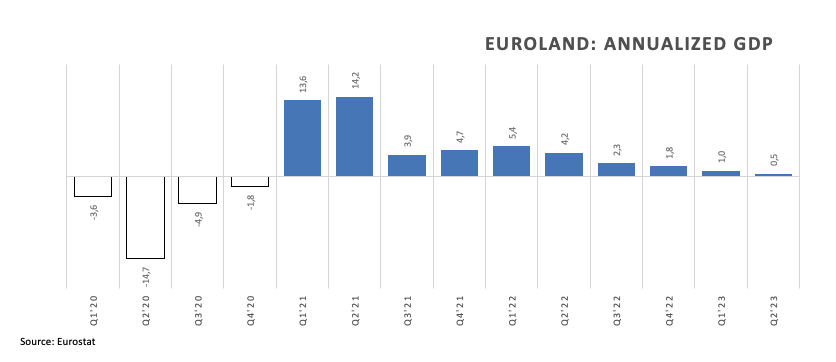

- Another revision saw Q2 Eurozone GDP growth rate lower than estimated.

- Usual weekly Claims and Fed speakers come next in the US docket.

The Euro (EUR) maintains its bearish stance against the US Dollar (USD) for yet another session, prompting EUR/USD to trade close to key support around the 1.0700 zone on Thursday.

On the USD-side, the Greenback trades in the area of multi-month peaks near the 105.00 hurdle when gauged by the USD Index (DXY) amidst the small knee-jerk move in yields across different maturities. These came against the backdrop of increasing speculation over rate cuts by the Federal Reserve (Fed) around March 2024 and divided opinions around a potential rate hike in November.

Back to the European Central Bank (ECB), consensus among Board members remains pretty divided regarding the interest rate decision due on September 14.

In the domestic calendar, Industrial Production in Germany contracted 0.8% on month in July, while another revision of the Gross Domestic Product (GDP) growth rate in the eurozone for the April-June period expect the econmy to expand 0.1% inter-quarter and 0.5% over the last twelve months.

In the US, all the attention will be on the usual weekly release of Initial Jobless Claims for the week ended on September 2, along with speeches by Philadelphia Fed Patrick Harker (voter, hawk), New York Fed John Williams (permanent voter, centrist), Atlanta Fed Raphael Bostic (2024 voter, hawk), and FOMC Governor Michelle Bowman (permanent voter, centrist).

Daily digest market movers: Euro keeps the selling bias near 1.0700

- The EUR resumes the decline against the USD.

- US, German yields gives away part of the recent advance.

- Chinese trade surplus shrank in August.

- The ECB’s interest rate decision in September is a close call.

- Markets continue to price in Fed rate cuts in Q2 2024.

- The outlook for the German economy continues to worsen.

Technical Analysis: Euro's outlook remains negative below the 200-day SMA

EUR/USD remains well under pressure near the key contention area around 1.0700. The loss of this zone could open the tap to further retracement in the short-term horizon.

If EUR/USD clears Wednesday's low of 1.0702, it could revisit the May 31 low of 1.0635 prior to the March 15 low of 1.0516. The loss of the latter could prompt a potential test of the 2023 low at 1.0481 seen on January 6.

On the upside, spot is expected to target the critical 200-day Simple Moving Average (SMA) at 1.0821. North from here, bulls should meet the the weekly top of 1.0945 (August 30), which appears reinforced by the provisional 55-day SMA at 1.0948 and comes prior to the psychological 1.1000 barrier and the August 10 top at 1.1064. Once the latter is cleared, spot could challenge the July 27 peak at 1.1149. If the pair surpasses this region, it could alleviate some of the downward pressure and potentially visit the 2023 peak of 1.1275 registered on July 18.

A sustained decline is likely in EUR/USD while it remains below the 200-day SMA.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region.

The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro.

QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Comments are closed.